Pay attention here. When you beat inertia and get on the track to retirement savings, a lot of opportunities tend to come your way.

One of those opportunities is having time to focus on other members of your family.

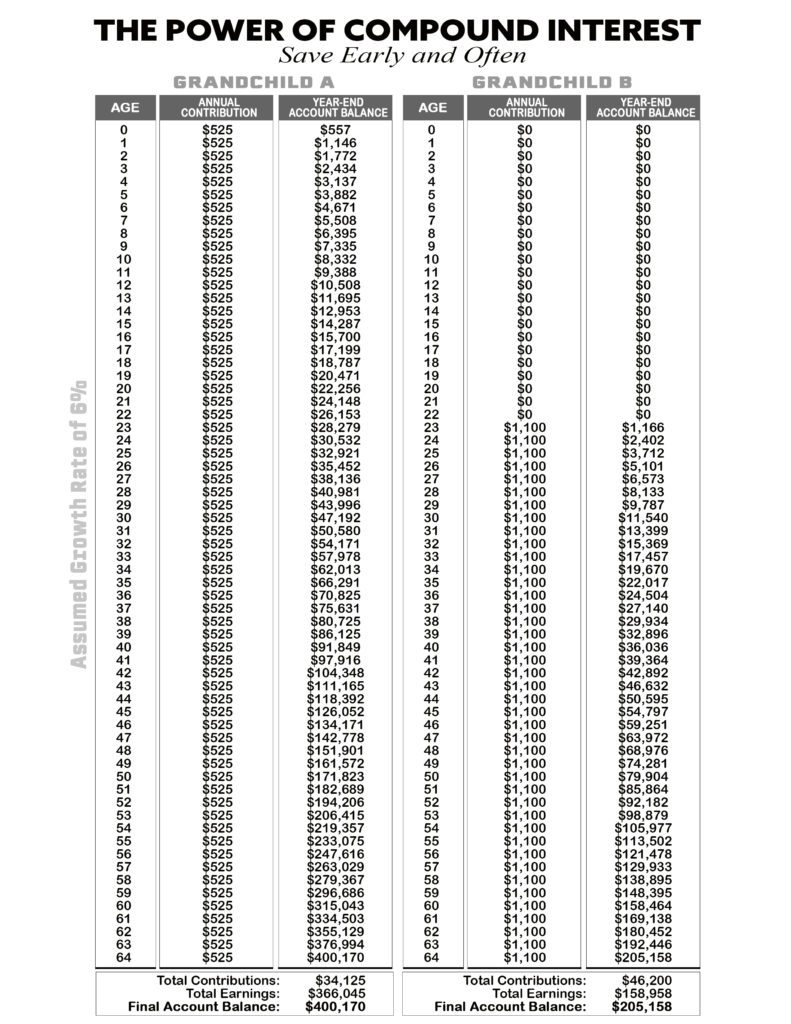

When it comes to investing, you and I know the most powerful tool to wealth is compound interest. But it requires time—a commodity in abundance when you’re young—and money. That’s where you come in (sorry).

You know the path to my rich grandchild, poor grandchild. You have the knowledge and the money (you don’t need a truck load) to teach them in real dollars about compound interest.

I’ll never forget a conversation I had not too long ago with a mid-sixties millionaire (a client). He said he had his grandparents to thank for all of this money because they got him started at a real young age. He never touched it (that’s not easy by the way) and today it supplements his Retirement Life.

OK, once you get your grandchild on the investment track, doors will begin to open up for everyone involved.

Baby Steps: A UTMA or UGMA

First you get them started with baby steps with a UTMA or UGMA account at Fidelity.

Then when they’re old enough to work, open a Fidelity Roth IRA for kids or a Kiddie Roth IRA.

Kiddie Roth IRA

I love Kiddie Roths because you can be creative here in so many ways.

For example, if your grandchild earns money scooping ice cream, cutting lawns, and/or busing tables, she can contribute her earnings to a “kiddie” Roth IRA up to her earnings level.

If she earns $1,000 that’s the max she can contribute (the annual max contribution for 2019 is $6,000).

Here’s what I like about this. You can help her with the contribution. The IRS doesn’t care where the money comes from as long as it doesn’t exceed her cap.

For example, you and she can agree to match her earnings or half her earnings (you decide) to contribute to her Kiddie Roth. If it’s a 100% match you agree to, then you put $1,000 into the Kiddie Roth. She doesn’t have to contribute anything if she wants to use her summer money for her own spending. That’s her choice.

Here’s more about a Kiddie IRA from Fidelity:

Fidelity Roth IRA for Kids

Help a child invest for the future. This account can be opened and managed by any adult—parent, grandparent, aunt, uncle, family friend—on behalf of a minor earning income.

Tax advantages

Earnings Earnings grow federally tax-free.1 Withdrawals Withdrawals are tax-free.1 Account features

Eligibility Minors must be under the age of 18. Minors must have employment compensation.2

Qualifying income can come from a job and/or self-employment such as babysitting, mowing lawns, or shoveling snow.

Account management The adult maintains control of the account and is the sole recipient of account statements and communication. The account must be invested for the benefit of the minor and all account assets must be transferred when the minor reaches the required age (varies by state).

Maximum contributions IRA contributions cannot exceed a minor’s earnings, e.g., if a minor earns $1,000, then only $1,000 can be contributed to the account. There’s an annual maximum contribution of $6,000 per child, per year for 2019 and 2020.

Minimum investment There is no minimum to open the account. Certain investments, like mutual funds, require a minimum initial investment.

Investment options Access a wide range of investments offering growth or income including mutual funds, stocks, bonds, ETFs, and FDIC-insured CDs. Support and guidance Our online courses make it easy for minors to learn the basics of investing. Get insights on the markets with Fidelity Viewpoints®.

Test investing ideas or discover new ones with our powerful research and screening tools.

Fees

Account fees There is no opening cost, closing cost or annual fee for Fidelity’s Traditional, Roth, SEP, SIMPLE, and rollover IRAs.* Trading fees3 $0 commission for online US stock, ETF, and option trades.

Read more from Fidelity here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024