You know all about ESG (Environmental, Social, and Governance) investing from reading this site regularly. Most of the attention ESG gets is for the E, environmental. But the S and G are just as dangerous. The push for ESG has enriched Biden’s union allies and hurt the retirement security of Americans. F. Vincent Vernuccio of the Institute for the American Worker and Sam Adolphsen of the Foundation for Government Accountability explain in the NY Post:

In 2022, the Department of Labor rolled out a rule letting private-sector investment managers prioritize ESG, which sacrifices the financial growth investors want.

The rule applies to union pension funds themselves as well as investment funds that manage retirement savings for tens of millions of Americans.

These firms are broadly supportive of ESG, and under the new rule, they can use investors’ money to vote for union priorities.

What exactly are those priorities?

The answer is simple: whatever will help them control more workers.

At Starbucks, that meant capitulating to union demands for a collective-bargaining framework at organized stores.

At other companies, unions and their allies support a host of shareholder resolutions that would push workers into unions without full information or a secret-ballot election.

One common union demand is “non-interference policies.”

Unions want to force companies to sit out unionization campaigns.

That means not talking to their employees about the drawbacks of unionization, as well as letting unions intimidate workers using card check instead of a secret ballot in unionization campaigns.

Companies like Delta Air Lines, Chipotle Mexican Grill, DoorDash, Netflix and Tesla have all faced union-backed proposals along these lines.

Another common resolution requires a third-party “assessment” of a company’s collective-bargaining policies.

The assessments are designed to provide ongoing negative media coverage, pressuring companies into accepting non-interference policies, card check and other union priorities, like unfettered access to workers — including at home.

Amazon, Walmart and CVS have faced such resolutions, and Apple recently adopted one.

Reports on “working conditions” and “diversity, equity and inclusion practices” serve a similar purpose, attempting to browbeat companies into accepting union demands.

What’s happening at Starbucks shows the end game is to give unions more power. Yet while unions win, workers lose — and so do the investors whose money is being used for political purposes.

Union pension funds, which are already famously mismanaged, are jeopardizing their members’ retirement savings.

But so are other investment firms on which millions of investors rely.

Research shows unionized companies can forfeit 5% to 10% of shareholder value, largely because they lose flexibility.

Sure enough, ESG funds tend to underperform the broader market.

But investors don’t want to underperform the market — they want the strongest possible return on investment.

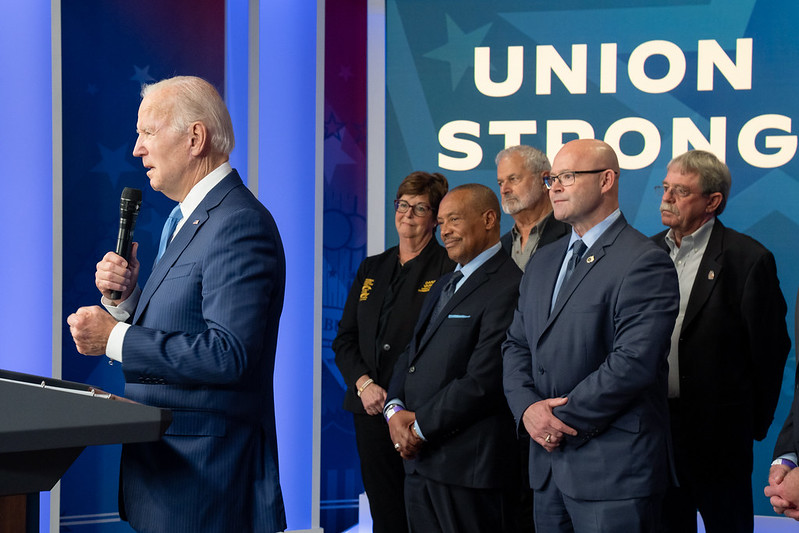

President Biden has put special-interest goals ahead of investors’ retirement goals, none more so than labor unions’.

Action Line: ESG hurts shareholders by prioritizing political outcomes over shareholder return. Vernuccio and Adolphsen explain just one of the many ways ESG has hurt retirees. Read more about ESG in the links below, and click here to subscribe to my free monthly Survive & Thrive letter.

- ESG Pushback Lands in Europe

- Companies Are Erasing ESG

- Disney Signals Problems with the ESG Agenda

- ESG Bankers Worried about Legal Blowback for Greenwashing

- Some ESG Chickens Come Home to Roost

- HOT POTATO: S&P Drops Its ESG Rankings

- Investors Souring on ESG

- ESG’s New False Choice

- End of ESG?

- The ESG Cartel