The Cato Institute’s Chris Edwards, a featured speaker at the Cato Club Naples 2016, notes in the Cato Tax & Budget Bulletin published in September, 2015 that “Federal debt now totals more than $13 trillion, or about $107,000 for every household in the nation.” Last week, regarding the latest CBO Budget, he wrote “Federal borrowing from global capital markets is expected to soar from an outstanding $14 trillion this year to $24 trillion by 2026 under the baseline.” As you can see, the numbers aren’t getting any better. Edwards notes that the post-WWII debt decline was mostly due “to the government shafting bondholders with unexpected inflation”.

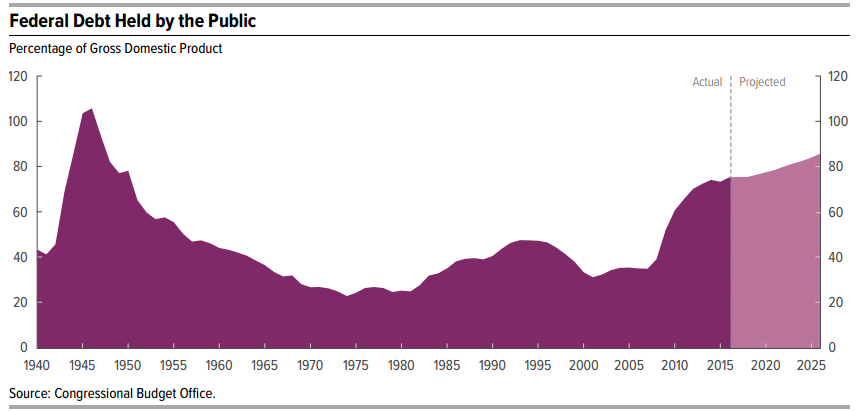

Here is another scary factor that is rarely discussed: The CBO budget report has included the chart below for many years. The current debt load is the highest ever in peacetime but is still below the World War II peak. I suspect people looking at the chart are comforted by the rapid decline in the debt following the war—if we belt-tightened back then, then we can do so again.

But little of the post-war debt decline was due to belt-tightening. In fact, the government has steadily increased spending and run deficits 85 percent of the years since 1930.

The post-WWII debt decline was partly due to strong economic growth, but mainly due to the government shafting bondholders with unexpected inflation. Inflation reduces the real value of outstanding debt, and thus imposes losses on creditors. The ability to cut real debt by inflation depends on the debt’s maturity and whether creditors expect inflation. If the average maturity is long, the government can reduce the real debt load with unexpected inflation.

That is what happened following WWII. As the chart shows, the debt-to-GDP ratio was cut almost in half between 1946 and 1955. Economists Joshua Aizenman and Nancy Marion found that nearly all that drop was due to the combination of inflation and long maturities on the debt at the time. In subsequent decades, maturities fell, so inflation resulted in less debt shrinkage.

Here’s the upshot: It is unlikely that the government would be able to shaft bondholders like that again, nor would that be a good idea. So Congress and the next president need to make major budget reforms to avert the government’s disastrous debt pile up. They are going to have to cut spending, and that is actually a good thing because spending cuts would reduce economic distortions and help spur more growth.