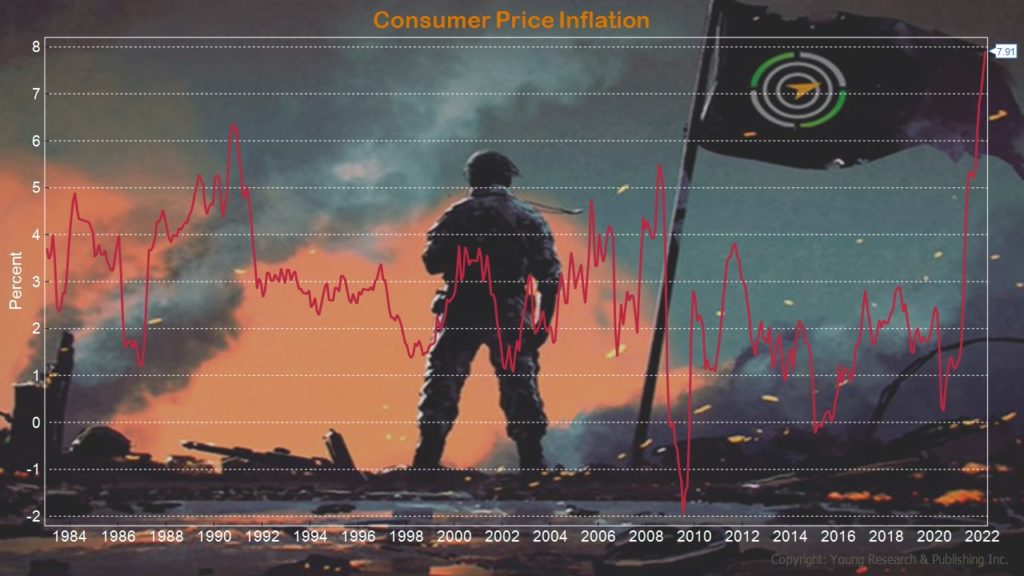

You knew it was only a matter of time. Government spending at record levels, and Fed funds rates at record lows. How long could inflation be kept at bay? Not forever. And now, it has been unleashed. Inflation in February hit rates unseen since 1982, forty years ago. Gabriel T. Rubin reports in The Wall Street Journal:

The Labor Department’s consumer-price index, which measures the cost of goods and services across the economy, was at its highest rate since January 1982, when annual inflation was 8.4%

Rising energy prices, including higher gasoline prices, helped push up the inflation reading, along with increases for groceries, restaurant food, transportation services and apparel. Economists expect additional price increases related to the Ukraine crisis after crude oil prices in March hit their highest levels since 2008, and U.S. gasoline prices reached record highs.

Excluding volatile energy and food prices, the Labor Department reported Thursday that consumer inflation rose at a 6.4% annual rate in February, up from 6% the prior month.

The 12-month rates aren’t adjusted for seasonality. The CPI measures what consumers pay for goods and services, including groceries, clothes, restaurant meals, recreation and vehicles. Month to month, CPI rose a seasonally adjusted 0.8% in February.

Gasoline prices were up a seasonally-adjusted 6.6% from the prior month, for an unadjusted annual increase of 38%. Groceries were up 1.4% over the prior month for an annual rate of 8.6%. Housing-rental costs rose at a slower rate, up 4.7% over the year. Used car prices declined slightly last month, pausing double digit price increases over the past year.

Before the Ukraine crisis, economists and policy makers had been hoping for a peak in year-over-year inflation this spring as supply chains heal from pandemic-related disruptions and the Federal Reserve begins an expected series of interest rate increases next week. But the outbreak of war has supercharged prices for oil, wheat, and precious metals, threatening higher inflation for longer.

“We thought that inflation would come down, especially due to the untangling of the global supply chain, but we don’t know how what’s happening in Ukraine will re-tangle that,” said Joel Naroff, chief economist at Naroff Economics LLC.

Elevated inflation, prior to the war in Ukraine, was primarily driven by brisk demand for goods, shipping bottlenecks and shortages of supplies such as semiconductors. Fed officials were braced for a run of higher inflation to start the year, but recent trends have been higher than expected. Housing and food costs have risen sharply, and hints at moderating prices in the used-car market have been overshadowed by further disruptions in new automotive manufacturing.

Action Line: Inflation is a stealth tax on your retirement, and if you don’t plan for it, life can become very difficult. If you’re retired or soon to be retired, you need to build your investment portfolio with inflation in mind. If you need help, I would love to talk with you. If you would like to get to know me before we talk on the phone, there’s no better way than signing up for my free monthly Survive & Thrive letter. In the letter each month, I encourage and push you to achieve the personal and financial security goals you’ve set for your family. Click here to subscribe. We’ll get to know each other, and get serious about your future success.