Regardless of the savings vehicle being used, Americans simply aren’t saving enough for retirement. The Wall Street Journal reports:

Regardless of the savings vehicle being used, Americans simply aren’t saving enough for retirement. The Wall Street Journal reports:

Financial experts recommend people amass at least eight times their annual salary to retire. All income levels are falling short. For people ages 50 to 64, the bottom half of earners have a median income of $32,000 and retirement assets of $25,000, according to an analysis of federal data by the New School’s Schwartz Center for Economic Policy Analysis in New York. The middle 40% earn $97,000 and have saved $121,000, while the top 10% make $251,000 and have $450,000 socked away.

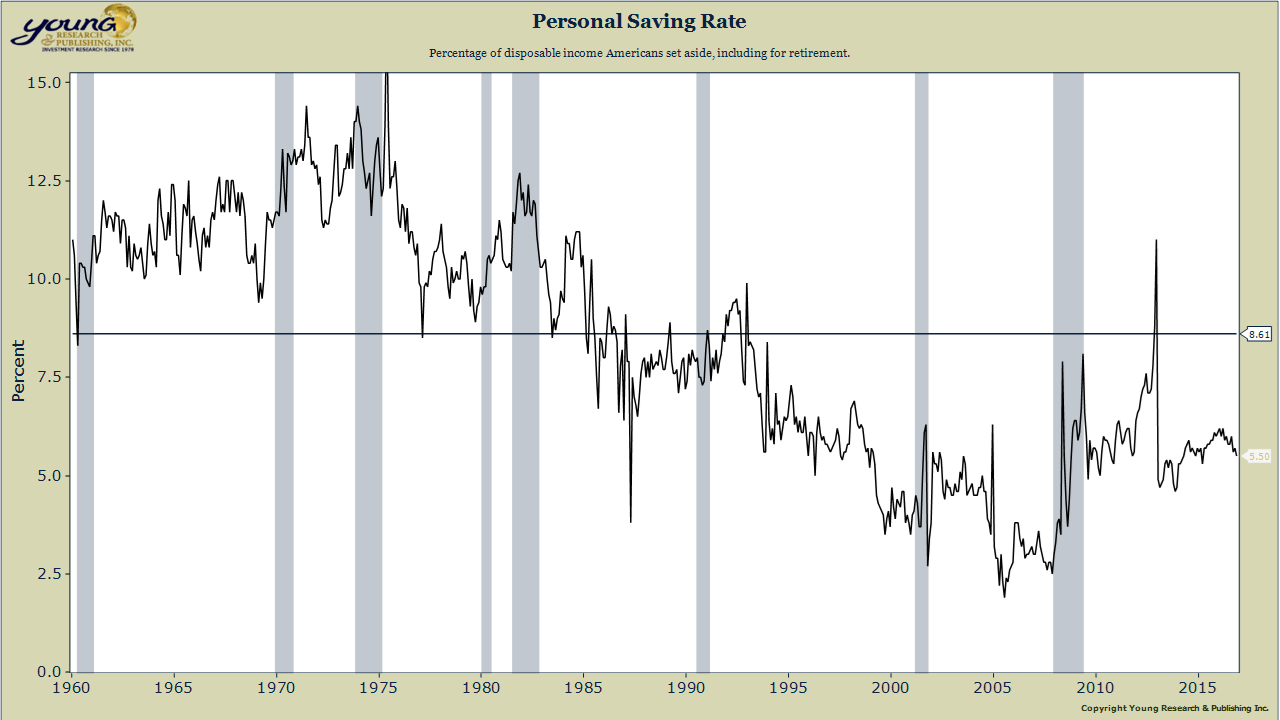

Savings gap

And the savings gap is worsening. Fifty-two percent of U.S. households are at risk of running low on money during retirement, based on projections of assets, home prices, debt levels and Social Security income, according to Boston College’s Center for Retirement Research. That is up from 31% of households in 1983. Roughly 45% of all households currently have zero saved for retirement, according to the National Institute on Retirement Security.

More than 30 million U.S. workers don’t have access to any retirement plan because many small businesses don’t provide one. People are living longer than they did in the 1980s, fewer companies are covering retirees’ health-care expenses, wages have largely stagnated and low interest rates have diluted investment gains.

Read more here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024

- Newport, Rhode Island: Sailing, Mansions, and High Taxes - April 24, 2024

- Yes, Money Can Buy You Happiness - April 23, 2024

- State Income Taxes and the 2024 NFL Draft Class - April 23, 2024