Burton Malkiel has released a new edition of his book A Radom Walk Down Wall Street. In it he recommends substituting a part of a bond portfolio with high-yielding stocks. This is rotten advice and will likely get his followers into some trouble down the road.

Yes, bond yields are low, but bonds should always be in your portfolio.

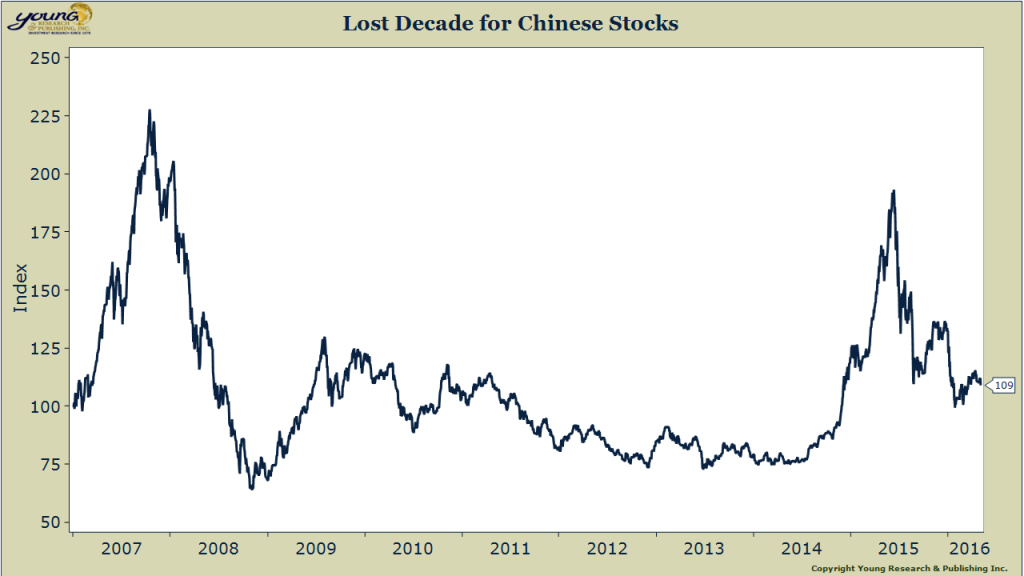

I’ve called out Mr. Malkiel in the past on his tendency to offer up poor recommendations while talking up his book. For example when he talks about China:

But, a couple of years ago, in late 2010, Malkiel recommended overweighting China. The following year, last year, China’s Shanghai index lost 22%. Here’s what he wrote last week:

Much worry has been expressed about real-estate prices and construction activity in China. “It’s Dubai times 1,000,” says one hedge-fund manager who predicts an economic collapse. Obviously, an end to China’s growth would be a significant blow to the world economy.

But parallels to the U.S. real-estate bust and the resulting damage to the economies and financial institutions of the Western world seem unwarranted. The absorption of vacant space remains extremely high in China, where hundreds of millions more people are expected to move from farms to cities. And unlike the U.S., where people bought new homes with little or nothing down, Chinese buyers make minimum down payments of 40% on a new home (and 60% on a second home).

Look at how that turned out.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “What Do You Do If the Market Crashes?” - April 19, 2024

- Costco Gold Bars Sell Out Despite Premium Price - April 19, 2024

- A Wise Man’s Take on the Boston Bruins Playoff Chances - April 19, 2024

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024