Dear Survivor,

Are you up to speed with Your Survival Guy? Do you check in daily at www.yoursurvivalguy.com?

I’m E.J. Smith, Your Survival Guy. I created www.yoursurvivalguy.com to give Main Street Americans a boots-on-the-ground look at how to protect their most valued assets from natural and manmade disasters.

My focus at www.yoursurvivalguy.com is:

- Retirement investing and planning

- Fixed income/bond strategies

- Your Survival Guy’s Super States

- Living a Liberty Retirement

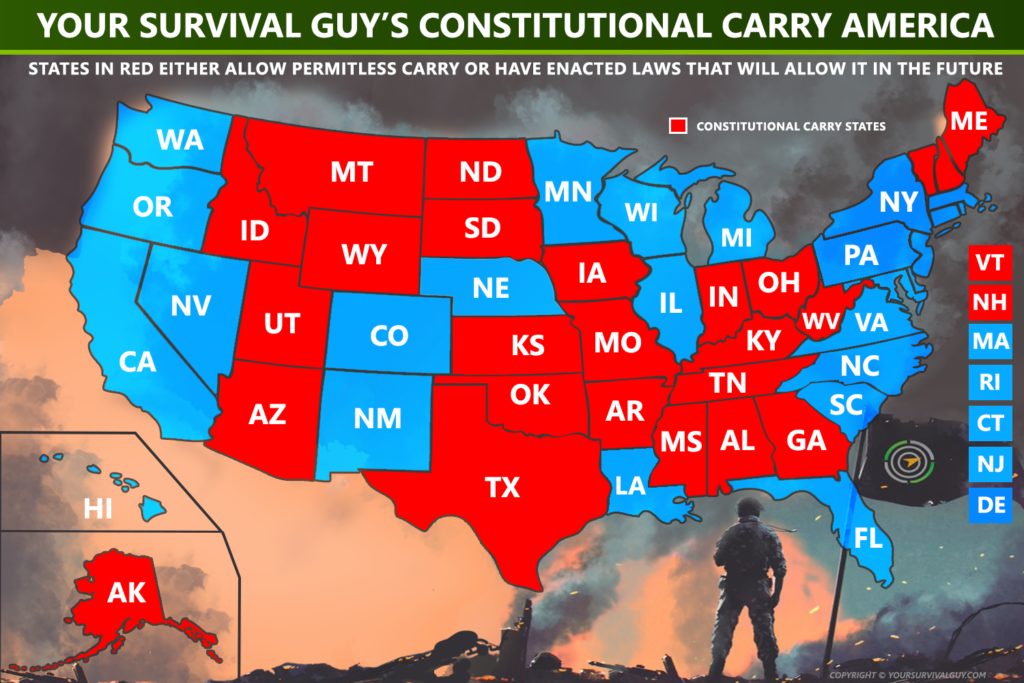

- Constitutional Carry States and Freedom

- Generational wealth strategies for families

Disaster prep and financial prep go hand in hand. Your Survival Guy understands that most investors only begin to realize their true risk tolerance after markets fall. Just like when it comes to self-protection they don’t rise to the occasion, they fall to the level of their training. When it comes to investing, I prep you for the falls and help you get the training you deserve.

Bad stuff happens. I help you deal with it daily. And you’ll hear about my own disasters too. Is there anything better than learning from someone else’s mistakes? I’m no different than you in that regard.

I come from a tight knit family. My dad was a salesman. People loved doing business with him. He was the realtor in town that everyone knew. My mom was a fourth-grade teacher, and to this day, her students, now adults, run up to her and tell her, “Mrs. Smith, you were my favorite teacher!” When we were kids, my younger sister and I would be home every night for family dinner. This was my family’s Main Street America.

Later, I studied investments at Babson College and then worked at Fidelity Investments, where I saw how the sausage was made. On the side, I owned a multi-family, and with those early earnings, I began my lifelong pursuit of compounding money.

Today I work with investors like you, many of whom were faithful readers of my father-in-law’s newsletter Richard C. Young’s Intelligence Report, edited monthly by Dick and Debbie Young for over three decades. The letter was built upon Dick’s decades of experience in institutional finance. Today, my brother-in-law Matt is President and CEO of Richard C. Young & Co., Ltd., and my wife Becky is CFO. I’m director of client relations. It’s just a Main Street family business consistently ranked among the best by Barron’s (2012-2022) and CNBC (2019-2022). Disclosure

When I go back to Mattapoisett, MA, where I grew up, and walk up my parents’ stairs, there’s a picture that always stops me in my tracks. It’s of the two of them wearing Ronald Reagan hats at the 1980 Republican National Convention in Detroit. I remember like it was yesterday, sitting at dinner and listening to their excitement for America. Because America, at the time, was broken. High crime, high inflation, uncertain economy…sound familiar? Life on Main Street hasn’t been this hard in a while.

CONSTITUTIONAL CARRY: Because Law Abiding Americans Are NOT the Problem

If an American has gone their whole life without a felonious run-in with the law, should the state or city they live in be given the subjective authority to deny them their Second Amendment rights for no reason? The answer is obviously no. All law-abiding Americans should be allowed to exercise their rights without interference. No one would expect the state to license free speech. Why is the Second Amendment different in interpretation than the first?

Thanks to the efforts of the NRA and other gun rights organizations, and the common sense of state legislators, half of America’s states now protect the rights of citizens to carry firearms with constitutional carry laws. At America’s 1st Freedom, Dave Kopel and Alexander Adams discuss the NRA’s ongoing efforts to explain the benefits of constitutional carry to legislators. They write:

When it becomes clear that a popular change in state law does something fundamentally good for citizens’ freedom without doing harm, it becomes much easier to get legislators to do the right thing. This is part of the reason for the quick spread of constitutional-carry laws, which now cover half of the states, as of press time. (A state is “constitutional carry” if a law-abiding adult who can legally possess a handgun does not need a permit to carry that handgun concealed for lawful protection.)

Another part of the reason for the fast spread of constitutional-carry legislation is the NRA Institute for Legislative Action’s (ILA) team, which has worked across America to bring the facts to state legislators. They have been so effective that a majority of state legislators in Alabama, Georgia, Indiana and Ohio most-recently opted to get their state’s bureaucracies out of the way of their law-abiding citizens’ Second Amendment rights.

An underlying reason this has been an effective push is the basic fact that law-abiding American citizens are not problems that needs to be solved. Despite what the Biden administration argues, armed citizens help to keep individuals safer. Nevertheless, each time a constitutional-carry law comes up for debate, gun-control groups argue that getting the government out of the concealed-carry-license business will result in “Wild West-style shootouts” on the streets. But each time these laws pass, the data clearly shows that doesn’t happen.

This has been a big change from a few decades ago when Vermont was the sole state with constitutional carry. The term “constitutional carry” comes from legal history; when the Second Amendment was adopted in 1791, constitutional carry—either open or concealed—was lawful in every state.

This year alone, Georgia, Alabama, Ohio, and Indiana have adopted constitutional carry laws. That brings the total number of states to 25. If you haven’t already, get your gun and your training, now.

If You Have a Plan, I Believe You’ll Get to Where You Want to Go

When Your Survival Guy was 12-years old, my family traveled across the country in a 21-foot Winnebago Brave. Winnebago was on to something with the name because we saw the country all right, including the major national and state parks. But we also saw a lot of gas stations and even a few friends for an unexpected, extended stay in Cincinnati, OH. But that’s what’s great about RVing. You remember stuff you never planned on seeing.

When we were “stuck” in Cincinnati, we went on a riverboat, played Wiffle ball, went to the club pool, and to the Kings Island amusement park where we rode “The Beast,” which my dad and I still talk about to this day.

When you’re RVing, life on the road can be anything but on schedule. But you figure it out. I know a lot of you do the same during your own trips on the road, in the air, and/or on the water. In my conversations with you, you tell me you just finished a winter season in the sunny Bahamas on your sailboat, and when it was time to pick up the hook and head home, you didn’t want to leave. That’s the sign of a good trip.

In another conversation with you this week, you told me you’ll spend weeks exploring the national parks in the southwest in your RV for your summer job. How? Well, you went on vacation with an RV group, and liked it so much you became ambassadors helping to guide them now. Your job is to be the forward team helping with the paperwork before the group arrives at the next campground or a gunner bringing up the rear in case there’s a problem. And there are always problems. It’s RVing.

But that’s what makes it fun. Fun, that is, once you’re sharing a glass of wine with your new friends gathered around the campfire, talking about your day and anticipating tomorrow. The RV life—and any adventure for that matter—is always easier when you’re in it together. It’s always easier to get out of bed when you know you’ll be missed if you don’t. It can be work. But it can also be a way to see the world. My clients will be heading next year to New Zealand/Australia as vacationers. Who knows what that will lead to.

The hardest part about big trips like these is getting out the door. But like a lot of experiences in life, that’s how they start. Sure, there will be unexpected stops along the way. But if you have a plan, I believe you’ll get to where you want to go.

Don’t Throw Your Bond Portfolio Out the Window

Remember, as interest rates rise, you’re able to buy bonds at higher yields. We’re not that far from an interest rate level that will be a game-changer for retirees. I like this from Jason Zweig at The Wall Street Journal:

Thanks to the recent plunge in prices, the yield on the aggregate U.S. bond market, at about 3.6%, has doubled since Dec. 31.

People always chase the past with their money. Investors added more than $445 billion to bond funds in 2020, largely because past returns were so strong. But by the end of that year, the yield on the U.S. bond market had fallen to barely more than 1%—meaning that future returns were bound to be feeble.

Investors were too enthusiastic then. Maybe they’re too pessimistic now.

The single best predictor of the future returns of bonds, before inflation, is their yield to maturity. As prices fall, yields rise, so the recent rout in bonds has raised their expected returns.

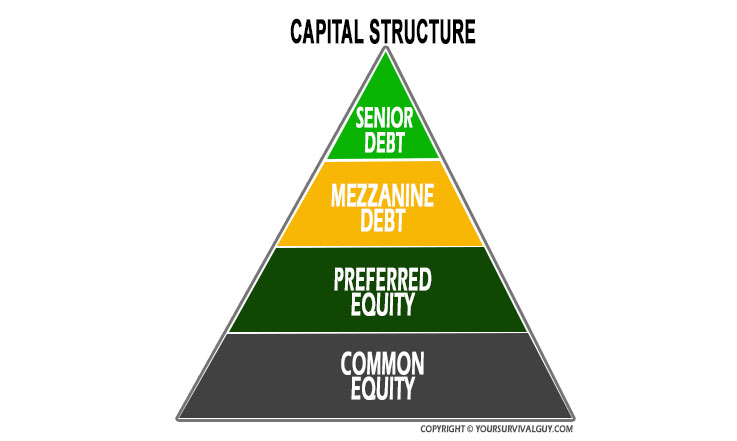

Don’t throw your bond portfolio out the window when there’s a little adversity. Keep in mind Your Survival Guy’s Capital Structure Pyramid, and see who gets paid first in times of trouble. It’s not stockholders. If you want to discuss how to improve your bond portfolio, let me know.

ESG Is Another Way to Attack Conservative Principles

You know how I feel about ESG investing. It’s a politicized money grab for finance and government to extract more fees from investors and to choose winners and losers subjectively. It’s good to see Utah is standing up against the mob.

Utah’s treasurer, Marlo Oaks, is fighting back against an effort by S&P Global Ratings to issue credit ratings for states and municipalities partially based on ideological criteria. S&P wants to apply ESG to muni bond ratings. It doesn’t take much deep thought to realize that rewarding or punishing democratically elected governments based on their policies is a bad idea. Oaks writes in The Wall Street Journal:

Ideological criteria will now influence the credit ratings of state and local governments, thanks to S&P Global Ratings. In addition to rating governments on meaningful financial criteria, in March the biggest of the top three credit-rating firms began to apply an environmental, social and governance, or ESG, rating system. But Utah isn’t about to submit to these subjective standards. State officials, including myself, recently wrote a letter to S&P objecting to the ESG indicators and ratings it has assigned to Utah and calling for the company to withdraw them.

ESG is sometimes dressed up to look objective with quantitative “metrics” and complex “analytical frameworks.” But this blurs the distinction between subjective judgments and objective financial assessments.

S&P Global says it “incorporates [ESG] risks and opportunities into the credit rating analysis” of public issuers. This includes ambiguous and open-ended categories such as how a state scores on “managing carbon,” “political unrest stemming from community and social issues” and “adverse publicity that results in reputation risk.” Leaving no doubt as to the measurement’s subjectivity, S&P notes, “reflecting ESG risks and opportunities within our credit rating analysis will require a qualitative view of an entity’s capacity to anticipate and plan for a variety of emerging risks.” Unlike quantifiable financial metrics, this qualitative view depends entirely on the beliefs of whoever constructs it.

It’s easy to see that those beliefs are left-wing. S&P assigns a lower ESG score to states that have both “physical risks” like earthquakes and natural disasters and a larger percentage of their economy tied to natural resource extraction, such as Texas, Alaska and Louisiana. S&P’s Environmental category, after noting federal-state partnerships’ financial mitigation of natural disasters, focuses its assessment on the costs of making the transition to “net zero” and the policy changes it predicts will be necessary to “curtail” greenhouse-gas emissions.

Certainly, if a state’s finances are overly concentrated on any one particular industry this will affect its financial outlook because of the risk that revenue could decline should that industry’s fortunes contract. But a traditional credit rating takes into account the diversity of industry in a state already, so why create an ESG metric that could be politicized? Instead of focusing on the financial risk associated with economic concentration, the ESG metric highlights if a state or local government allows what S&P thinks is too much oil, gas or coal extraction.

Further, there are national security, economic and even environmental benefits for U.S. states to produce traditional energy. Many countries are searching for sources of natural gas and oil so they can lower their dependence on Russia after its invasion of Ukraine. In that environment, states like Texas, Alaska and Louisiana have a tremendous market advantage and could see improved cash flows. Not only are their fossil fuel revenues benefiting a free democracy, Russia’s natural gas exports to Europe burn 41% dirtier than American natural gas. Exporting U.S. natural gas would create a significant environmental benefit. Authoritarian regimes like Russia threaten, among other things, the environment, human rights, free societies and democratic government—all factors that should be important to ESG proponents. That S&P’s ESG metrics completely ignored or missed these variables exposes some of the major flaws of ESG ratings. Such scores place a value judgment on political issues that do not have one right or wrong answer, are highly complex, and are impossible to predict.

As the Russian situation has shown, ESG assessments depend on variables that can change rapidly. Before Russia attacked Ukraine, Europe was moving away from fossil fuels and military spending. That changed almost overnight. This is why markets are so valuable; they encapsulate many different views of the future and their organic structure allows for quick adaptation. ESG scores, by contrast, rigidly hold to one viewpoint and are slow to pick up on changes in the world. The minds behind S&P’s ESG metrics seem to believe that a transition to green energy is inevitable and therefore punish states that produce traditional energy for “climate transition risk.” But no one really knows what this “climate transition” will look like. There are no widely accepted, economically viable alternatives to fossil fuels in the market. No one knows where they’ll come from, what they’ll be or when they’ll arrive.

ESG metrics’ false certainty about future events, and consequent inability to keep up with unanticipated current events, causes capital to be misallocated. They create bubbles in favored industries while starving others that could be profitable.

The solutions to our most difficult challenges—such as climate change—can come only through innovation. Foisting rigid ESG factors onto the market discourages innovation by mandating conformity, penalizing creativity and punishing the industry with the greatest incentive to find alternatives—the energy sector. Fracking has reduced U.S. carbon emissions immensely, but it could cost you under S&P’s ESG metrics.

Utah has prudently managed its finances over decades and as a result maintains the highest possible credit rating from all major firms, allowing the state to borrow money at the lowest rates and save taxpayer dollars. But under the new ESG regime, those financial factors may be supplanted by subjective, political ones.

These metrics also threaten Utah and other states’ democratic sovereignty. The ESG disclosures many corporations have felt compelled to release have also led to frivolous legal action and shareholder resolutions, an additional fiscal drag on businesses. Extending this regime into the municipal sphere is an invitation to litigation and other coercive tactics that will sabotage states’ self-determination and independence.

States like Utah value our constitutional republic, which has ensured freedom, and free markets, which have fostered innovation and generated prosperity for generations. Any states, governmental jurisdictions, corporations, individuals, and investors who also hold those beliefs should join us in standing against ESG.

Oaks lays out how states that prudently manage their residents’ wealth could be harmed by S&P’s ESG ratings, but the opposite will be true for poorly managed states that happen to promote the ideologies S&P is looking for. Poorly run states will get an unearned boost by saying the right things, even while still mismanaging residents’ wealth, and that of muni-bond buyers. You need to avoid falling into this trap as an investor. If you need help, let’s talk.

If your state’s leaders would rather appeal to S&P’s subjective credit ratings than pursue prudent policies, it’s time to look for a new home. Start with my Super States.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Gab, MeWe, and Gettr.

P.S. Thought I’d share this email with you that I received from a client recently.

Hi EJ,

Thanks for your e-mail today. Thanks for all you do for your clients and our investing. I have taken your advice and been with Richard Young for over 30 years now and am very satisfied with all you have helped me with.

As we know, this too shall pass. I am happy that we went conservative with my accounts a couple of years ago. You and your firm really look out for your clients and stay in touch on a regular basis! Thanks!

Your Friend,

Jeff

P.P.S. Earlier this year, Your Survival Guy received two books and a note from a long-time client. We’ve been working together now for what will be 20-years come August 2023. That’s an eternity in this field of work where “what have you done for me lately?” can rule the day. But that’s the nature of the beast, and my job is to help protect my customers from the dangers trying to separate them from their money that lurk around every dark corner. This is hardball.

Years ago, my client decided to eschew the pressures of Christmas cards and gifts and to send his thanks at his own “intentional” pace. You can imagine my surprise when this package of books and a Christmas card, thank you, arrived weeks later. This is why we do what we do. Thank you for reading.

P.P.P.S. Is office work dead? For those who just graduated from high school or college, some of the best work experiences you can get are from being in the office, or restaurant—face to face with your coworkers and customers. You get lessons you can’t learn from a textbook.

What I learned at Fidelity Investments in Boston, MA was how the back office worked. That’s an essential understanding for me today as we use Fidelity as our custodian for clients. But what I also learned was how to live on my own, get to work on time, see how a large team works (not always together), get my car fixed, registered, etc. You know, the basic skills of living on your own.

When I had an internship at a start-up company during one of my Babson College summers, the founder was in the office at his desk by 6:20 am. I showed up by 6:30 am because I felt late arriving at 7 am. He left for the day at 6:30 pm. This was a tough slog. But in my conversations with you, I remember talking to you about your schedule. You were up daily at 3 am and out the door by 3:30 am and in your office in NYC. As a CFO, you led by example and now you’re enjoying the fruits of your labor.

When I scooped ice cream for $0.25 a cone in high school, I didn’t realize I was getting an education in inflation. I never liked leaving my friends at the beach to go to work. But once I was at work and made it through the two-hour rush of serving fried clams, fish and chips, and coffee frappes, it was fun. It was fun knowing we struggled together and had made it through another night. I don’t think about the time I missed at the beach.

Yes, doing well in school matters, especially getting your first job. But after that, no one really cares where you went to school just as long as you get your job done. How you read the cues in the office while everyone has their head in their computers is a lot easier when you can see and hear what’s going on around you. You can’t do that from the beach.

You can’t know what you don’t know. You must experience life. Let’s go. I’m here for you.

Tunku Varadarajan explains in an opinion piece in The Wall Street Journal:

That explains why young people are drawn to cities—and why, in Mr. Glaeser’s view, in-person work is vital in the early stages of a career. Cities—and face-to-face contact at work—have “this essential learning component that is valuable and crucial for workers who are young,” he says. The acquisition of experience and improvement in productivity, “month by month, year by year,” ensures that individual earnings are higher in cities than elsewhere.

Mr. Glaeser commends a “superb paper,” published in the Review of Economic Studies in 2017, that documents how people learn by working in big cities. The authors show that workers in Madrid earn 55% more than those in rural Spain. “These wage benefits don’t appear magically when workers come to Madrid or Barcelona,” Mr. Glaeser says. “Instead, a new worker in the big city earns only about 10% more than a worker in a mid-sized city.” After 10 years, that earnings gap grows to 35%.

“The sort of young people who don’t want to come back to the office,” he says, “don’t really know what they’ve missed.” They think that the experience of “working from a Starbucks is all.

Download this post as a PDF by clicking here.