Chicago-area politicians have given their constituents something special this year, a major property tax increase. In a state already near the top for income taxes, residents of Chicago and Cook County are facing property tax bills that have skyrocketed.

In the face of property tax bills that have even climbed by 60%, some residents are being forced by the bills to move out of the area. Dana Kozlov reports for CBS:

Property tax increases in Cook County are going beyond sticker shock. For some families it’s life-changing, and they say they will have no choice but to move.

“This is out of control,” said Liz Gold.

She and her family have lived in their 1890s rehabbed home in Ravenswood since 2001. They had hoped to stay until they were hit with their recent Cook County property tax bill that may force them out.

“Overall for the year it increased by 60%,” she said. “We are now paying almost $21,000 — $20,200.”

She said they had been paying $12,000.

Gold said the extra $800 a month they need to find to pay their new yearly bill erased any college money they had hoped to save for their youngest son.

“I’m not getting a $10,000 a year raise. My husband won’t be getting a $10,000 a year raise. I don’t know how we’re going to make that happen,” she said. “It’s not feasible for us to absorb that cost.”…

“I just don’t understand how there’s not some sort of ceiling on this or a cap of some sort,” said Gold. “If we could plan for it, it would be different.”

Now Gold is planning to leave.

“We probably will end up moving from Chicago,” she said.

Read more here.

For many Americans, especially those who are retired, property tax increases can make or break a budget. If you’re retired, you’ve paid off your mortgage, and you’re on a fixed income, one of the most volatile expenses you have may be your property taxes. Big jumps in your assessment, or hiked rates can cripple a budget you’ve worked so hard to control.

Illinois is replete with problems, as I have written:

- High Tax Illinois Suffers Exodus

- Illinois: New Governor, Same Old Pension Pyramid Scheme

- Americans Want to Leave Their High Tax States

- Illinois Goes Back to the Trough

- Illinois Politicians Trying to Kill Local Employee Freedom Initiatives

- Illinois is About to Stick its Head Deeper in the Sand

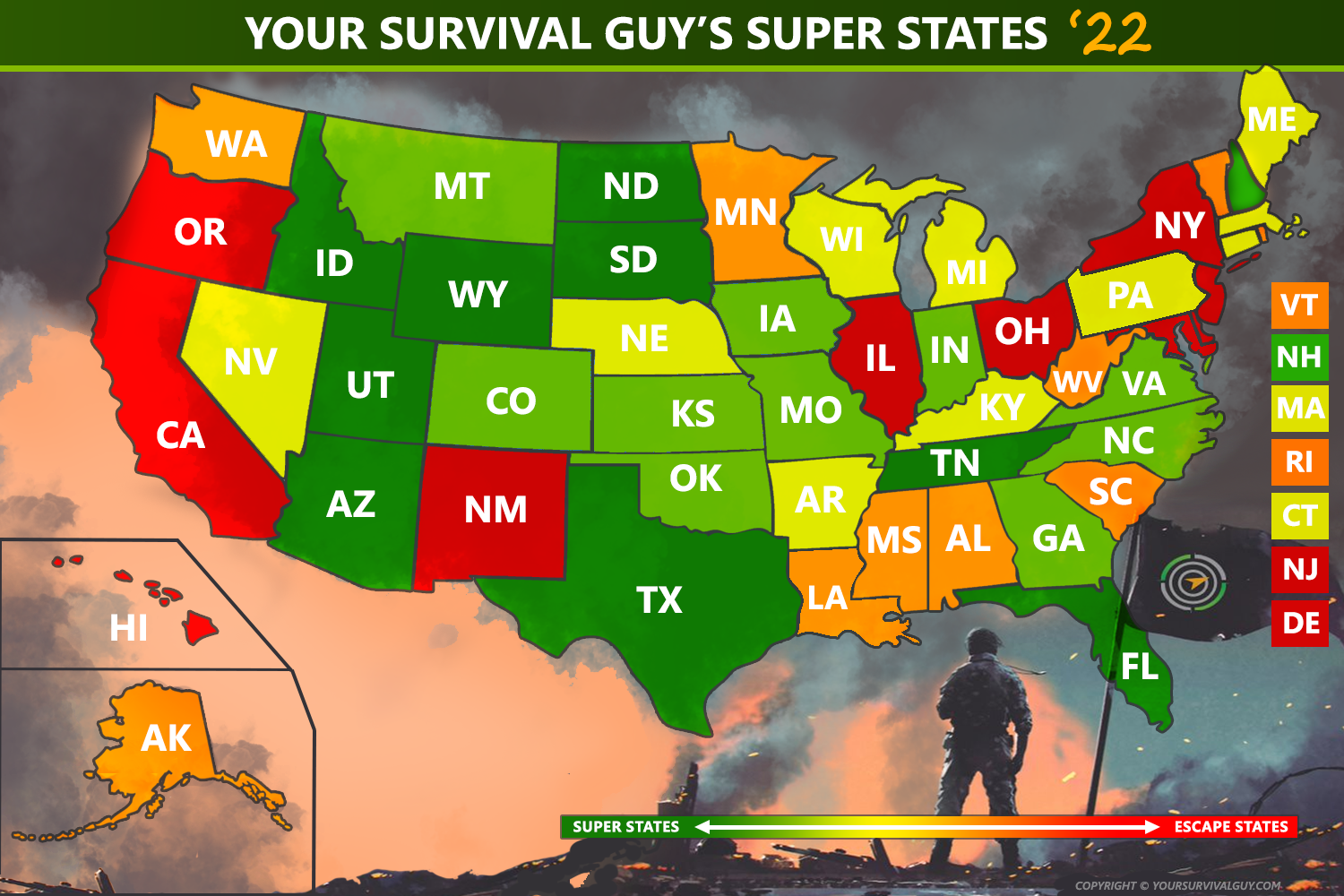

Poor tax policy is driving resident from Chicago, and Illinois in general. If you’re retired or are retiring soon, it’s important to examine where you choose to retire, and make sure that it’s the right place for you.