Happy Monday from Your Survival Guy. It was quite a week for two S&P 500 darlings, Facebook (Meta) and Amazon. What’s interesting is how so many commentators are saying, “I told you so,” as if predicting the future is easy. I can give you plenty of reasons why it could be tough sledding ahead for Amazon’s stock price. But the low hanging fruit is to pick at the road ahead for Facebook.

Here’s my takeaway, why bother with either when such huge price swings are part of the equation? Because when everyone’s talking about the same stocks, isn’t the secret out? Why not focus on the picks and shovels of this technology gold rush? I’ve always been a fan of dividend paying companies that utilize technology to increase value in their own businesses.

A good back of a napkin example is UPS. There’s a lot of technology in place to make this stock tick. Paul Ziobro writes in The Wall Street Journal:

United Parcel Service Inc. is making more money shipping fewer packages and rewarding investors with a meatier dividend payout.

The delivery company on Tuesday boosted its quarterly dividend by 49%, or 50 cents a share, the largest increase since the company’s public-markets debut in 1999. The planned per-share payout of $1.52 reflects the company’s new policy under Chief Executive Carol Tomé to return half of earnings to shareholders through its dividend.

UPS shares closed Tuesday at a record high of $230.69, up 14% for the day. The company posted fourth-quarter revenue and earnings ahead of analysts’ expectations and said it would reach its long-range revenue and operating-profit targets at the end of this year, instead of in 2023.

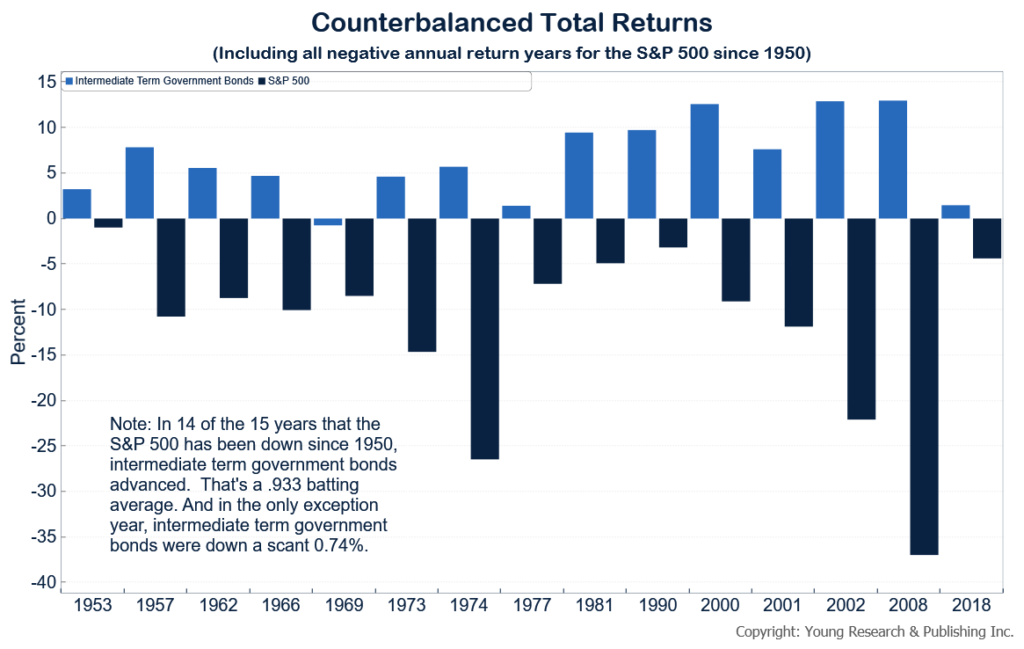

Investing is about building a moat around your money. It’s about creating a margin of safety. You know I always want bonds as a component in your portfolio so you can invest in your stocks with peace of mind.

To me, having too much of your money in a Facebook, for example, where a quarter of your position can be wiped out in a day, is not investing. The same is true about Amazon. Investing is understanding that you need to be just as worried about the downside and get paid in the form of dividends at all times

Action Line: If you need help building an investment stronghold that includes bonds to build a moat around your money, I would love to talk with you. Until then, get serious about your future. Click here to sign up for my free monthly Survive & Thrive letter, and I’ll help you stay motivated to achieve the goals you set for yourself and your family. It’s time to get serious.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Yes, Money Can Buy You Happiness - April 23, 2024

- State Income Taxes and the 2024 NFL Draft Class - April 23, 2024

- This ARK is Sinking - April 23, 2024

- “That’s Why I Hired You,” They Tell Me - April 22, 2024

- The Silver Lining of Higher Interest Rates - April 22, 2024