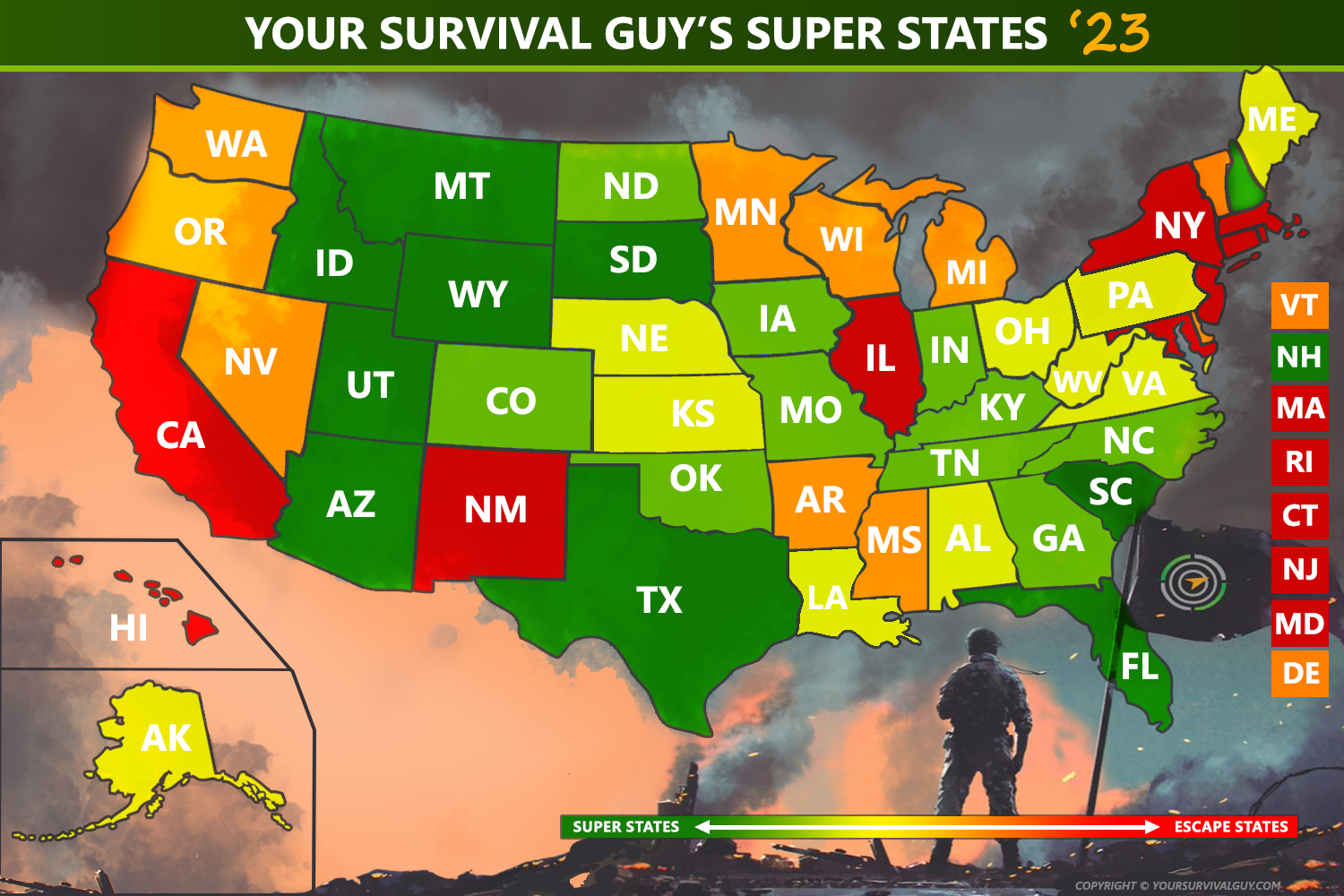

Recently a reader friend, who has noticed Your Survival Guy encouraging Americans to find their place in one of the country’s Super States, sent this email discussing his own living plan, which includes a top tier duo. He writes:

EJ,

I’m personally not advocating for the masses moving to our state, but thought that this might be of interest.

We’ve been enjoying Florida winters and New Hampshire summers for almost 10 years. Works well for us!

Regards,

D

The combination of New Hampshire and Florida, from a tax perspective, could be America’s best for Snowbirds looking to enjoy warmer climates year-round.

At the bottom of his letter, he adds a link to an article on Humbledollar.com by John Yeigh, who gives good advice to anyone leaving a high tax state for a low or no-tax state like New Hampshire or Florida. Yeigh writes:

We’ve learned that high-tax states perform residency audits on those that change their residency status while still retaining a home in their old state, which is what we plan to do. Indeed, physical residency is tough to game. Cell phone data, electronic toll road collections, internet activity and video camera recordings can all provide a digital footprint for tax authorities to confirm where we live.

One tax-avoidance strategy is to move fulltime into a recreational vehicle and establish your permanent residence, or domicile, at an RV park in a zero income-tax state. Since the no-tax state doesn’t care about your whereabouts, RV residents may not even reside in that state for most of the year. Boat owners have utilized the same strategy to shift residency.

When changing residency from a high-tax state without selling your house, it’s important to cut many of your ties with your old state. Merely changing your driver’s license and spending less than half the year there may not satisfy tax authorities. They may claim you’re still enjoying the benefits of state residency even if you spend much of your time elsewhere.

That’s why there are apps that allow you to track your residency, including TaxBird, TaxDay and Monaeo. Even this may not be enough for RV residents who continue with many personal activities—such as doctor’s appointments, mail deliveries and property storage units—in their former high-tax state.