By VGstockstudio @ Shutterstock.com

You know that getting saving for your grandchild is the best thing you can do as a grandparent. You’ve read my recommendations on Roth IRAs and UGMAs for your grandkids. Christmas is a great time to save for your grandkids, but any time will do when you’re funding a tax-free savings plan for your grandchild.

In Kiplinger, Mary Kane lays out the basics of seeding a Roth IRA for a grandchild, writing (abridged):

Contributions to Roth IRAs give grandchildren “a huge head start,” says Jennifer Failla, a certified financial planner with Strada Wealth Management, in Austin, Tex. Grandchildren can later tap the accounts for expenses such as buying a home or, ideally, use them to build tax-free retirement income.

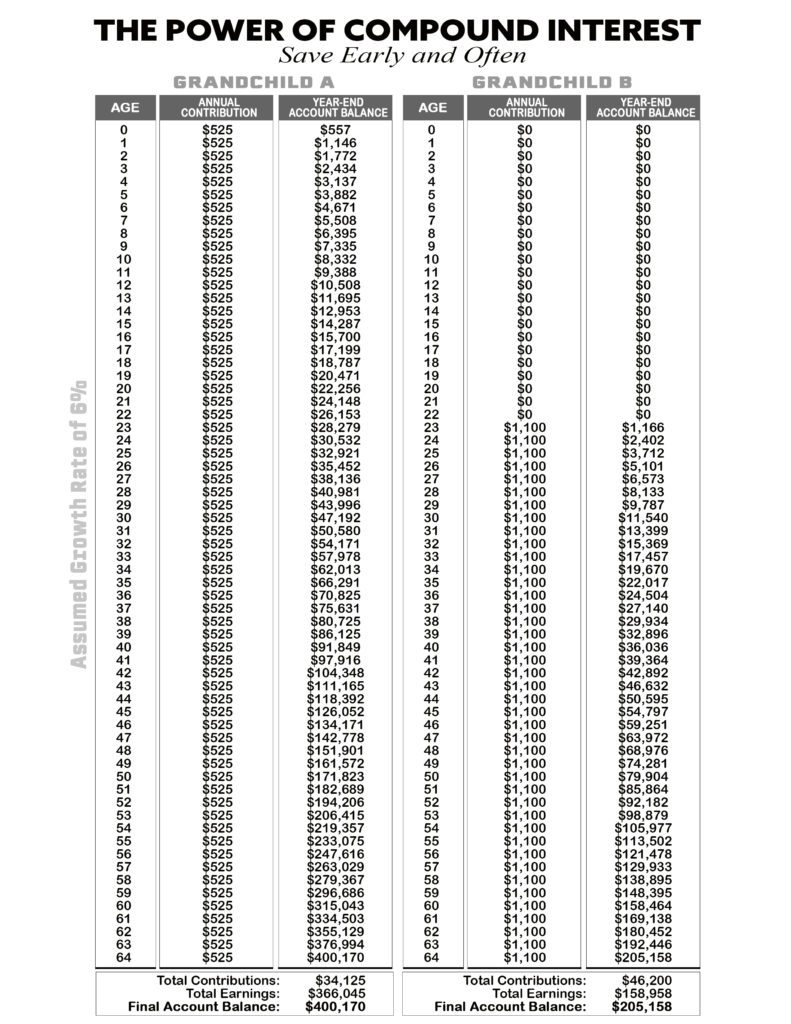

You’ll also be teaching your grandchild the value of saving from a young age, says Ajay Kaisth, principal with KAI Advisors, in Princeton Junction, N.J. For example, if you contribute $2,000 a year over four years starting when your grandchild is 15, assuming a 6% annual rate of return, the contributions will grow to more than $143,000 by the time the grandchild turns 66.

Your grandchild must have earned income to be able to contribute to a Roth IRA, and the contribution can’t be more than they earned during the year, or the maximum of $5,500 (the IRS’s cap for 2017), whichever is less. You can put the money into the account for your grandchild, while the grandchild keeps his or her earnings. Here’s an example: Your grandchild earns $3,500 from a summer job, but she uses it toward buying a car. If you give $3,500 to the grandchild, that money can be contributed to the Roth IRA.

Your contribution will be considered a gift to the child, so be sure to coordinate it with your other gifts for the year. Each grandparent can give a total of $14,000 per year per person without having to file a gift-tax return, or $28,000 total to one person from both grandparents, says Adam Zuercher, wealth manager at Hixon Zuercher Capital Management, in Findlay, Ohio.

Action Line: If you have a grandchild, and their birthday is coming or it’s near the holidays, it’s likely they have a room full of toys and a filled out wardrobe. Before you go and get them a lot of things they don’t need, consider saving that money for them. If you save it today, by the time they use it the power of compounding will have turned it into real money. Start today.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “What Do You Do If the Market Crashes?” - April 19, 2024

- Costco Gold Bars Sell Out Despite Premium Price - April 19, 2024

- A Wise Man’s Take on the Boston Bruins Playoff Chances - April 19, 2024

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024