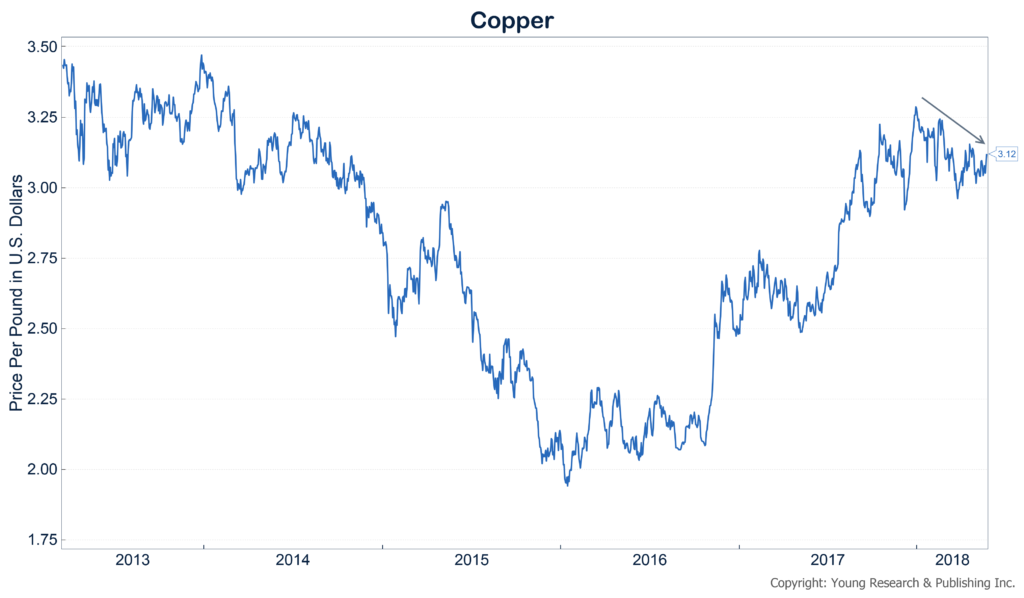

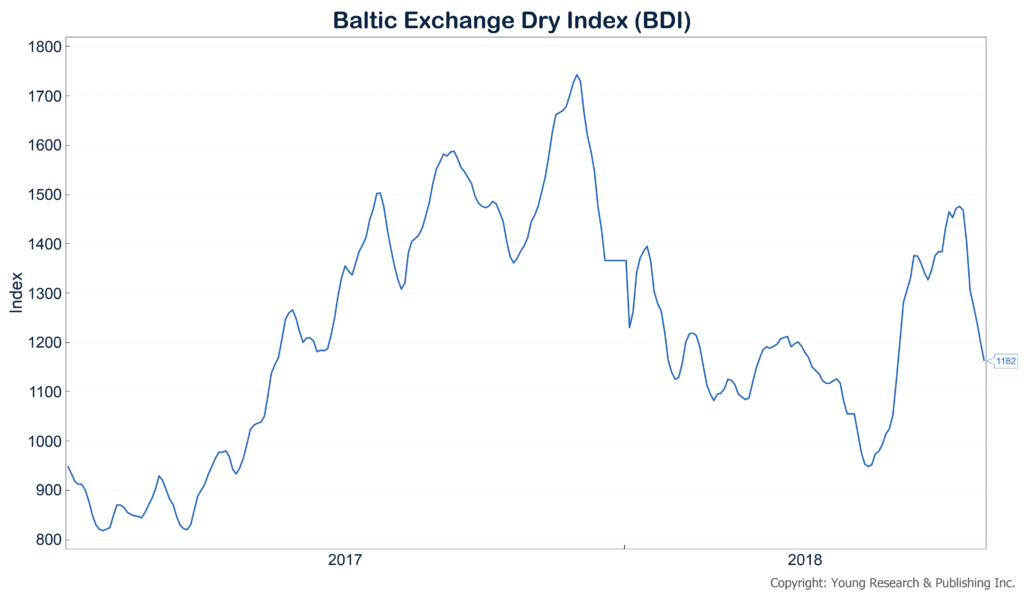

The WSJ Logistics Report raises the red flag on a major warning sign for the global economy. Copper, known as Dr. Copper for having a Ph.D. in economics, has begun falling in price, even while other commodities are rising. Another early indicator of the direction of the world economy, the Baltic Dry Index, has plummeted as well. See my charts below on both. The WSJ reports:

Warning signs for the global economy are being drawn in copper. After hitting a high of nearly four years in 2017, copper prices have slumped this year even as prices for other commodities have been rising. That’s a troubling sign for economic growth, the WSJ’s Amrith Ramkumar reports, because of copper’s crucial role in a wide array of manufacturing supply chains, from airplanes to smartphones. Recent weaker economic data from China, the world’s largest commodity consumer, and Europe and Japan have compounded worries that trade tensions and other factors are taking a toll on demand. The Baltic Dry Index, measuring prices for shipping raw materials, has tumbled nearly 15% over the past week. Still, the falling copper prices may be the result of plentiful supply following a year when labor unrest and other conflicts put a cap on production.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Yes, Money Can Buy You Happiness - April 23, 2024

- State Income Taxes and the 2024 NFL Draft Class - April 23, 2024

- This ARK is Sinking - April 23, 2024

- “That’s Why I Hired You,” They Tell Me - April 22, 2024

- The Silver Lining of Higher Interest Rates - April 22, 2024