You know, there’s a lot of living inside these charts. It’s easy to forget how much goes on in your life in a week, never mind a year.

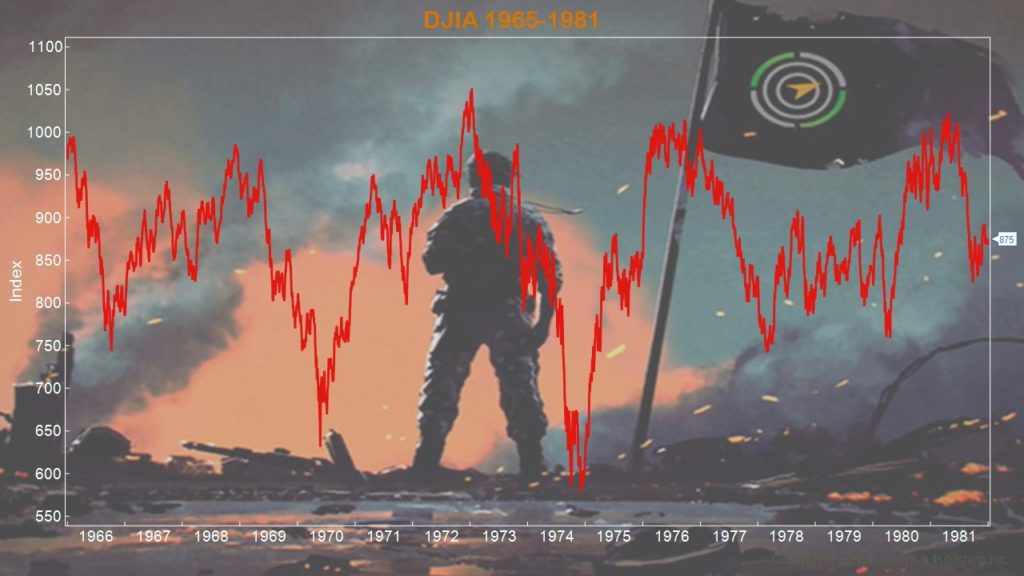

You can see above how the Dow Jones Industrial Average performed from 1965-1981. But back then, like today, you didn’t know what tomorrow would bring.

A lot of what matters for your investment success is not how old this bear or that bull market is—it’s how old or young you are. Everyone’s a long-term investor until they lose money.

When we’re young, just starting out, we’re trying to raise a family, pay the mortgage, and save as much as we can. It’s easier to forget tough markets when not much is lost (temporarily, I hope). But the older we get, the more painful the losses. When you start thinking about replacement costs—what it will cost to make it back in hours of work—the numbers get scary fast.

I don’t like to be scared out of the market. That’s why I like the peace of mind of bonds. They help smooth out the ups and downs. You’d be surprised how not “losing” money helps drive a portfolio’s success. And I like watching the income come into my IRA tax free.

Sure, bond prices were down last year, but the income wasn’t. And it’s been fun this year watching the income continue to increase. Who cares about the prices? I like income. Prices come and go.

Action Line: Don’t let prices ruin a good stream of income. You got this. I can help.