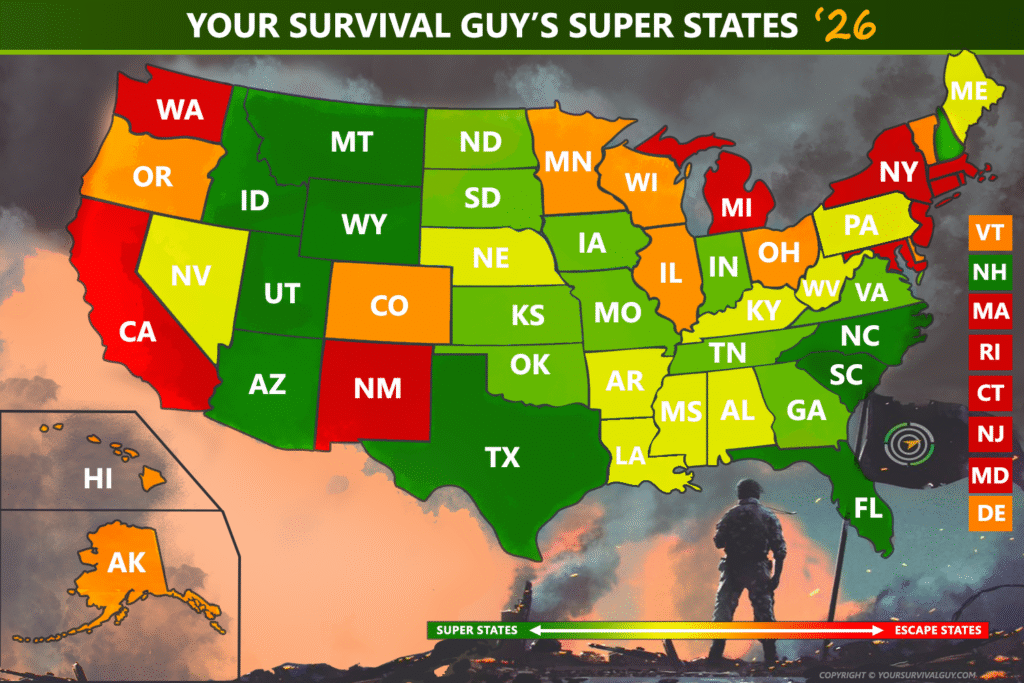

OK, Your Survival Guy’s 2026 Super States ranking is in, and if you live in a blue state, it begs the question: Is it time to flee? Because, as you can see from the bottom third or so of the list, the big blue blob cities and states are digging in even deeper to take from your lifetime of work and effort—in other words, your savings—and spend it.

Look at what Mamdani is trying to do in New York City, and you immediately understand they will never look at this as a spending problem. What’s yours is theirs. It’s why the wealthy are fleeing.

The good news is that the states are laboratories of democratic governance in competition for residents. Yet too many politicians look upon your success as theirs, believing they made your success happen. And you know that just isn’t true.

Look at this list and draw your own conclusions and plan accordingly. As we’re seeing with the exodus from California and other blue states, money goes to where it’s well treated. Is it time for yours to hit the bricks?

Here’s what we’re looking at:

The U-Haul Salesman of the Year Award Goes to….

Recently, during a record-breaking X.com Spaces interview with Donald Trump, Elon Musk and Trump discussed the state of Illinois and Gov. J.B. Pritzker.

Trump said of Pritzker, “Illinois is badly run with Pritzker. He’s a real loser.”

To which, Musk responded “Some of these governors are doing so badly. I mean, they got so many people moving out of their state, they should get U-Haul Salesman of the Year Award.”

You can listen to their entire conversation below.

At the Illinois Policy Institute, Bryce Hill, the Director of Fiscal and Economic Research, explains that Illinois has lost population each year for the last ten years, and in 2023, the state lost 83,839 residents. He writes:

Illinois lost 83,839 residents who moved to other states, one of the highest rates in the U.S. and driving a 10th consecutive year of population decline. It ranks near the bottom on multiple other population measures, too.

A decade of population declines is bad, but when Illinois’ 2023 population drop and loss of residents to other states are examined there is an even greater level of concern.

Here are some ways the U.S. Census Bureau recently measured Illinois’ poor ability to keep its residents.

Illinois vs. others: The state’s number of people moving to other states and total population decline are among the worst in the nation. When comparing all 50 states’ 2023 population change, Illinois (-32,826) ranks 48th with only California (-75,423) and New York (-101,984) losing more people. Even when considering population size, Illinois ranks 47th in total population decline with only Hawaii, Louisiana and New York losing population faster.

The same trends hold true for domestic migration – the sole cause of Illinois’ population decline. Illinois (-83,839) ranks 48th in raw domestic migration, ahead of only New York (-216,778) and California (-338,371). When measured relative to the state’s total population, Illinois’ outmigration crisis ranks 46th, with only residents of Alaska, Hawaii, California and New York leaving their states at a faster rate.

When will Pritzker stop by U-Haul headquarters to receive his reward? Illinois is one of Your Survival Guy’s Escape States.

— Elon Musk (@elonmusk) August 13, 2024

California Politicians Want to Bite the Forbidden Apple

You know that California politicians have sought to harass wealthy residents into paying higher levels of taxation. Now, they want to bite the forbidden apple of taxation by implementing a wealth tax on the state’s richest residents. And they’re asking voters for help. A ballot measure has been proposed that will, according to Jason Ma writing in Fortune, call “for California residents worth more than $1 billion to pay a one-time tax equivalent to 5% of their assets.”

It’s no surprise that the state’s billionaires have other plans. Ma explains:

Tech billionaires are making plans to bail on California ahead a possible ballot measure that would tax their assets to help pay for healthcare.

Sources told the New York Times that venture capitalist Peter Thiel has explored spending more time outside California and opening an office for his Los Angeles-based personal investment firm, Thiel Capital, in another state.

Meanwhile, Google cofounder Larry Page has discussed leaving the state by year’s end, sources told the Times, while three limited liability companies associated with him have filed documents to incorporate in Florida.

Chamath Palihapitiya, a California tech investor, explained in a post on X.com that if the proposal passes, the state’s most talented entrepreneurs will leave, and funding the state will be up to its middle class.

California is proposing a 5% excise tax on “billionaires”. I put it in quotes because it proposes counting everything and the kitchen sink as a dragnet to qualify as many people as possible.

But what they are really doing is breaking the seal on a trend that will bankrupt the… https://t.co/IUZBkGvmqN

— Chamath Palihapitiya (@chamath) December 22, 2025

Maybe not all of California’s billionaires will leave, this time. But how many “temporary” or “one-time” taxes have become annual rituals extending in perpetuity? Who believes that once California has taken a bite of the forbidden apple of wealth taxation, it will stop until it has eaten down to the core? Money goes where it’s treated best, and so do those who have it.

NYC Gets What It Asked For: Higher Taxes

It didn’t take Zohran Mamdani long at all; he’s already calling for higher property taxes on New Yorkers after NY Gov. Kathy Hochul made it clear that she wouldn’t approve higher taxes on corporations and wealthy New Yorkers.

To fund his Fiscal 2027 budget, Mamdani announced that he’d raise property taxes by 9.5% and raid the city’s “rainy day fund.” From the budget explanation from the mayor’s office:

Absent new revenue authority, the City will be forced to use the only tools currently available to increase revenue and fill this gap: property taxes and the use of reserves. The $127 billion FY 2027 Preliminary Budget assumes a 9.5 percent property tax rate increase — generating $3.7 billion in FY 2027. The City also applied $980 million from the city’s Rainy Day Reserve Fund in FY 2026 and $229 million from the Retiree Health Benefit Trust in FY 2027 in order to balance the budget as legally required.

Of course, there was no thought of cutting the budget to balance it out. Only arguing over who would be tapped to pay for Mamdani’s political agenda. He places the blame squarely on everyone else.

He blames former Mayor Eric Adams for the budget gap, writing:

TODAY, Mayor Zohran Kwame Mamdani released the Fiscal Year (FY) 2027 Preliminary Budget, outlining the scope of a fiscal crisis inherited from the prior Administration…

He blames the Governor for not allowing him to tax the wealthy:

There are two paths to bridge the city’s inherited budget gap. The first path is the most sustainable and fairest: raising taxes on the wealthiest and corporations, and ending the drain by fixing the imbalance between what the City provides the State and what we receive in return….If we do not go down the first path, the City will be forced to go down a second, more harmful path of property taxes and raiding our reserves…

Whether or not Mamdani can eventually cajole Governor Hochul into supporting his increased corporate and wealth taxes remains to be seen, but it’s clear that Mamdani is prepared to put his personal political agenda ahead of the hard-working New Yorkers who will foot the bills for his largesse. Elections have consequences, and NYC residents are about to learn that the hard way. What’s going to happen when property taxes are raised but landlords can’t raise rents to match? Building maintenance will be neglected, and unsafe and unsanitary conditions could take root.

Virginia Gun Owners Are in Trouble

Encouraged by the election of a new anti-gun governor, Abigail Spanberger, Virginia Democrats are unleashing a wave of anti-gun legislation on their constituents. Among the many bills being pushed through the state’s legislature are:

- HB 217: An “assault weapons” and standard capacity magazine ban

- HB 21: An anti-firearms manufacturer bill

- HB 229: A bill to ban firearms in hospitals and other health facilities

- HB 626: Narrows the number of people who can legally carry in state-owned buildings and on college campuses

- HB 871: Requires firearms to be locked up in homes with minors or prohibited persons present

- HB 40: A bill targeting “ghost guns”

- HB 93: A bill increasing scrutiny on private firearms transfers

- HB 110: A bill to punish anyone leaving their firearm visible in an unattended vehicle

Radical anti-gun legislators wasted no time in their efforts to implement their freedom-restricting policies. You shouldn’t waste any time either. Get your gun and your training now, before anti-gun politicians take your chance away.

The Widening Gap

You saw on the nightly news the success Elon Musk’s DOGE had in angering big government politicians everywhere, while proponents of smaller government cheered around the country. Some of those proponents sit in governors’ offices in places like Florida, New Hampshire, Oklahoma, and Iowa, where they created similar state-level efficiency organizations to root out waste, fraud, and abuse in the budgets.

Governor Ron DeSantis of Florida created a DOGE effort in his state.

Florida Governor Ron DeSantis announced a creation of a “State DOGE Taskforce.”

DeSantis hopes to eliminate over 70 Florida government boards and commissions.

“It will be a 1-year term. It will sunset following the completion of the mission.” pic.twitter.com/mJajIfXAU3

— Red Line News (@RedLineNewsUSA) February 25, 2025

The governor told Fox News pundit Laura Ingraham that Florida was DOGE before DOGE was cool.

“Florida…we were DOGE before DOGE was cool.” — Gov. DeSantis. @elonmusk pic.twitter.com/w2Blfoz9w7

— Florida Grand (@florida_grand) February 12, 2025

At City Journal, Steven Malanga explains how small government states and big government states are diverging, writing:

The trend toward deregulation and cost-cutting exemplified by state DOGE efforts emerges as the tax gap between red and blue states grows larger. During the pandemic, several large Democratic-led states used fiscal emergencies to justify tax hikes, while many Republican states moved to cut taxes once it became clear that the economy would rebound faster than expected from Covid-era shutdowns. New York, for instance, passed a whopping $4.3 billion increase in corporate and income taxes early in the pandemic, while New Jersey boosted its top tax rate on high-income individuals to the tune of nearly $400 million, and Massachusetts added a surcharge on high earners projected to raise $1 billion, even as local news reports described state government as “awash in cash.” By contrast, for fiscal year 2021 alone, 11 largely Republican states cut income-tax rates, and five reduced corporate taxes.

Since then, Republican locales have kept trimming levies and shrinking costs. A total of nine states—including Indiana, Mississippi, Missouri, and West Virginia—slashed income taxes in 2025. These followed reductions in 14 states the previous year, including GOP-leaning Georgia, Iowa, and Kentucky. Meantime, Democratic-controlled Maryland raised taxes on residents earning more than $500,000 in 2025, and Rhode Island introduced a new levy on vacation homes—dubbed the “Taylor Swift tax” because she owns a property there. In Washington State, Democrats hiked the capital-gains tax and expanded the business-and-occupation tax, a move projected to generate more than $1 billion annually.

There is a widening gap between state governments that treat residents like a piggy bank from which to fund political agendas and those that want to reduce the impact of government on their lives. It’s no surprise that so many people are looking for a better America.

Your Survival Guy’s 2026 Super States Ranking:

| Rank | Super States |

| 1 | New Hampshire |

| 2 | Florida |

| 3 | Idaho |

| 4 | Utah |

| 5 | Wyoming |

| 6 | North Carolina |

| 7 | South Carolina |

| 8 | Texas |

| 9 | Montana |

| 10 | Arizona |

| 11 | Tennessee |

| 12 | Indiana |

| 13 | Georgia |

| 14 | South Dakota |

| 15 | Iowa |

| 16 | Virginia |

| 17 | Oklahoma |

| 18 | Kansas |

| 19 | Missouri |

| 20 | North Dakota |

| 21 | Nevada |

| 22 | Nebraska |

| 23 | Kentucky |

| 24 | Maine |

| 25 | Arkansas |

| 26 | West Virginia |

| 27 | Pennsylvania |

| 28 | Mississippi |

| 29 | Alabama |

| 30 | Louisiana |

| 31 | Alaska |

| 32 | Colorado |

| 33 | Ohio |

| 34 | Wisconsin |

| 35 | Minnesota |

| 36 | Vermont |

| 37 | Delaware |

| 38 | Hawaii |

| 39 | Oregon |

| 40 | Illinois |

| 41 | Maryland |

| 42 | Michigan |

| 43 | New Mexico |

| 44 | Washington |

| 45 | Rhode Island |

| 46 | Connecticut |

| 47 | Massachusetts |

| 48 | New Jersey |

| 49 | California |

| 50 | New York |