One of my favorite columnists, Dan Neil on the automobile bubble:

But there’s a lot of paper out—over $1 trillion in outstanding automotive loans in 2016, according to the credit-score company Equifax. About 20% of auto loan originations are subprime and delinquency rates have climbed steadily. And just like risky mortgages, delinquency-prone car loans are securitized, bundled and sold as asset-backed securities (ABS), which never worked out badly for anyone, ever.

Quietly, auto execs are worried sick about any contraction in auto-loan credit, but they would tear their tongue out before saying so on the record.

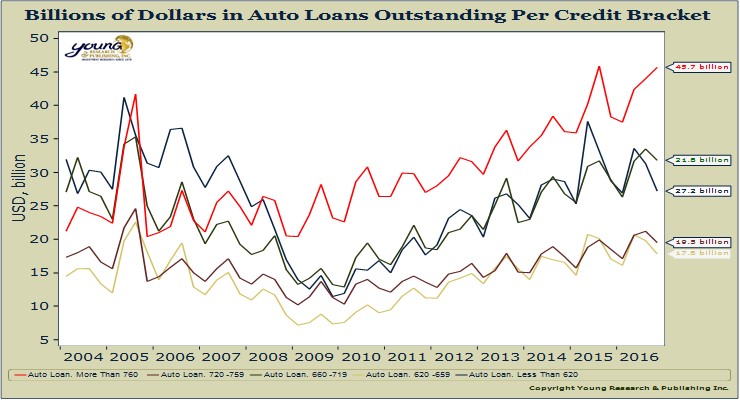

Read more from Neil here. You can see on my chart below that loans for all credit ranges are creeping back up near their 2005 bubble highs, with loans for those with the best credit already at record levels.