Your Survival Guy witnessed firsthand on my recent fact-gathering trip to Paris just how taxes can impact the labor force. Obviously, the business world is wiping the Covid crust from its eyes, but there’s a fine line between government assistance that creates value, and that which does not. When taxes are high, and assistance discourages work, there’s much less incentive to rejoin the labor market. When speaking with locals in Paris, they told me some workers will never come back to the workforce if they can help it.

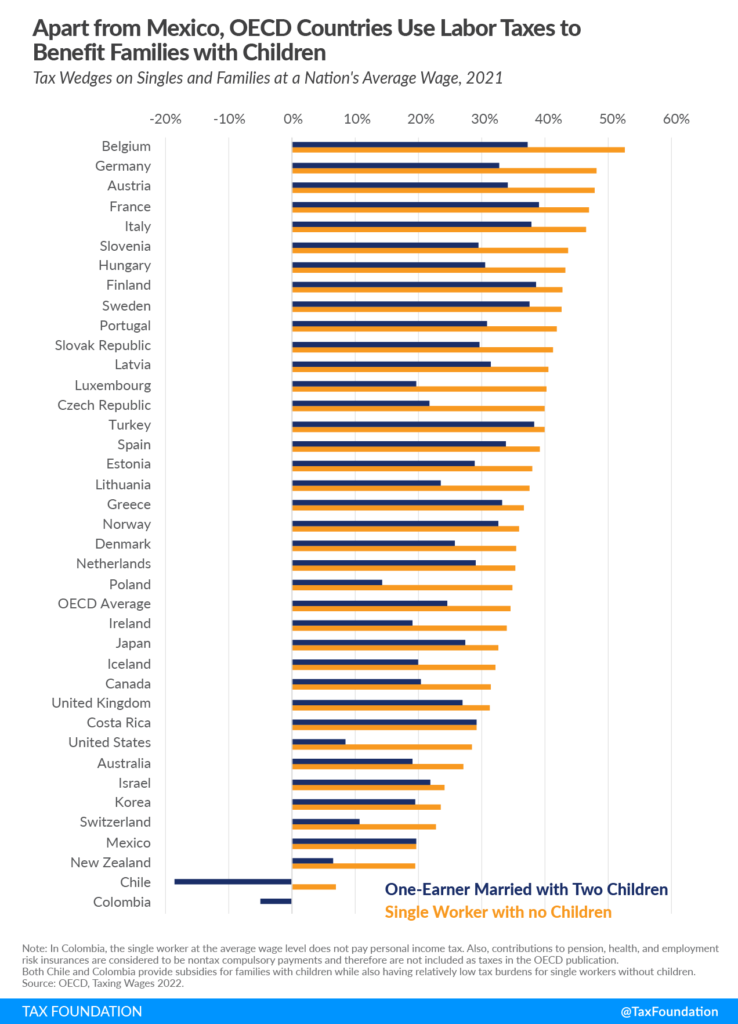

Do they feel their taxes are allocated well? It’s a simple question. It’s the young, single worker without children who is penalized most by high taxation (see table below). Encouraging these workers to work is the stepping stone to a strong labor force. But that’s the opposite of what’s happening. In France, they’re being taxed nearly 10 percentage points more than their friends who are married with children.

My gut feeling is many in Europe are rethinking the equation. Daniel Bunn of the Tax Foundation writes, “To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services. This will be particularly important as policymakers explore ways to encourage a robust economic recovery.”

He continues:

Governments with higher taxes generally tout that they provide more services as an explanation, and while that is often true, the cost of these services can be more than half of an average worker’s salary, and for most, at least a third of their salary.

Individual income taxes, payroll taxes, and consumption taxes like value-added taxes (VAT) make up a large portion of many countries’ tax revenue. These taxes combined make up the tax burden on labor both by taxing wages directly and through the tax burden on wages used for consumption. This so-called tax burden on labor reflects the difference between an employer’s total cost of an employee and the employee’s net disposable income.

Payroll taxes are typically flat-rate taxes levied on wages and are in addition to the taxes on income. In most OECD countries, both the employer and the employee pay payroll taxes. These taxes usually fund specific social programs, such as unemployment insurance, health insurance, and old age insurance. Although payroll taxes are typically split between workers and their employers, economists generally agree that both sides of the payroll tax ultimately fall on workers.

In 2021, single, average-wage workers paid about one-third of their wages in taxes. In most Organisation for Economic Cooperation and Development (OECD) countries, families had smaller tax burdens than single workers without children earning the same income, but how much less varied. Accounting for consumption taxes reveals higher tax wedges than when just accounting for income and payroll taxes.

Changes to income tax systems directly impact the tax burden on labor: Some individual countries have made substantial changes to their income and payroll taxes in the last two decades. Hungary, the OECD country with the highest tax burden on labor in 2000, has had the most notable decrease in its tax wedge, from 54.7 percent to 43.2 percent in 2021. This is partially due to the introduction of a flat tax on income, which lowered the income tax burden relative to total labor costs. Additionally, Hungary reduced its payroll taxes relative to total labor costs. Denmark, Sweden, and Lithuania have also lowered their tax burden on labor substantially, with a reduction between 6 and 8.1 percentage points each.

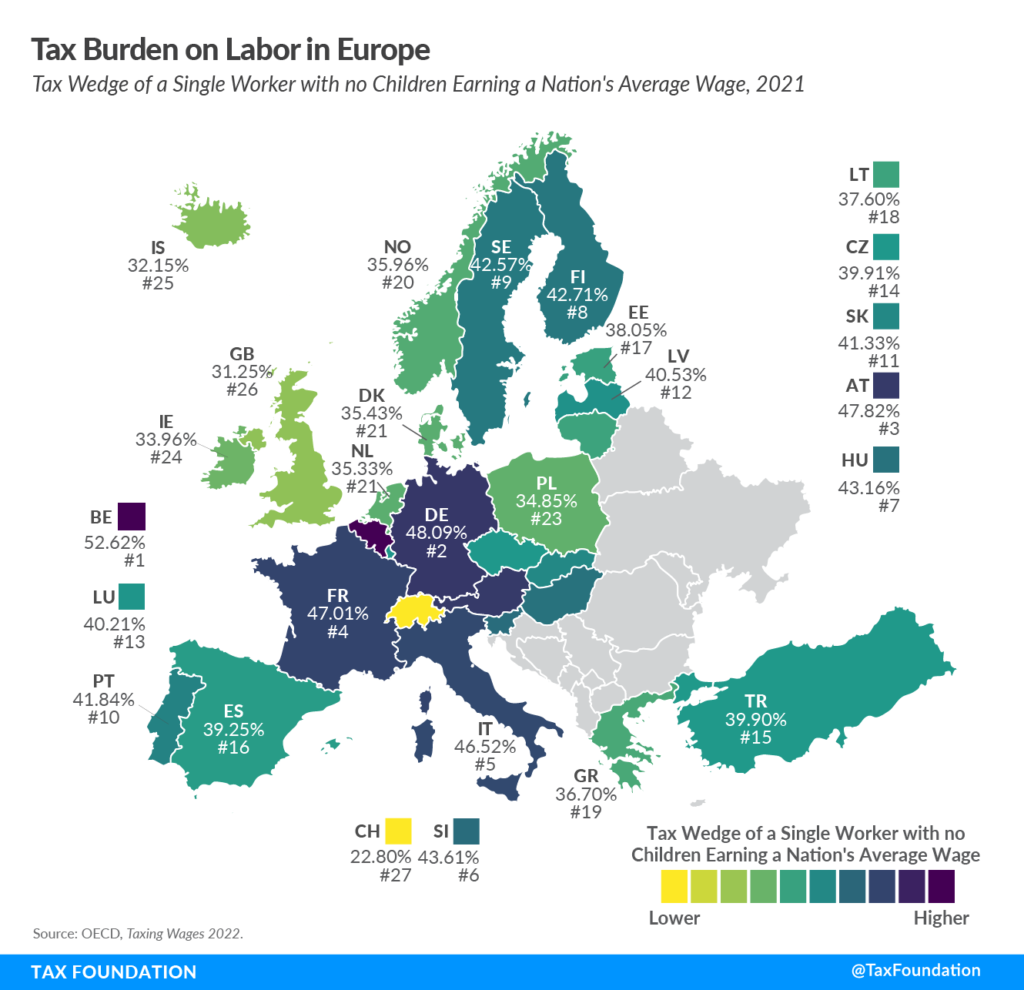

Europe specifically: Although the tax wedge in Europe is generally high, there is a relatively wide range. The following map illustrates how European countries differ in their tax burden on labor.

Belgium has the highest tax burden on labor, at 52.6 percent (also the highest of all OECD countries), followed by Germany and Austria, at 48.1 percent and 47.8, respectively. Meanwhile, Switzerland had the lowest tax burden, at 22.8 percent.

It’s important to note that all European countries provide some targeted tax relief for families with children, typically through lower income taxes. In Germany, a single worker earning the nation’s average wage faces a tax wedge of 48.1 percent. A family with two children and one earner adult would face a tax burden of 32.7 percent. Mexico is the only country in the OECD that does not tax families at a lower rate than single workers (at the average wage).

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services. This will be particularly important as policymakers explore way to encourage a robust economic recovery.

Action Line: Live somewhere you won’t be treated like a piggy bank. Move to a Super State and avoid the punishing taxation of the big blue blobs. If you need motivation in your fight to do what’s best for your family, click here to subscribe to my free monthly Survive & Thrive letter. I’ll push you to make the right decisions in your life, and help you succeed where others might fail.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024