Your Survival Guy noted some unsavory comments from Warren Buffett at the recent Berkshire Hathaway annual shareholders meeting. Buffett, the “Oracle of Omaha,” suggested that “higher taxes are likely.” He went on to say that “They may decide that some day they don’t want the fiscal deficit to be this large because that has some important consequences. So they may not want to decrease spending and they may decide they’ll take a larger percentage of what we own, and we’ll pay it.”

If Joe Biden gets his way, those higher taxes might come sooner rather than later. Kelley R. Taylor reports at Kiplinger:

President Biden’s $7.3 trillion FY 2025 budget released last month, proposes several tax changes aimed at wealthier taxpayers, including a minimum tax on billionaires, a near doubling of the capital gains tax rate, and an increased Medicare tax rate.

This budget proposal comes as the IRS says it has recently collected (through ramped-up enforcement) more than $500 million in unpaid taxes from delinquent millionaires and “wealthy tax cheats.”

The White House says the President’s budget, which also contains several tax breaks for those with lower and middle incomes, including new homebuyer tax credits, would reduce deficits by nearly $3 trillion over ten years.

Here is more of what you need to know.

Biden capital gains tax increase

The capital gains tax rate for long-term capital gains, assets held for more than one year, is at most 20%. Capital gains are the profits you make from selling or trading an asset. The tax rates that apply to a particular capital gain (i.e., capital gains tax rates) depend on the type of asset involved, your taxable income, and how long you held the property before it was sold.Biden’s FY25 budget proposal would nearly double that capital gains tax rate to 39.6%. That proposed capital gains rate increase would apply to investors who make at least one million dollars a year.

44.6% capital gains proposal?

You may have heard about a proposed 44.6% capital gains rate in a budget footnote. That rate is a separate proposal that if ever approved, would apply only to those with high net investment and taxable income.The rate supposes an increase of the net investment income tax rate to 5% above the $400,000 threshold with an increased top ordinary rate of 39.6%.

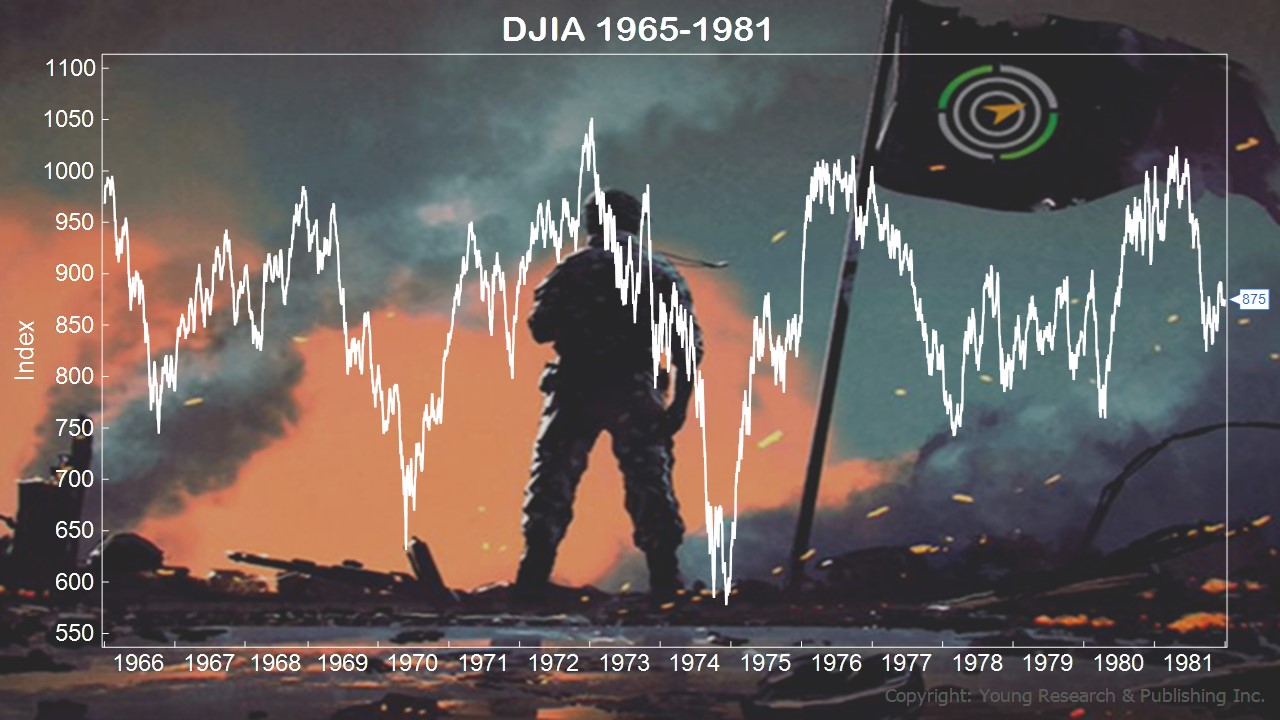

Action Line: That’s just a sample of the tax increases Biden is proposing. If Biden is given another four years in the White House, he could layer draconian taxes on top of Bidenflation. The 1970s are calling. They want their economy back. Inflation, coupled with a tax and spend fiscal policy, led to some pretty mediocre years. Look at the performance of the Dow Jones Industrial Average through that time. The cure for the tax-and-spend, inflationary era was a combined dose of one part Paul Volcker and one part Ronald Reagan. What will four more years of Joe Biden do to the American patient? Click here to subscribe to my free monthly Survive & Thrive letter.