Retirees today are overcoming a mountain of bad timing. Read why in this post I wrote on December 3, 2018.

Retirees today are the victims of an unfortunate double whammy. In the prime home-buying days of their youth, they were forced to pay the exorbitant mortgage rates of the late 70s and early 80s. Then, during the Financial Crisis, which should have been the peak of their earning and saving years, many lost jobs and watched their stock holdings evaporate. In the following years when many would have typically moved more of their portfolio into fixed income, they were left with the crumbs offered by the Federal Reserve’s 0-interest rate policy.

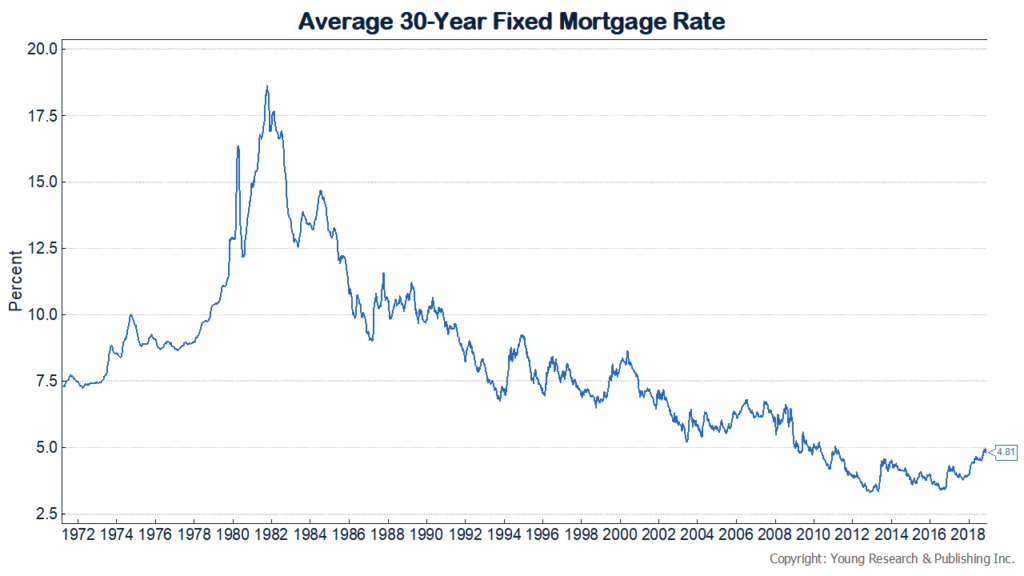

You can see on the chart below the decline in rates over the career of today’s retirees. The Double Whammy of high rates in youth and low rates in retirement could force many retirees to keep working, despite their desire to stop. Read more about how many retirees will keep working here.

P.S. Fed Chairman Jerome Powell is in a “Danger Zone.” He needs to raise rates, but when rates are this low, any mistake could be catastrophic. Read more about it here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024

- Newport, Rhode Island: Sailing, Mansions, and High Taxes - April 24, 2024