By UfaBizPhoto @ Shutterstock.com

Dear Survivor,

You might be looking for the best place in America to retire. You may enjoy owning firearms, paying low taxes, and being left alone. That’s the definition of what I’m calling a “liberty retiree.”

Recently a liberty retiree, known as U, asked MarketWatch‘s Catey Hill where would be the best place for them to retire. Hill answered (abridged):

To answer your question, I went right to the source: the Libertarian Party itself, where I had a lively chat with Dan Fishman, the party’s executive director, who had a lot of advice for you. He said that, while the Libertarian Party doesn’t maintain a list of the most libertarian cities and towns in America, there are certain states known to be more libertarian-friendly in many ways: New Hampshire — with its motto “Live Free or Die” — being the most obvious one, but also some spots in the mountainous western U.S., as well as parts of Texas.

That said, U, you probably won’t get all of the items on your libertarian checklist. But you can get many. To make my list of suggestions, I first looked at the states that seemed the most libertarian-friendly, based on Fishman’s advice and an assessment of the tax and gun laws. Then I looked at where in those states retirees might love. Here are some suggestions.

Cheyenne, Wyo.

The state of Wyoming is a solid spot for libertarians to consider retiring, thanks to its wide open spaces (you can “live and let live” here), lower tax climate for retirees (the state has no income tax and low sales and property tax) and its gun-friendly environment. It’s one of the 10 best states for gun owners, according to Guns & Ammo magazine, and there is “no statewide emissions inspection requirement,” according to AAA.

Keene and Laconia, N.H.

The state of New Hampshire is probably the best known of the libertarian-minded states (that’s why I picked two spots here): Not only because of its state motto, either; it’s the home of the Free State Project, which bills itself as “a movement of thousands of freedom-loving people to New Hampshire, where we are working to reduce the size and scope of government in order to achieve Liberty in Our Lifetime.” In other words, you can be around like-minded folks in this state, which is why we chose to include it. The tax situation, though, is mixed: New Hampshire has no income tax on salaries and wages and no sales tax, though it does tax dividends and interest, and property taxes can be high. It scores decently on gun friendliness, according to Guns & Ammo magazine, and highly on health care, which is obviously good news for retirees.

Mesa, Ariz.

Arizona is one of the most tax-friendly states for retirees, according to Kiplinger’s, in addition to being gun friendly (it ranks No. 1 on Guns & Ammo’s list). Though Fishman points out that Arizona residents generally aren’t keen on open borders, as many libertarians are. And unlike New Hampshire and Wyoming in most months, Arizona offers warm weather, which is a big reason it’s popular with retirees.

I suggest combining Hill’s work with my ranking of the Top 10 Best States for Survival. Both New Hampshire, the “Smith Family Robinson’s Live Free or Die” state, and Wyoming, where you can find success with slow money, rank in my top ten.

The top state on my list of Best Survival States is Idaho, where the state legislature is advancing a bill to give educators the ability to protect the children they teach from danger by allowing them to carry a concealed firearm at work. Legislators in Idaho are actively working to expand their citizens’ rights, not reduce them. Fox News reports:

A bill that would allow some school staffers in Idaho to carry a concealed firearm at work without the permission of the school board moved forward Thursday after the Idaho House passed it 58-18.

The Republican who sponsored the bill said it was a “Second Amendment issue,” the Idaho Statesman reported.

“The Second Amendment right doesn’t stop at the door of a school. I trust Idahoans to be responsible,” state Rep. Chad Christensen said on the floor of the House.

State Rep. Karey Hanks, another Republican, said she works for a school district and wants to carry a gun “to be able to protect those students.”

If you’re choosing where to retire, you need to keep your liberty in mind. Moving to a state that’s going to treat you like a piggy bank, while taking away your freedom is no way to spend your life. There are many places in America you can still go to live a free life, and most of them are in America’s “growth corridors.”

A Liberty Retirement in Alabama

Pier at Daphne, Alabama Bayfront Park on Mobile Bay during sunset. By George Dodd III @ Shutterstock.com

Once you finally make the decision to retire, and you shut off the flow of new income into your portfolio, your expenses quickly become the center of your attention.

Your cost of living means a lot in retirement. One place where you can get more for your money is in Alabama. Birmingham and Montgomery are two of the least expensive cities in America to buy a midsize home.

Being careful with your money in retirement is important, but maintaining a FIRE mentality during your working years, and saving more ahead of retirement is the best way to unlock the power of compound interest.

But a “Liberty Retirement” isn’t only about saving your money. It’s also about living free. Alabama’s state government is run by Governor Kay Ivey, who maintains an A rating from the NRA. The state also has a “Castle Doctrine” law in place that allows residents to protect themselves in the face of danger.

Alabama also protects employees’ right to work by banning forced unionism.

When it comes to the cost of living, Alabama sweetens its low property prices with the nation’s second-lowest property tax rates. And as an added bonus for retirees, Alabama fully exempts Social Security benefits from income taxation.

Is This State the Next Destination for America’s Liberty Retirees?

West Virginia, Beauty Mountain. By anthony heflin @ Shutterstock.com

You want to build yourself an ‘island‘ in retirement. You want to separate you, and your money, from those who would take it from you. Settling down in one of America’s growth corridors is a good first step toward finding the right place in America. But if you want to get a head start on your retirement, and move while you’re still working, you probably want to find a state with low, or no income taxes.

There are seven states with no personal income taxes, including:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

New Hampshire doesn’t have personal income taxes on wages or salaries but does tax dividends and interest income.

Another state may soon set out on a path to join these by cutting its own personal income taxes. Cal Thomas reports in the Chicago Tribune:

West Virginia is unique among America’s 50 states. At a convention in Wheeling, Virginia, in 1861, delegates from Virginia’s northwest counties, which were loyal to the Union, voted to break away from that state over the issue of slavery and their refusal to be part of the Confederate states.

West Virginia is again attempting to “break away,” this time on the issue of taxes. While the Biden administration wants to raise federal income taxes to cover overspending, the governor of West Virginia, Jim Justice, wants to reduce and eventually eliminate his state’s personal income tax. If successful, West Virginia would join nine other states that do not impose state income taxes on their citizens.

Though his state has experienced a population decline for 70 years, Gov. Justice believes now is the right time to reverse the trend by cutting the state’s income tax by 60% in the first year, leading to its eventual elimination.

In an interview, I asked the governor for his rationale behind erasing his state’s major revenue source. He said it is because the state’s economy is booming and it now has a “$100 million surplus,” in spite of the pandemic. That’s because, he says, businesses, including restaurants, “are 100% open” and people are flocking to the state to spend time and money.

He estimates that if his tax cut proposal passes the majority Republican legislature it will “put $2,200 more in people’s pockets. Every single person in the state will end up cash positive.”

Cutting or eliminating West Virginia’s income tax could be a powerful draw for the state. Currently, every state bordering West Virginia has a lower top marginal tax rate.

Liberty retirees and small business owners looking for a better place in America could be pleasantly surprised with West Virginia.

Second Amendment supporters may also find a good home in the Mountain State. The state’s constitution clearly identifies citizens’ rights regarding firearms in Article 3, Section 22, stating “A person has the right to keep and bear arms for the defense of self, family, home, and state, and for lawful hunting and recreational use.”

According to the NRA, West Virginia demands no permit to buy long guns or pistols, no registration of any firearm, no licensing, and no permit to carry. The state also boasts an enacted Castle Doctrine law, a no-net loss provision, a right to carry confidentiality law, and many other protections for firearms owners.

If you live in the Mid-Atlantic states or the Rust Belt, do what many Americans are doing and take a trip to West Virginia. Remember, you want to live where your money is respected.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Twitter, Instagram, and Facebook.

P.S. A few thoughts for you as a client/friend tells me life is good. Life hasn’t changed too much in retirement during the pandemic, he tells me. He laughed and commented that according to Clint Eastwood, you know you didn’t have much of a social life if the pandemic didn’t change it much.

- You read Amazon will stream NFL games. Yippee. What happens when your internet gets overloaded, and you miss the game-winning TD?

- Cash is king? Not buying it? Good. When was the last time the government created anything of value?

- I like high-quality short-term bonds mixed in with some high yield junk and sprinkled with some floating rate. Bond investing doesn’t have to be b-o-r-i-n-g.

- Writing stock options or playing golf? No brainer. Golf.

- Stop losses. Yes or no? No.

- Why? Because a stop loss isn’t a promise to sell at your price. It’s a promise to look for a buyer. There needs to be a buyer.

- It’s like visiting Stop & Shop. You’re the produce.

- When you can’t predict the future (if you can, you don’t need me, right?) then why rely on predictions with naked calls?

- Being right once is hard enough.

- A client in Louisiana in her 90s misses her lunches with her lady friends. She said she’s ready to get back out there. She’s going to sell her motor coach/van, though—no one to travel with.

- This time last year, we were heading out to Telluride, CO. Had to come back after three days because of some virus in China.

- This ski season, resorts are doing the best they can.

- Mad River Glen has an old, single-person chair. As a reader in the WSJ comments noted: That’s some forward-thinking.

- Remember the Poma lifts? Where going up was as challenging as coming down?

- How about the T-Bar? Good luck if you had an older sibling trying to knock you off.

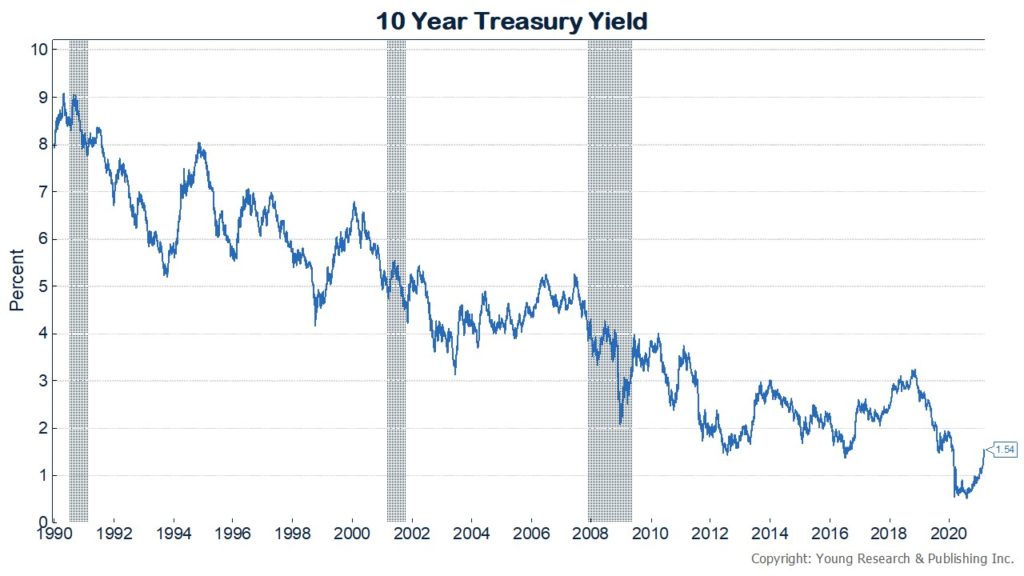

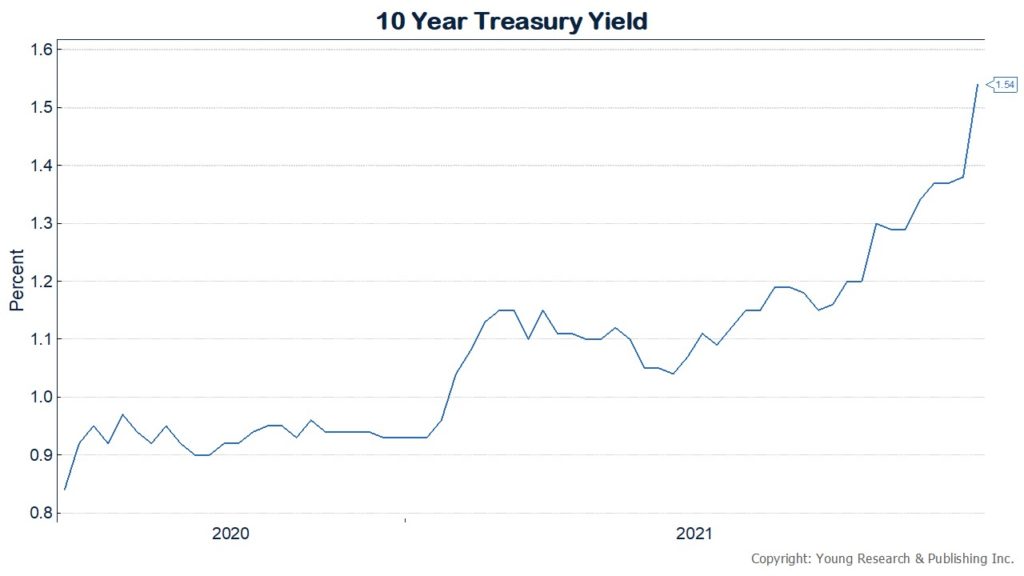

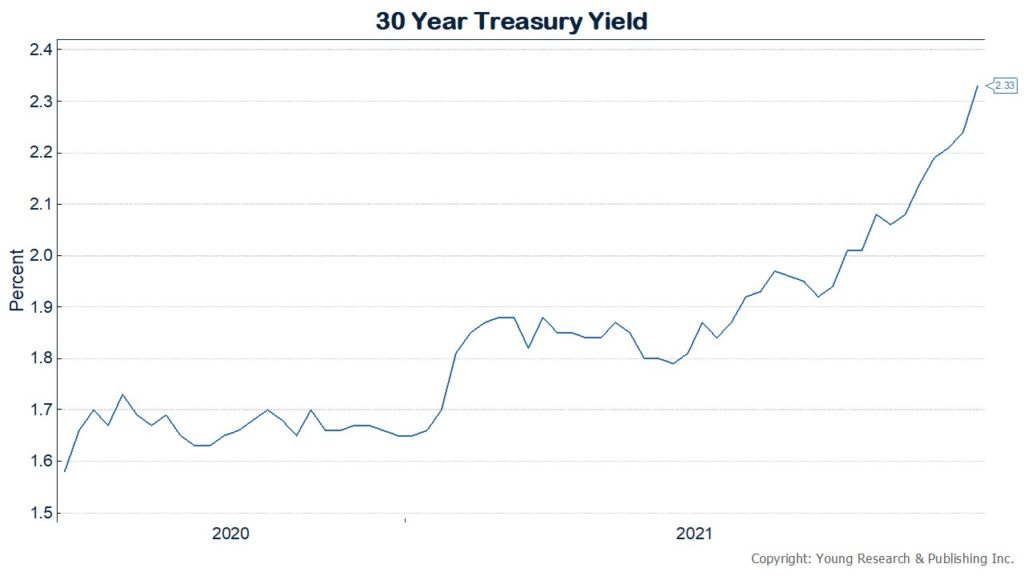

- How about 70% tax rates? Isn’t that what savers are paying for lost income thanks to the Fed’s low interest rate absurdity? Of course, it’s a tax. Paid by all SAVERS (deferred gratification is supposed to be REWARDED).

- Talked with a child psychologist client/friend yesterday who reluctantly told me business is booming.

- Open up America.

- Enough already.

Cobia and Yellow Jack.

President Barack Obama meets with Warren Buffett in the Oval Office, July 14, 2010. (Official White House Photo by Pete Souza)

P.P.S. It’s nice to have some traditions you can count on. One of those is Warren Buffett’s recently released annual letter to shareholders of Berkshire Hathaway. With all the chaos in the world, it’s nice to have stability when you can find it.

I read the report Sunday morning before Becky and I met my parents for lunch at a favorite spot in Tiverton, RI. My Mom and I ordered the fresh cod with littlenecks and linguica. My Dad commented that he had the same dish Friday with his friend at another restaurant in New Bedford.

If you’ve ever read the history of how Berkshire Hathaway got its name, then you learned about a textile company in New Bedford that was bought by some investor from Omaha, Nebraska. It turned out the investment was a dog. But it taught the investor, Warren Buffett, the importance of not just buying cheap companies—but owning great companies.

Some interesting points from the letter:

- As I’ve emphasized many times, Charlie and I view Berkshire’s holdings of marketable stocks – at year end worth $281 billion – as a collection of businesses. We don’t control the operations of those companies, but we do share proportionately in their long-term prosperity. From an accounting standpoint, however, our portion of their earnings is not included in Berkshire’s income. Instead, only what these investees pay us in dividends is recorded on our books. Under GAAP, the huge sums that investees retain on our behalf become invisible.

- It took me a while to wise up. But Charlie – and also my 20-year struggle with the textile operation I inherited at Berkshire – finally convinced me that owning a non-controlling portion of a wonderful business is more profitable, more enjoyable and far less work than struggling with 100% of a marginal enterprise.

- Most of Berkshire’s value, however, resides in four businesses, three controlled and one in which we have only a 5.4% interest. All four are jewels. The largest in value is our property/casualty insurance operation, which for 53 years has been the core of Berkshire. Our family of insurers is unique in the insurance field. So, too, is its manager, Ajit Jain, who joined Berkshire in 1986.

- Our second and third most valuable assets – it’s pretty much a toss-up at this point – are Berkshire’s 100%ownership of BNSF, America’s largest railroad measured by freight volume, and our 5.4% ownership of Apple. And in the fourth spot is our 91% ownership of Berkshire Hathaway Energy (“BHE”). What we have here is a very unusual utility business, whose annual earnings have grown from $122 million to $3.4billionduring our 21 years of ownership.

Buffett went on to explain the value of owning companies with actual assets (My emphasis added in bold):

Recently, I learned a fact about our company that I had never suspected: Berkshire owns American-based property, plant and equipment – the sort of assets that make up the “business infrastructure” of our country – with a GAAP valuation exceeding the amount owned by any other U.S. company. Berkshire’s depreciated cost of these domestic “fixed assets” is $154 billion. Next in line on this list is AT&T, with property, plant and equipment of $127billion.

Our leadership in fixed-asset ownership, I should add, does not, in itself, signal an investment triumph. The best results occur at companies that require minimal assets to conduct high-margin businesses –and offer goods or services that will expand their sales volume with only minor needs for additional capital. We, in fact, own a few of these exceptional businesses, but they are relatively small and, at best, grow slowly.

Asset-heavy companies, however, can be good investments. Indeed, we are delighted with our two giants – BNSF and BHE: In 2011, Berkshire’s first full year of BNSF ownership, the two companies had combined earnings of $4.2 billion. In 2020, a tough year for many businesses, the pair earned $8.3 billion.

BNSF and BHE will require major capital expenditures for decades to come. The good news is that both are likely to deliver appropriate returns on the incremental investment.

Let’s look first at BNSF. Your railroad carries about 15% of all non-local ton-miles (a ton of freight moved one mile) of goods that move in the United States, whether by rail, truck, pipeline, barge or aircraft. By a significant margin, BNSF’s loads top those of any other carrier.

The history of American railroads is fascinating. After 150 years or so of frenzied construction, skullduggery, overbuilding, bankruptcies, reorganizations and mergers, the railroad industry finally emerged a few decades ago as mature and rationalized.

BNSF began operations in 1850 with a 12-mile line in northeastern Illinois. Today, it has 390 antecedents whose railroads have been purchased or merged. The company’s extensive lineage is laid out athttp://www.bnsf.com/bnsf-resources/pdf/about-bnsf/History_and_Legacy.pdf.

Berkshire acquired BNSF early in 2010. Since our purchase, the railroad has invested $41 billion in fixed assets, an outlay $20 billion in excess of its depreciation charges. Railroading is an outdoor sport, featuring mile-long trains obliged to reliably operate in both extreme cold and heat, as they all the while encounter every form of terrain from deserts to mountains. Massive flooding periodically occurs. BNSF owns 23,000 miles of track, spread throughout28 states, and must spend whatever it takes to maximize safety and service throughout its vast system.

Nevertheless, BNSF has paid substantial dividends to Berkshire – $41.8 billion in total. The railroad pays us, however, only what remains after it both fulfills the needs of its business and maintains a cash balance of about$2 billion. This conservative policy allows BNSF to borrow at low rates, independent of any guarantee of its debt by Berkshire.

One further word about BNSF: Last year, Carl Ice, its CEO, and his number two, Katie Farmer, did an extraordinary job in controlling expenses while navigating a significant downturn in business. Despite a 7% decline in the volume of goods carried, the two actually increased BNSF’s profit margin by 2.9 percentage points. Carl, as long planned, retired at yearend and Katie took over as CEO. Your railroad is in good hands.

Some other interesting points from Buffett in his letter:

- In no way do we think that Berkshire shares should be repurchased at simply any price. I emphasize that point because American CEOs have an embarrassing record of devoting more company funds to repurchases when prices have risen than when they have tanked. Our approach is exactly the reverse.

- In 1937, its first full year of operation, GEICO did$238,288 of business. Last year the figure was $35 billion.

- Today National Indemnity is the only company in the world prepared to insure certain giant risks. And, yes, it remains based in Omaha, a few miles from Berkshire’s home office.

- NFM now owns the three largest home-furnishings stores in the U.S. Each set a sales record in 2020, a feat achieved despite the closing of NFM’s stores for more than six weeks because of COVID-19.

- the 1983 annual report – up front – laid out Berkshire’s “major business principles.” The first principle began: “Although our form is corporate, our attitude is partnership.” That defined our relationship in 1983; it defines it today. Charlie and I – and our directors as well – believe this dictum will serve Berkshire well for many decades to come.

- In 1958, Phil Fisher wrote a superb book on investing. In it, he analogized running a public company to managing a restaurant. If you are seeking diners, he said, you can attract a clientele and prosper featuring either hamburgers served with a Coke or a French cuisine accompanied by exotic wines. But you must not, Fisher warned, capriciously switch from one to the other: Your message to potential customers must be consistent with what they will find upon entering your premises.

- The tens of millions of other investors and speculators in the United States and elsewhere have a wide variety of equity choices to fit their tastes. They will find CEOs and market gurus with enticing ideas. If they want price targets, managed earnings and “stories,” they will not lack suitors. “Technicians” will confidently instruct them as to what some wiggles on a chart portend for a stock’s next move. The calls for action will never stop.

- Productive assets such as farms, real estate and, yes, business ownership produce wealth – lots of it. Most owners of such properties will be rewarded. All that’s required is the passage of time, an inner calm, ample diversification and a minimization of transactions and fees. Still, investors must never forget that their expenses are Wall Street’s income. And, unlike my monkey, Wall Streeters do not work for peanuts.

- Investing illusions can continue for a surprisingly long time. Wall Street loves the fees that deal-making generates, and the press loves the stories that colorful promoters provide. At a point, also, the soaring price of a promoted stock can itself become the “proof” that an illusion is reality.

- If that strategy requires little or no effort on our part, so much the better. In contrast to the scoring system utilized in diving competitions, you are awarded no points in business endeavors for “degree of difficulty. ”Furthermore, as Ronald Reagan cautioned: “It’s said that hard work never killed anyone, but I say why take the chance?”

Click here to read the entire letter.

P.P.P.S. Sailfishing off Key West.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024