By Alena Ozerova @ Shutterstock.com

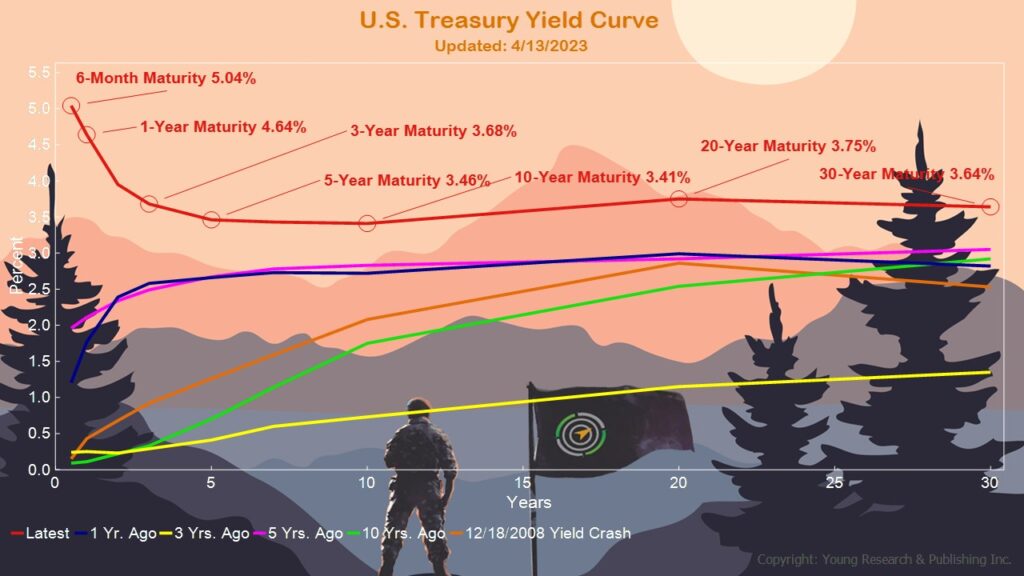

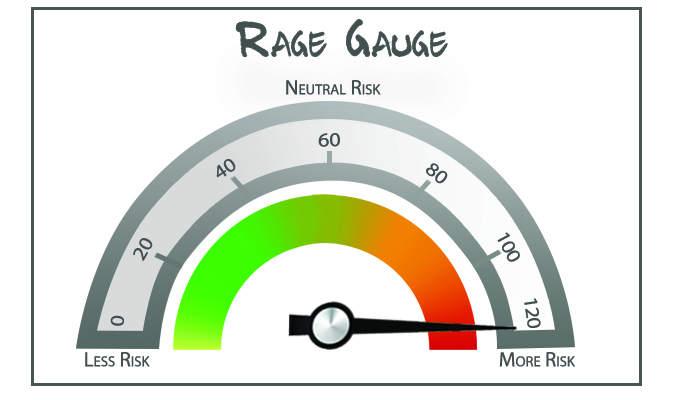

OK, my latest RAGE Gauge is in, and it’s not pretty. What did you expect me to say? The black swan isn’t gone for the season. Hardly. But, with interest rates you can sink your teeth into, it’s time to get your banking life in order. Look at the yield curve below and see what I’m talking about. Get your lazy cash off the couch. Get it working for you. No more banker’s hours.

As you can see, we’re in the midst of a generational opportunity in bonds. As Your Survival Guy, I want you off the bench and in the game. Don’t let crusaders for the “perfect” get in your way. Inertia is a terrible foe, especially in a land of confusion.

Getting the lay of the land is hard. When you see articles about the death of the 60-40 (or a balanced portfolio), you wonder who’s writing this stuff. Listen, whether you’re 70-30, 60-40, 50-50, 40-60, 30-70, or somewhere in between, my focus is purely on the quantitative. Prices are qualitative. Prices come, and they go. Money, that’s quantitative. The cold hard cash of dividends and interest regularly coming into your account is quantitative.

Barrels of ink are wasted on prices. But when you’re under no pressure to sell at today’s prices, you have the peace of mind to ride out the qualitative. You have the unique opportunity to go against the grain and reinvest dividends and interest. Over a lifetime of investing in the quantitative, it adds up. It’s the magic of compounding money.

Compounding money isn’t what sells, though. When was the last time you heard that simple message? Who knew Charles Schwab had a banking division weighing its stock down? (Schwab Down 30%, Fidelity, Vanguard, BlackRock, and You). How about all this talk about ESG with Vanguard and BlackRock—a trojan horse to charge higher fees and satisfy the woke? Not everyone wants their money voted with other people’s politics.

- BlackRock and Vanguard: Controlling Interest

- Inside the Wreckage of a Dystopian Financial District

- Did SVB Fail Because of Climate Change?

- Is Vanguard Voting Against Your Political Beliefs?

Simplify your life. All you need to do is ask: Are you a fiduciary? That’s it. Yes, Your Survival Guy’s a fiduciary. Forget the titles like “Wealth Manager.” Forget the acronyms after a name that look like a game of Scrabble. Ask one simple question, get it in writing, and a lot of your money concerns are solved.

Your Survival Guy doesn’t want you hangin’ at the public pool. For you, I want the private spa, the private access. I want you to be the center of attention.

Action Line: When you’re ready, talk with me, not some random branch on a phone tree.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- A Word on Stocks - July 26, 2024

- Is Vanguard Too Big? What’s Next? - July 26, 2024

- Boomer Candy? - July 26, 2024

- My BEST Insider’s Guide to Key West - July 26, 2024

- Having Fun Yet? Nasdaq Worst Day in Years - July 25, 2024