By Shchus @ Shutterstock.com

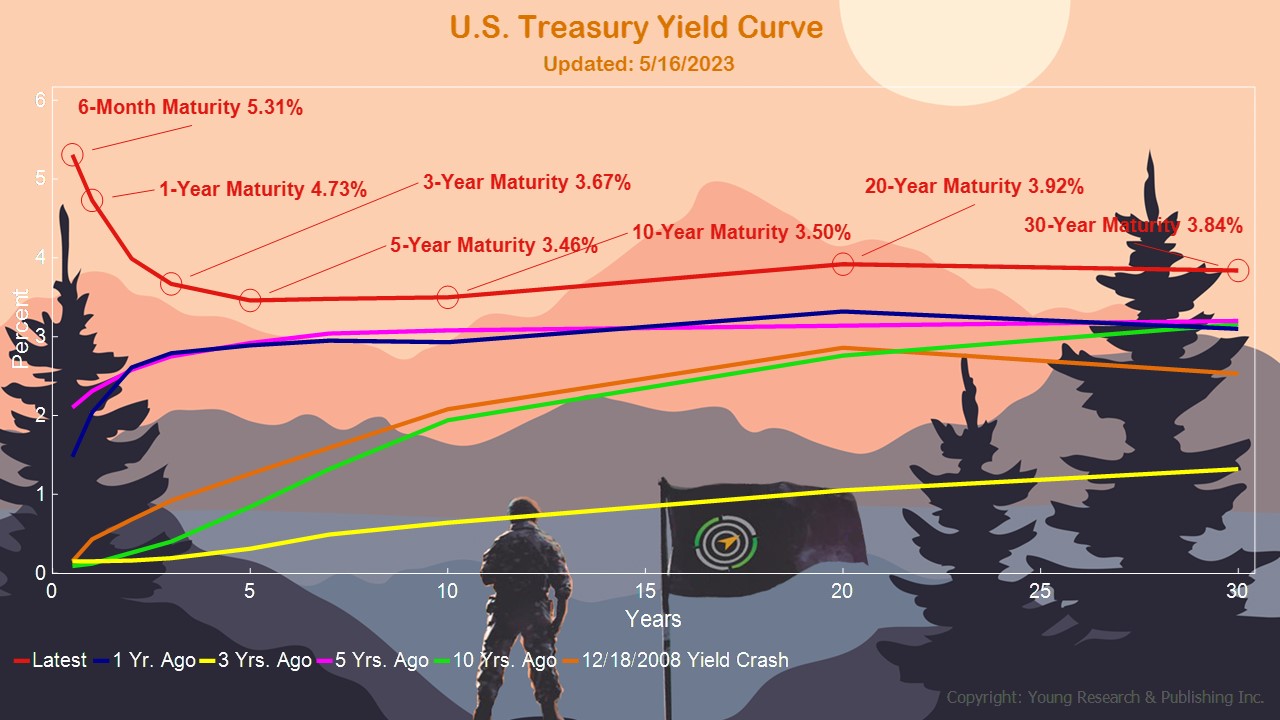

Starving for fixed income? Looking for a stream of cash you can live with and live on? I hear you. When rates are this high, I pay attention. Because with this generational opportunity come lots of decisions. You have a chance to get your lazy cash out of the bank. You have an opportunity to park it in my favored Fidelity Treasury Money Market, yielding around 4.5% today.

When you move your lazy cash from the bank and invest it, you get paid a handsome rate for your efforts. Isn’t that the way it’s supposed to work? You turn the tables. You invest. You win. I like that.

What about CDs, you ask? I’m not a fan. As with most things, there are exceptions. In certain cases, they work, but they’re not as liquid as a money market. Lori Ioannou describes some of the problems with CDs in The Wall Street Journal, writing:

Your money typically is locked up until the CD matures. Some come with early withdrawal penalties, which can be a flat fee or percentage of interest earned. They carry interest-rate risk. Some brokered CDs have call options.

What about an annuity? Rat food. An insurance product tied to the financial strength of an insurer.

Remember 2008? What could possibly go wrong?

When it comes to your streams of income, Your Survival Guy favors multiple targets. A diversified mix of products carefully crafted for your income needs. A plan that puts safety first.

Action Line: Don’t let this generational opportunity pass you by. Don’t be sold products that aren’t the best option for you. Work with a fiduciary. Get it in writing. Solve your fixed income needs. I can help.

P.S. Tomorrow, I want you to “Tell Me,” How Are You the Millionaire Next Door?

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024

- Newport, Rhode Island: Sailing, Mansions, and High Taxes - April 24, 2024

- Yes, Money Can Buy You Happiness - April 23, 2024

- State Income Taxes and the 2024 NFL Draft Class - April 23, 2024