Work hard and play hard. My dad used to tell me that a lot. He still does.

One year he and I drove down south to look at colleges and we stopped in Myrtle Beach to play golf. As we were eating breakfast I noticed his hair looked a little too shiny. One of the shampoo bottles in his travel kit had the sunscreen.

Work and play in investing terms is called counterbalancing.

Looking at the average annual return for the last ten-years it’s easy to overlook the years that can decimate a portfolio. Vanguard GNMA was up 4.36% and the S&P 500 was up 7.51% per year.

But, did you know that Vanguard GNMA was up 7.33% in 2008 while the S&P 500 was down 37%—a difference of 44.33%?

Imagine retiring in 2007 and only owning the S&P 500.

A lot of great things can happen in your life in ten-years.

You want to be able to enjoy these precious years. Remember work and play, bonds and stocks, shampoo and sunscreen, all have a place in your life.

Don’t mix them up.

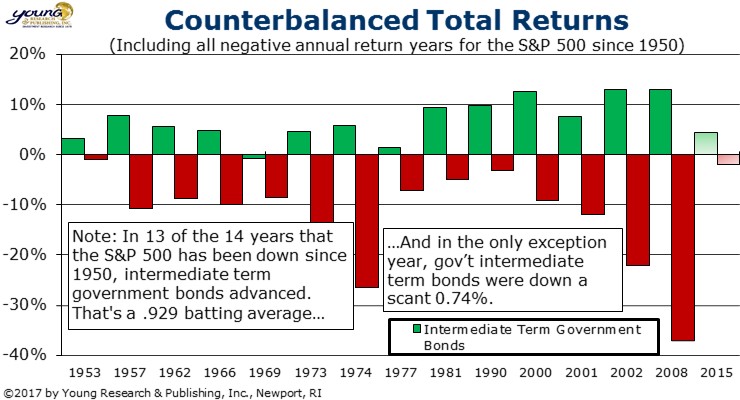

Below you can see how important bonds can be to an investment portfolio in hard times. The red columns represent every year the S&P 500 has taken a loss since 1950. The green columns represent the corresponding year’s return for intermediate term government bonds. In every year the S&P 500 fell but one, bonds generated a positive return.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “That’s Why I Hired You,” They Tell Me - April 22, 2024

- The Silver Lining of Higher Interest Rates - April 22, 2024

- China Poised to Wreak Devastating Blow to U.S. Infrastructure - April 22, 2024

- “What Do You Do If the Market Crashes?” - April 19, 2024

- Costco Gold Bars Sell Out Despite Premium Price - April 19, 2024