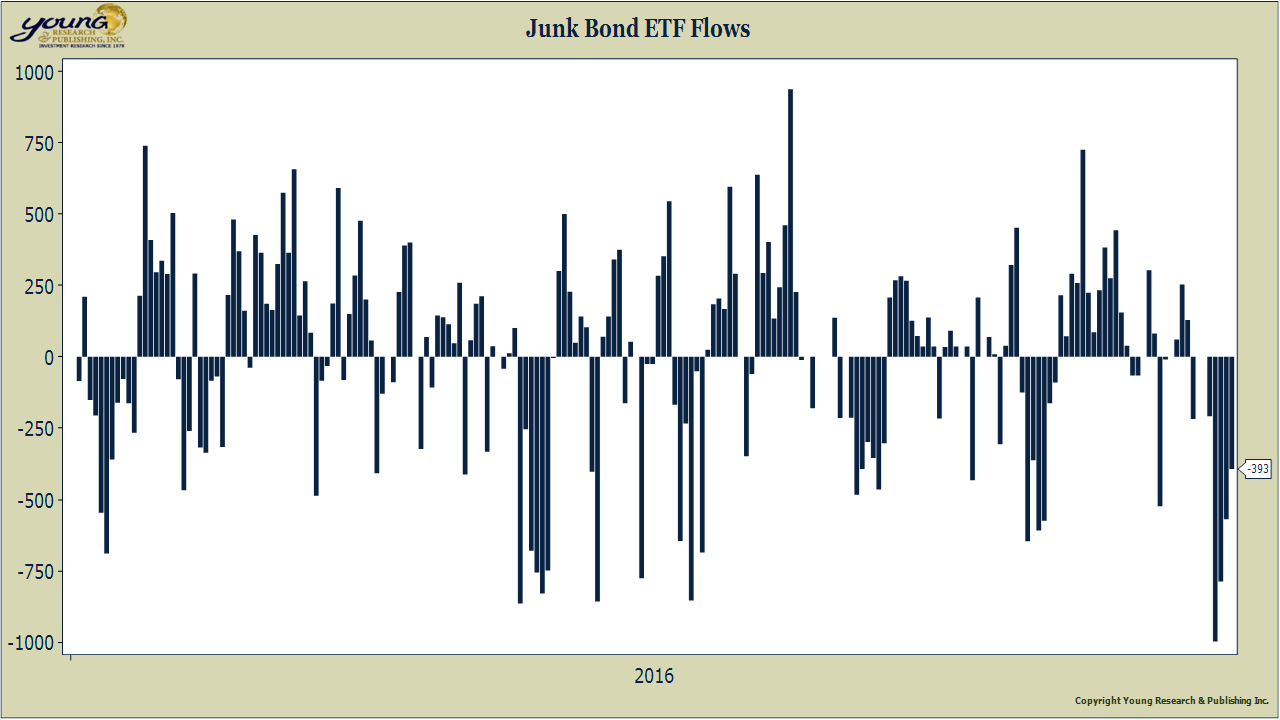

Inflation and uncertainty over future interest rate moves by the world’s central banks are causing junk bond investors to flee for the exits. Over the last week a wave of money has exited the junk bond market. The chart above displays the outflows from junk bond ETFs HGY and JNK. After I wrote to you yesterday, investors pulled money out of of junk bond ETFs yet again. The Wall Street Journal’s Chris Dieterich writes:

The bond market’s October retreat fueled record withdrawals from some popular exchange-traded funds, the latest sign of investor anxiety over inflation.

Investors pulled $998 million last Thursday from the oldest and largest junk-bond ETF. That is the largest daily withdrawal on record, said BlackRock Inc., the ETF’s provider.

Investors also pulled $1.7 billion last week from the the biggest weekly outflow since its inception in 2002.

The redemptions coincided with a global rout in government bonds that sent the yield on the 10-year U.S. Treasury note to its highest levels since late May. On Tuesday, the 10-year Treasury yield fell to 1.822%, as prices rose.

Bond investors are bracing for an interest-rate increase from the Federal Reserve and grappling with signs of rising inflation, which erodes the fixed value of bond payouts over time, in the U.S. and globally.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “What Do You Do If the Market Crashes?” - April 19, 2024

- Costco Gold Bars Sell Out Despite Premium Price - April 19, 2024

- A Wise Man’s Take on the Boston Bruins Playoff Chances - April 19, 2024

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024