Dear Survivor,

Life comes at you fast. One minute you’re living your retirement life. The next, you need major surgery. “I’m having major surgery tomorrow,” a client said to me yesterday. “Take care of things for me,” he said. “I will,” I said.

We’ve been working together for over 20 years. He’s been trusting Richard C. Young for many more. He’s financially fit because he invested in himself at an early age and was smart with his savings. He realized a long time ago that saving money and investing are two different things. He needed help with the second one.

I know his family because he tells me about them. They know me because he tells them about Your Survival Guy. He also puts me on speaker every time we talk. “Hang on,” he’ll say. “Did you hear what he said, hon?”

“Can you say that again, Survival Guy?”

And I’m ok being the voice of reason. Taking the slings and arrows. That’s my job. When you work with good people—good families—it’s a calling.

I Meant to Tell You My Recent “Survival Guy” Story

You know from here, here, here, and here that bad stuff happens. More times than I care to admit, I’m involved. Dear reader, is there anything more enjoyable? I get it. But once the feeling of “thankful it wasn’t me” passes, it gets darn serious. “What,” you may ask yourself, “if that happens to me?”

The other weekend Your Survival Guy arrived at his cabin in New Hampshire with no heat. Hours earlier, glancing at my phone to check the indoor temp I turned up on the app (life’s a little too easy at times), I realized it hadn’t budged and was falling. Sure enough, the furnace was out.

Good luck finding help on a Friday night. Imagine Your Survival Guy bringing in loads of wood I had put away for the season the prior weekend and climbing back up into the cabin to light a fire. Outside was warmer than indoors. I thought about sleeping on the deck. The dog had run away. And everyone’s wondering why I’m so upset. That’s no way to start a weekend.

Anyway, I got this email below from a long-time client. He’s the guy who can build a garage over the weekend. So can his two brothers and brother-in-law, all clients. Talk about feeling helpless. He writes:

When we talked earlier this week, I meant to tell you my recent “Survival Guy” story.

Two weeks ago, on Saturday night, after we watched UConn win its Final Four game (at about 11:30PM), we prepared for bed and discovered that we had no water. My guess was that our well pump died, but it was too late to do any troubleshooting.

Fortunately, I had 8 gallons of water stored in a rolling container, so I was able to fill a couple of buckets to allow toilet flushing and at least get us through the night and into the morning in civilized fashion. Our bottled water inventory provided what little potable water we needed.

Last summer, I bought a spare well pump and stored it on a shelf in the basement as a safeguard against any untimely failure of our in-service pump. Saturday night near midnight definitely qualifies as “untimely!”

That $700 expense proved to be most fortuitous.

Early Sunday morning, I contacted my brother and brother-in-law (you know both of them) and asked for their help to replace the well pump. They arrived at mid-morning, whereupon we pulled the pump out of the well and did the necessary electrical and plumbing work to disconnect the old pump and replace it with the new pump. We were back up and running by noon.

Several levels of forethought and preparedness, along with a bit of skill, saved the day.

Take care

Being prepared is a mindset. And yes, it helps to have the skills to boot. Stuff happens. You don’t have to solve all of life’s problems alone. I’m here to help…with some of them.

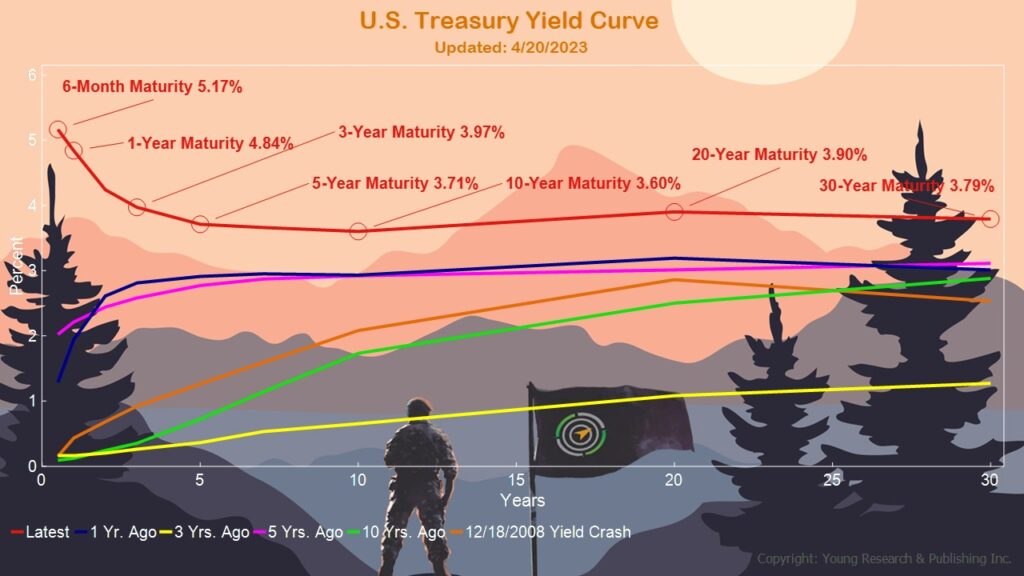

Locking In a Generational Opportunity in Fixed Income

As you can see below, you’re witnessing a generational opportunity in fixed income. Attention retirees and those soon to be retired—don’t miss the boat. Because when you can lock in yields for years and years into the future—a large chunk of your retirement life—Your Survival Guy wants you to pay attention.

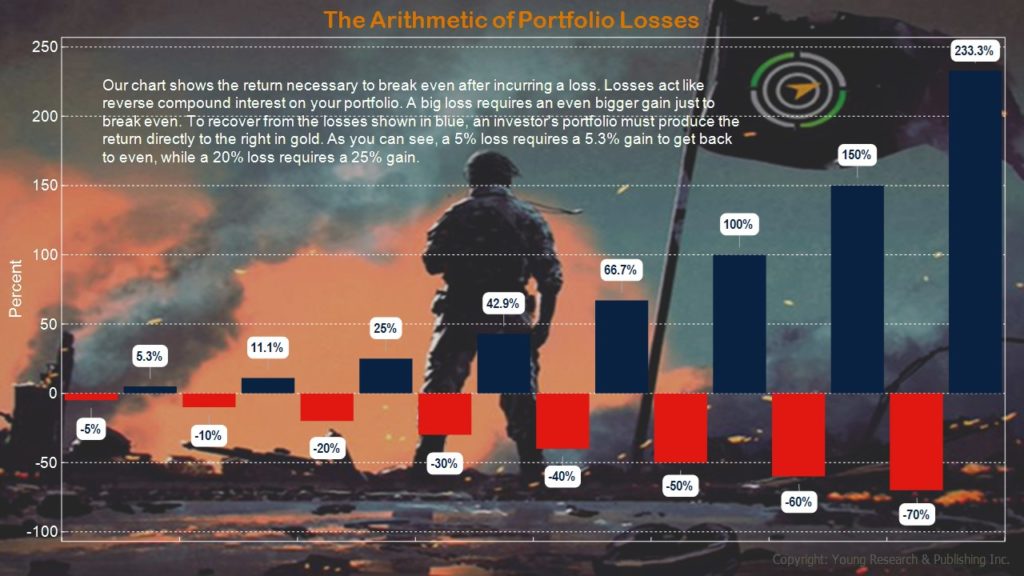

Sink your teeth into these yields. Lock some money in for five or seven years. Tackle the reinvestment risk CD investors face at maturity, which comes way too soon. I’m not comfortable with the Fed’s track record of cutting rates at any sign of trouble. Imagine going back in time, again, where rates are stuck at zero.

Make as much money as you can with Your Survival Guy’s margin of safety. Taking action is hard. Something always gets in the way. The to do list doesn’t get smaller as you get older. Dealing with more and more money is one of life’s greatest challenges.

What if the black swan is still lurking? Bad stuff happens. I witness it firsthand. And when the power goes out at my house, and the generator doesn’t kick in, among other things, Your Survival Guy calls the experts.

- LOSING POWER: Your Survival Guy’s Nightmare Scenario

- Your Survival Guy Under Fire!: Part I

- Your Survival Guy: Out of Gas in Newport

- MAYDAY: Black Smoke Rising from Your Survival Guy’s Boat

- Your Survival Guy: Out of Gas in Newport, Now What?

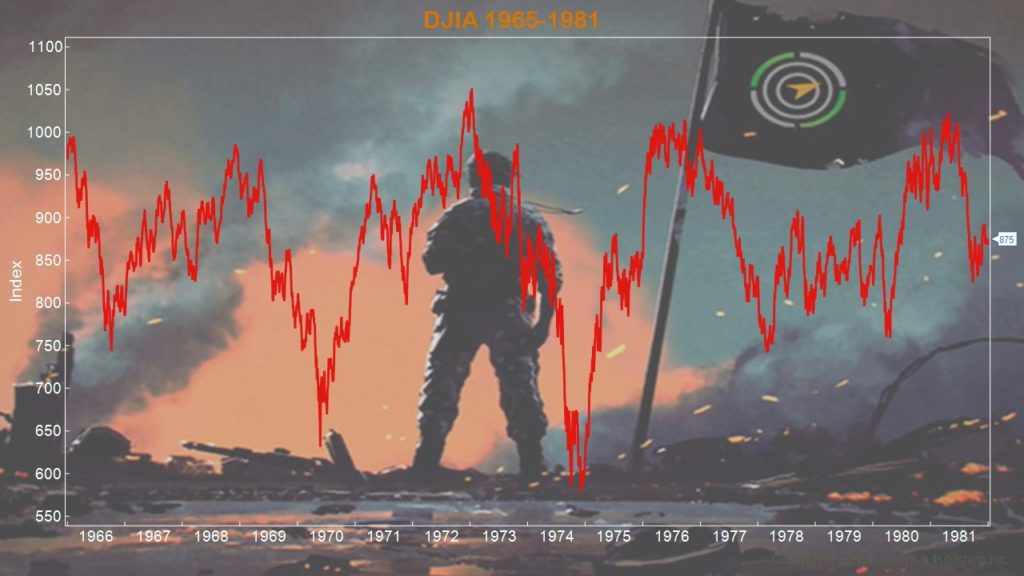

The stagnation of stock prices. It’s a thing. You know how I feel about prices. They’re qualitative. They’re speculative. They’re built on hope and a prayer. Income and dividends are quantitative. You can sink your teeth into cold hard cash. Prices are stubborn.

Take advantage of a generational opportunity in fixed income. When you’re ready to lock them in, I’m here. You’ll be first in line.

Why You Miss Richard C. Young’s Monster Master List

Happy Monday. Is your advisor a bank? If so, is it lending out your money for a song and paying you peanuts? Fidelity is not a bank. Fidelity is not a publicly traded company. In comparison, Charles Schwab has a banking division and is publicly traded.

How about Vanguard? When was the last time you spoke with a phone rep? Are you stuck only in Vanguard funds and ETFs? Are you being penalized by investors in the same fund as you who sell at any sign of trouble? Where Vanguard’s fund managers are forced to sell positions to raise cash, often at the worst times?

I want you at the private spa, not the public pool. But how?

What if you could create your own mutual fund type product where you own the stocks, bonds, etc., and it’s not a mutual fund or ETF? In my conversations with you, you tell me how much you miss Richard C. Young’s Intelligence Report, especially the Monster Master List. Wouldn’t it be nice if the stocks in your portfolio were an up-to-date rendition of the list? Where the homework is done for you?

We do the investing. You own the investments.

There was a time when Schwab made a killing on commissions. Those days are over. Commissions are basically free today. Same with Vanguard’s index funds. Basically free. They are commodities provided by one and all. Where’s the value today? Read more about that here: “What’s Happening to Charles Schwab?”

Today it comes down to this: With whom are you comfortable working? Who do you trust?

You’re seeing generational opportunities in fixed income. When you’re ready to talk, I’ll be here.

Survive and Thrive this Month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. Your Survival Guy recommends you separate your banking from your investments. Schwab’s stock is off nearly 40% YTD through Friday. It’s why I like Fidelity. Unlike Schwab, it isn’t a bank. And it’s a private, family-run business, which keeps the pressures of Wall Street earnings expectations at bay. The Wall Street Journal’s Justin Baer reports on Schwab’s latest earnings:

Charles Schwab is kicking off another bank-earnings week, posting higher first-quarter profit on gains in interest revenue and money-management fees.

The brokerage giant said Monday that its net income rose 14% to $1.6 billion, from $1.4 billion a year ago. Revenue climbed 10% from a year ago to $5.12 billion.

Adjusted per-share earnings beat the expectations of analysts polled by FactSet. Revenue only slightly missed expectations.

Here’s what else you need to know:

- Schwab benefited from a surge in new brokerage accounts and client assets, which swelled to $7.58 trillion, still down from a year ago but up from the previous quarter.

- Rising interest rates helped lift interest revenue on assets.

- But client deposits continued to shrink — by a lot. Deposits were about $326 billion at the end of the first quarter, down 11%, or $41 billion, from the previous quarter. That was also down 30%, or about $140 billion, from a year ago.

- Customers moved some of that cash into higher-yielding investments, though the pace of that shift had slowed by March.

Schwab’s finance chief Peter Crawford summed it up in a statement Monday: “Our first quarter revenue picture reflected the company’s sustained business momentum and the benefits of rising interest rates, partially offset by clients’ asset allocation decisions.”

Schwab shares rose about 2% in premarket trading, then reversed course, falling about 2% premarket later in the morning.

The stock has tumbled nearly 40% this year through Friday after the collapse of Silicon Valley Bank and Signature Bank sparked fears over the health of the U.S. banking industry.

P.P.S. Imagine you’re walking through the wreckage of a dystopian city. An empty financial district. Streets littered with white papers. Forgotten studies about ESG, woke capital, and DEI.

You pass the shuttered storefronts of banks that were supposed to be too big to fail. Net Zero and WEF membership stickers are coming unpeeled, next to signs that read “FDIC Insured” and “CBDC (Central Bank Digital Currencies) Only.”

It’s a ghost town.

And then there’s you. My hero in this story. The lone survivor. Standing amidst the carnage while the so-called experts are gone away. They failed to survive the apocalypse of their own creation.

And then I wake up. Sitting here talking with you. Wondering if that could ever happen.

Sitting in my office. An old brick building. A former bank, I wonder why investors get caught up in the vortex of it all. I sit in my hypothetical cave far, far away from it all. Away from the noise. On a tree-lined street in beautiful Newport, RI, with no one outside even knowing I’m here. There’s no storefront. There’s no signage. No stickers. It’s perfect.

One day, walking out the front gate, a passerby stopped in his tracks and said, “Beautiful building. What goes on in there?”

“Thank you,” I responded. “Research.” And we went our separate ways.

When you’re ready, come see me in Newport to talk “research.”

P.P.P.S. Look at this list, and then consider Your Survival Guy’s Super States. It’s an easy way to find your greener pasture.

The Wall Street Journal’s Sarah Chaney Cambon and Danny Dougherty report:

To find the best job markets in America, head to the South.

Nashville, Tenn., topped the list of 2022’s hottest job markets, followed by Austin, Texas, and Jacksonville, Fla. Other cities known for tourism—notably Orlando, Las Vegas and New Orleans—climbed the ranks last year.

Those Sunbelt cities benefited from a continued recovery in travel and a hiring boom at restaurants, hotels and music venues, consistent with the resurgent services sector driving the U.S. economy in recent months. Many remained relatively affordable as high inflation gripped the nation. Meanwhile, some Western job markets that heated up after the pandemic took hold—including Salt Lake City, Phoenix and Denver—cooled last year.

The Wall Street Journal, working with Moody’s Analytics, assessed about 380 metro areas. The rankings determined the strongest labor markets based on five factors: the unemployment rate, labor-force participation rate, changes to employment levels, the size of the labor force and wages in 2022. Larger areas, with more than one million residents, were ranked separately from smaller ones.

Broadly, the U.S. labor market remains robust, with employers consistently adding jobs last year and into the start of 2023. The U.S. unemployment rate ticked up to 3.6% in February from a 53-year low of 3.4% in January. But recession concerns linger due to the Federal Reserve’s aggressive interest-rate increases intended to combat high inflation, banking turmoil and corporate layoffs in industries such as technology.

Though the tides could shift, Southern cities have shown particular strength, with many top-ranked markets including Atlanta, Dallas, Charlotte and Raleigh, N.C., holding the ingredients to attracting and retaining workers.

“These are lower-cost areas, they are growing rapidly, there’s an increasingly large critical mass of young, educated people,” said Adam Kamins, economist at Moody’s Analytics. “The affordability is really appealing to families as well.”

If you’re looking for a better America, start your search with Your Survival Guy’s 2023 Super States.

Download this post as a PDF by clicking here.