Dear Survivor,

“It is all about compound interest, Brother. Tell that to your clients,” said Dick Young to me not too long ago, after explaining in our regular morning talks about how in the previous year he had made more money than any other year in his lifetime.

That’s what happens when you let compound interest perform miracles. Never once in my close to 30 years working with Dick has he ever complained to me about the market, hoping it did more for him to make his life “better.”

“Tell investors to focus on making money in their work and investing it to keep what they’ve made,” he’s always said. And still does. His message, as you might imagine, never, ever changes. It’s the same today.

I remember like it was yesterday talking with Dick during a huge market bust, how steady and calm he was, telling me, “What do investors expect when markets trade so high for so long? This is what investing is all about.”

It’s why when he wrote to you, he would refer to himself as one of the more conservative-minded investors out there. In other words, he knew how ugly markets could be, cutting his teeth in the 60s. He was just fine with a balanced approach in up and down markets. Letting the results do the talking.

It takes discipline to be a legendary investor. I believe you can be one.

“How Many Times Have You Heard Me Say…”

On a recent Saturday, Your Survival Guy was talking with Dick Young when he asked, “Survival Guy, how many times have you heard me say how “well” my accounts performed in any given year?”

“Never,” I said. “You don’t talk about percentage returns.”

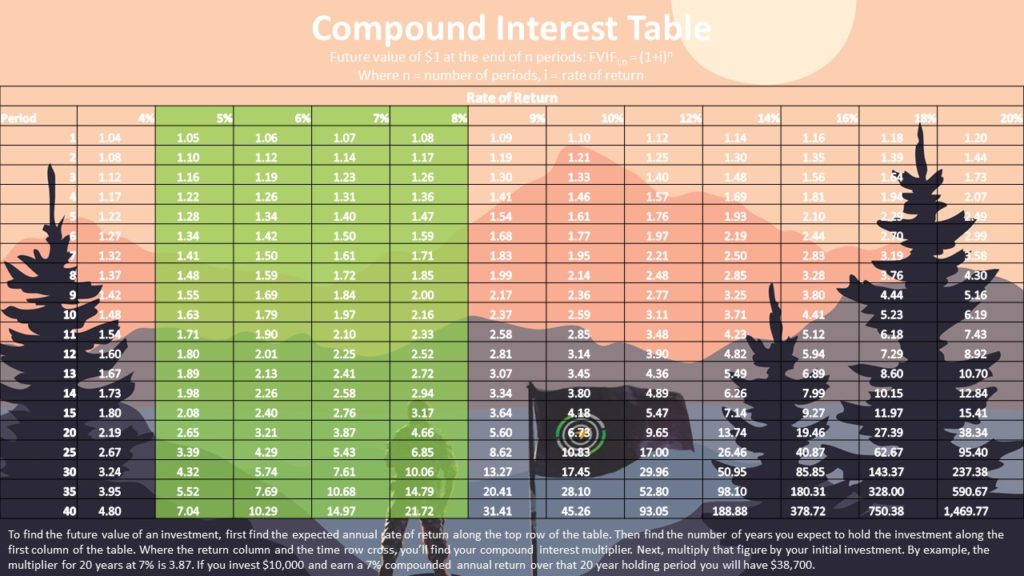

“That’s right,” he said. “I don’t give any time to the subject. What I do give time to is understanding the importance of working to save money and investing to keep it. And yes, over time, if you’re a Prudent Man, so to speak, compound interest will do the heavy lifting. I’m living proof that diversification and patience built on a foundation of compound interest works. I invest in areas I’m comfortable with and let interest on interest do the heavy lifting. Tell your clients that.”

“I will,” I said.

Remember, it’s not necessarily what you invest in but how you invest. In other words, are you invested in a way that makes you comfortable enough where you can invest in good times and bad? No one knows how long either one lasts, but having a plan you can stick with will most likely help you weather both with the peace of mind and comfort you deserve.

Run your finger along the efficient frontier to understand risk vs. reward. It’s been my experience that investors realize after the fact that their risk tolerance was, in fact, an intolerance.

The Mindset of the Uncomfortable vs. the Comfortable Investor

All the uncomfortable investor ever dreamed about was being comfortable. You know, being able to buy a fancy car and a second home. To be the big dog around town. To be able to prove to the world that he was worth something and not to be messed with.

All went well during the market melt-up, where anything he threw money at went up, and it made him happy, but he was never really happy or satisfied.

Then one day, he bet the ranch and leveraged up on a “sure thing” that turned out to be far from a sure thing. He lost more money than he could ever afford to lose.

Now, he’s blaming something or other for his failure and screams inside his head at the unfairness of it all.

This is the plight of the uncomfortable investor, always digging up what appears to be the next big thing, feeling like he discovered the golden ring, only to realize that he was a pawn in the game.

Now then, the comfortable investor doesn’t think much about the game. In fact, he’s happy doing his work, having dinner with his family, and doing it all over again the next day.

He saves but doesn’t view saving as an inconvenience at all. He’s OK deferring some more happiness into his retirement years, when he will continue to pursue happiness. He’s figured out the world and is fine with not sharing his secret way to happiness.

He’s not trying to “beat” anyone. His secret is that he is content. He doesn’t even want to beat the other guy. He doesn’t think or dwell on the other guy. He understands there’s plenty of wealth to go around for the successful.

This is the mindset of the comfortable investor.

Your Survival Guy seeks out the comfortable investor and knows immediately who you are when we speak about your path, a path that the uncomfortable will never understand. Let’s talk. Email me at ejsmith@yoursurvivalguy.com.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. You spend more time online than you used to, so does everyone. Bank accounts, credit cards, investments, insurance, tax payments, utilities, subscriptions, shopping, and every other way you spend or move money have been pushed further online. And with every account comes a login, with a username and password. Does your spouse know them all?

If you’re like most busy families, you divide and conquer. One person might handle the bank accounts while the other handles the investments. Or one the electric bill and the other the groceries. So it’s possible you have set up some accounts that your husband or wife doesn’t use regularly, or maybe has never used at all. What happens in an emergency?

The time to safely share passwords and logins is before an emergency hits. There are services that can help you, like LastPass, Proton Pass, Dashlane, and others (this isn’t an ad for any of these, but they might help if the feature set works for you).

Alternatively, you can do it the old-fashioned way and simply print out your logins and passwords on a piece of paper. The trouble with this method is that multi-factor authentication (MFA) has become much more popular, and if you don’t have access to passkeys, cell phones, or email accounts, you can quickly find yourself just as stuck as you would be with no password at all. You can mitigate those problems somewhat by sharing cell phone and email login passwords.

No one enjoys imagining worst-case scenarios, but everyone is happier when they happen if they’re prepared for them. Don’t get locked out at the worst of times.

P.P.S. You’re living in a service economy where you can’t get any service, especially when you really need it, right?

And when you do get service, it can be a far cry from the service you expected or deserve. When Your Survival Guy is stuck with an unwanted product from Amazon, odds are 50-50 on whether I’ll want to deal with the hassle of returning it or just keep it and pretend it didn’t happen.

In my conversation with you, you told me about helping a 94-year-old woman fly to Florida for the winter. You refer to her as Mom. And when you arrived at the terminal with dozens of kiosks at your “service,” panic set in because dealing with a kiosk is the last thing you needed.

You did it, but you felt bad for the guy trying to get home to Europe, who didn’t speak much English and was standing in front of a kiosk tapping with one hand, holding his phone in the other, trying to understand the 1-800 “help” rep. That’s no way to live.

When Your Survival Kid 1 or 2 needs help with a problem, they immediately get in touch with me…kidding. They immediately text Your Survival Gal. Your Survival Guy usually hears about the “issues” right before turning out the lights at bedtime.

P.P.P.S. You know Your Survival Guy is not in the predictions business. But he does pay attention. Take a look at what Treasury Scott Bessent says about the upcoming year for the economy. Bessent explains that the Trump administration “set the table, now we’re going to have the banquet.” Watch:

.@SecScottBessent: “I think we are going to see a fantastic economic year in 2026. We set the table, now we’re going to have the banquet… [Americans] are going to get substantial tax refunds… Americans will also see a real wage increase.” pic.twitter.com/to21UYJS9k

— Rapid Response 47 (@RapidResponse47) January 23, 2026

Bessent notes a number of newly signed trade deals and big tax refunds from the One Big Beautiful Bill as two reasons the economy will gain speed in 2026.

Need an investing problem solved? You can call me during office hours, but after 9 pm, I prefer e-mail. Thank you for your consideration. When you want to talk about your portfolio, email me at ejsmith@yoursurvivalguy.com. And click here to subscribe to my free monthly Survive & Thrive letter.

Download this post as a PDF by clicking here.