Worried about your required minimum distribution (RMD, aka minimum required distribution, MRD)? Don’t be. Fidelity’s got you covered. Here are the answers to some frequently asked questions regarding RMDs.

General information

- What are minimum required distributions (MRDs)?

Minimum required distributions, or MRDs, are mandatory, minimum yearly withdrawals that generally must be taken starting in the year you turn 70½. While there is a minimum amount you are required to withdraw in order to avoid severe penalties, you can always take more than the MRD amount.

You generally have to take MRDs from any retirement account in which you contributed tax-deferred assets or had tax-deferred earnings. These accounts include:

- Traditional IRAs

- Rollover IRAs

- SIMPLE IRAs

- SEP IRAs

- Most Keogh accounts

- Most 401(k) and 403(b) plans

Inherited IRAs have special rules for MRDs and the required distributions are time-sensitive, usually beginning in the year after the year of death of the original owner. If you have inherited an IRA, see MRD Rules for Inherited IRAs or call an inheritance specialist at 800-544-0003.

Our Retirement Distribution Center can help you calculate and manage your MRDs. Get estimated MRDs for your Fidelity IRAs (Traditional IRAs, SEP IRAs, SIMPLE IRAs, Rollover IRAs, and all small-business retirement plans) as well as tips on making the most of your withdrawals. Our system also keeps track of all withdrawals and allows you to set up automated distributions. Learn more about our Retirement Distribution Center.

- Are there any exceptions?

One exception is Roth IRAs. You are not required to take MRDs from your Roth IRA during your lifetime, and you cannot satisfy your Traditional IRA MRD requirement with a withdrawal from a Roth IRA.

Another exception is retirement plan accounts, if you are still working. If you continue to work beyond age 70½, and do not own more than 5% of the business you work for, you may be able to defer taking MRDs from your current employer’s Keogh, 401(k), 403(b), or other employer-sponsored retirement plan until April 1 of the calendar year after the year in which you retire. Please consult your plan administrator to learn more.

Calculating your MRD

- How do I calculate my MRD?

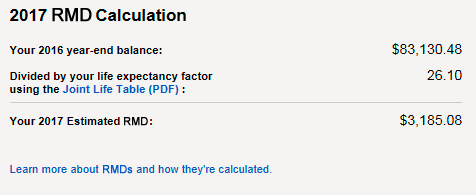

Generally, your MRD is determined by dividing the adjusted market value of your tax-deferred retirement account as of December 31 of the prior year by an applicable life expectancy factor taken from the Uniform Lifetime Table (PDF).

Our MRD Calculator

can help you determine what to withdraw. We also offer the Retirement Distribution Center which can help you manage your withdrawals. This free service keeps track of how much you’ve withdrawn to date, allows you to set up automatic withdrawals, and provides estimated MRDs for your Fidelity IRAs (Traditional IRAs, SEP IRAs, SIMPLE IRAs, Rollover IRAs, and all small-business retirement plans). Learn more about our Retirement Distribution Center.

- What if my spouse is more than 10 years younger?

If your spouse is more than 10 years younger than you, and if he or she will be the sole primary beneficiary for the entire distribution year, you should use the Joint Life Expectancy Table (PDF) to calculate your MRD. This will result in a smaller MRD than with the Uniform Lifetime Table. You can use the MRD Calculator

to do this calculation. If that spouse is listed on your account as the sole beneficiary with the correct date of birth on Fidelity.com, then Fidelity will use that information and your life expectancy factor from the Joint Life Expectancy Table. This information must be correct on Fidelity.com before December 31 for it to be used in the annual recalculation process.

- Will Fidelity calculate my MRD for me?

Yes, to view your MRD estimate for the current year, please visit the Retirement Distribution Center (RDC)Log In Required. You can also find current year estimates and year-to-date withdrawals on your account statement. Prior year estimates, dating back to 2012, are available in the RDC but only for accounts held at Fidelity during that time.

Please note, we calculate your MRD based on a variety of factors such as your date of birth, year-end account balance, and account beneficiaries. If any of this information changes, your Fidelity-provided MRD may no longer be accurate.

The MRD estimates use all the information on file as of December 31 of the prior year. For example, transfers that are not processed by December 31 will not be be reflected in the next year’s MRD. So, if you transfer funds to your retirement account in late 2015, but they are not received by December 31, 2015, your 2016 MRD will not reflect this deposit. Similarly, beneficiary changes made after December 31 will not be reflected in the current year MRD.

If you have consolidated assets, transferred funds, or made a beneficiary change that should have been taken into consideration for the current year, please call our representatives at 800-544-4774 for help recalculating your MRD.

Please note, MRD estimates for Fidelity’s Profit Sharing Retirement Plan, Money Purchase, and Self‐Employed 401(k) accounts, are presented separately and not aggregated in the All Your Fidelity IRAs section of your portfolio.

Additionally, 401(k), 403(b), and 457 plans held at Fidelity and certain annuities are not included in the MRD estimate. To learn more about how we estimate your MRD, please visit the RDC and select Learn more about your MRDs and how they’re calculated.

Sample RDC calculations page:

- I can’t find my MRD estimates on my account statement. Where is it located?

Your MRD estimates will appear on the account summary page, at the end of the account balance section.

- Where can I find the Retirement Distribution Center?

You can visit the RDC directly at www.fidelity.com/RDC Log In Required. It can also be found on the Track Your Minimum Required Distributions (MRDs) section of your account summary that appears after you log in.

Note: This information is only visible to those with required withdrawals. If you’re under 70 ½ or do not own an Inherited IRA account, you may not see the card.

If you own an Inherited IRA and are under 70 ½, you may still have required withdrawals. Learn more about MRDs for inherited retirement accounts

If you have required withdrawals but do not see an MRD estimate, we may be missing key information such as your prior year’s account balance and date of birth. If that’s the case, please update your account.

- Can I find my MRD estimates anywhere else?

Depending on your retirement status, you may see your MRD in account history or on the Withdraw from IRA or Convert to a Roth IRA pages once you’re logged in.

- How should I handle year-end transfers or rollovers?

The December 31 market value of each of your retirement accounts should be adjusted for any pending year-end transfers or rollovers. For example, if assets were withdrawn from an IRA or qualified employer-sponsored plan within the last 60 days of the prior calendar year, and then a portion or all of those assets were rolled over to a Fidelity IRA this year, you must add the amount of the rollover to the balance of your Fidelity IRA as of December 31 of the prior year. This may also apply to year-end transfers not credited to your account until after December 31, unless the MRD attributable to the amount transferred was distributed from another IRA.

If you are age 70½ or older, generally, you must withdraw the MRD from the employer-sponsored plan prior to rolling it over to your IRA. MRD amounts are not eligible for rollover. Please check your records to determine if that was done properly or ask one of our representatives if you need help understanding any paperwork from that process.

- Will Fidelity send me my MRD automatically?

Yes, if you enroll in our automatic withdrawals process, Fidelity will automatically recalculate your MRD each year, and distribute that amount based on your instructions. Enroll in automatic withdrawals

.

- How are MRDs taxed?

MRDs are taxed as ordinary income for the tax year in which they are taken and will be taxed at your applicable individual federal income tax rate. MRDs may also be subject to state and local taxes. If you made non-deductible contributions to your IRA, you must calculate your MRD based on the total balance, but your taxable income may be reduced proportionately for the after-tax contributions. Please consult a tax advisor to learn more.

- What if I made non-deductible contributions to my IRA?

Regardless of whether or not you made non-deductible contributions, you must take the MRD. If you have made non-deductible, after-tax Traditional IRA contributions (or if your account includes any after-tax rollover amounts), you will not have to pay taxes on the portion of your distribution that represents after-tax contributions, provided you have filed IRS Form 8606 each year you made a non-deductible contribution. Remember, you will owe taxes on any earnings on those contributions. Check with your tax advisor on what portion of your account is from non-deductible contributions.

Taking your first MRD

- When should I take my first MRD?

You generally have until April 1 of the year following the calendar year you turn age 70½ to take your first MRD. This is known as your required beginning date (RBD). In subsequent years, the deadline is December 31. If you turned 70 between July 1 of last year and June 30 of this year, you will be turning 70½ this year and will need to take your first MRD for this year.

- How should I time my first MRD when it comes to taxes?

If you take your first MRD between January 1 and April 1 of the year after you turn age 70½, you still need to take your second MRD by December 31 of the same year. Since IRA and Keogh distributions are taxed as ordinary income, this may push you into a higher tax bracket. Also note that if you take your MRD between January 1 and April 1 of the year after you turn age 70½, your December 31 account balance is not reduced by the amount of the MRD taken for the first MRD when calculating the amount of your second MRD. So, be sure to plan your first withdrawal carefully.

Taking your MRDs each year

- How should I take my MRDs if I have multiple non-Roth accounts?

If you have more than one non-Roth IRA, you must calculate the MRD for each IRA separately each year. However, you may aggregate your MRD amounts for all of your non-Roth IRAs and withdraw the total from one IRA or a portion from each of your IRAs.

If you have qualified plan accounts, such as a 401(k) or 403(b), in addition to your IRAs, you must calculate and satisfy your MRDs for IRAs separately from your qualified plan accounts. If you have more than one qualified retirement plan account, you must calculate and satisfy your MRD requirements separately for each qualified plan account.

For example, if you have both a profit-sharing plan and a self-employed 401(k), you must separately calculate and withdraw an MRD from each plan. Also, MRDs for Inherited IRAs must be satisfied separately from your other IRAs.

After you have fully retired from all employers it may be easier to consolidate your accounts into an IRA in order to make taking MRDs easier to manage. Consider rolling over your retirement accounts to Fidelity and managing your MRDs in one place.

Our Retirement Distribution Center can help you keep track of MRDs for your Fidelity IRAs (Traditional IRAs, SEP IRAs, SIMPLE IRAs, Rollover IRAs, and all small-business retirement plans). Learn more about our Retirement Distribution Center.

- What are the deadlines for taking MRDs?

You may withdraw your annual MRD in one distribution or make withdrawals periodically throughout the year, but the total annual minimum amount must be withdrawn by the deadline of December 31 (except for your first MRD, as explained above in “When should I take my first MRD?”).

Our Retirement Distribution Center can help you keep track of how much you’ve withdrawn so you’re never behind. You can also set up automatic withdrawals on a monthly, annual, or customized basis. Learn more about our Retirement Distribution Center.

- What are the penalties if I miss a deadline?

The penalty for taking less than your MRD can be severe. If you withdraw less than the minimum required amount, the IRS may assess a penalty equal to 50% of the amount of the MRD not taken. If you missed taking MRDs, consider discussing your options with your tax advisor. You may be able to file for an exemption from the penalty by filing an IRS Form 5329. Consult your tax advisor.

- Do I have to take my MRD if I am still working?

Yes, with certain exceptions:

In some circumstances you may delay MRDs from any retirement plan for a current employer, such as a Keogh, 401(k), 403(b), or other employer-sponsored retirement plan account until you retire. If you are still working and have other tax-deferred retirement accounts in previous employers’ plans, you must satisfy your MRD for those other accounts each year beginning when you reach age 70½.

Roth IRAs are also an exception, as they are not subject to MRDs while the original account owner is still living.

- Can I still contribute to my IRAs while taking MRDs?

You can contribute to a Roth IRA after age 70½ as long as you have compensation and meet the income eligibility requirements. Otherwise, you generally cannot contribute to any other kind of IRA in the year you turn age 70½ or any year thereafter.

Beneficiaries and stretching tax advantages of assets

- Why is it so important to consider beneficiaries when taking MRDs?

Retirement accounts generally pass outside the instructions of a will. Your beneficiary designations will determine who receives your retirement assets upon your death. That’s why it is so important to carefully consider who you have designated as a beneficiary on your accounts. Also, there are opportunities for beneficiaries to stretch out the tax-deferred growth of IRA assets after the death of the original account owner. With proper planning, many beneficiaries can minimize their required distributions and potentially maximize the advantage of continued tax deferral.

- How do I name a beneficiary?

A designated beneficiary is an individual, charitable organization, estate, or other entity that you have named to receive any assets in your account upon your death. Update your beneficiaries

.

You may also complete a beneficiary form.

- Should I convert to a Roth IRA, since they don’t have MRDs?

You can convert a Traditional IRA to a Roth IRA at any age. If you are over age 70½ when you convert, you will need to take your MRD for the Traditional IRA before converting any other amounts into the Roth IRA. Our online Convert an IRA to a Roth IRA

Calculator will help with that process.

- Are Qualified Charitable Distributions (QCDs) available for IRAs in 2015?

In 2015, Qualified Charitable Distributions (QCDs) were permanently extended.

For a distribution to qualify as a QCD, it must meet all of the following requirements:

- Taxpayer must be over the age of 70 ½.

- Total of all distributions does not exceed the maximum of $100,000 per taxpayer.

- Distributions are made directly from an IRA to the charity.

- Written receipt is obtained from each recipient charity. Note: Recipient charity is qualified as a 501(c)(3) organization per IRS regulations.

You may also want to consider the following when making a QCD:

- Donations count toward any IRA minimum required distributions for the year.

- Married individuals filing a joint return may exclude up to $100,000 donated from each spouse’s own IRA ($200,000 total).

- Amounts excluded from gross income are not deductible.

- Donations from an inherited IRA are eligible if the beneficiary is at least age 70 ½.

- Donations from an ongoing SEP or SIMPLE IRA aren’t eligible.

- Donations from a Roth IRA are eligible.

Note: Private foundations, supporting organizations, or donor‐advised funds do not qualify for QCD contributions.

Please consult your tax advisor if you have specific questions about your eligibility for this exemption.

- How do I know if I’m qualified to make a QCD?

The IRS requires that:

- The taxpayer is over the age of 70½.

- Distribution(s) do not exceed the maximum of $100,000 per taxpayer.

- Distributions are made from an IRA.

- Written receipt is obtained from each recipient charity.

- How to do I request a QCD from my Fidelity IRA?

If you qualify, you have the following choices for requesting a QCD from your Fidelity IRA.

- Use the Withdrawals—IRA One-Time form (PDF) to request a QCD from your account. In section 4, please select the first checkbox, which includes “check paid to a payee other than the IRA owner.” Enter the name of the qualified charity, but leave the address blank. We will send the check to your address of record for you to send to the charity. This ensures that the charity recognizes you as the contributor and gives you the written receipt required by the IRS.

- If you have checkwriting established on your IRA, you can write a check directly to the qualified charity.

Note: The charity must cash the check by December 31 in order to meet your minimum required distribution (MRD) and the QCD deadline for that year.

Fidelity will report the distributions as normal on 1099-R for the account.

Please speak with your tax advisor on how to report the distribution as a QCD when you file your taxes.