My April RAGE Gauge is in, and RISK remains HIGH. Therefore, I want you to be a mindful and cautious investor, especially with your “safe” money. Your anchor-to-windward savings need to be safe.

I’m talking specifically about bonds. Bonds are not dead, far from it. They’re alive and well, especially if you have access to new and secondary market issues. And not just letting the chips fall as they may.

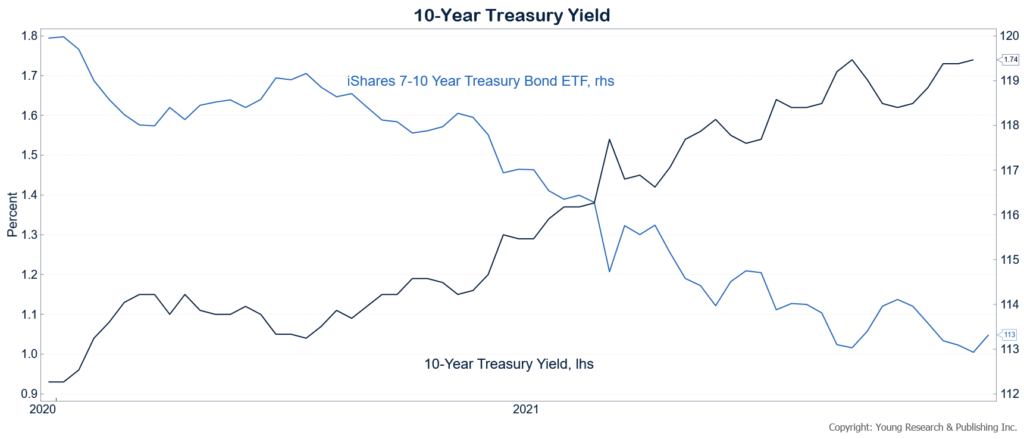

Remember, bond prices swing in the opposite direction of interest rates. Their sensitivity to interest rate swings is measured by duration. As a rule of thumb, duration (measured in years) is a measure of the price decline in bonds if interest rates rise by one percent. In other words, if interest rates rise by one percent, a bond with a ten-year duration will lose ten percent of its value.

Action Line: My favored way to counter duration risk is to invest in individual bonds directly, where if rates rise, you can hold until maturity and get your principal and interest back. I also like to keep the average maturity of my bond portfolio on the shorter-term side. This gives you a foundation to pick and choose some winners that are perhaps outside of that criteria but offer tremendous VALUE.