President Joe Biden delivers remarks on the drawdown of U.S. troops from Afghanistan, Thursday, July 8, 2021, in the East Room of the White House. (Official White House Photo by Hannah Foslien)

You may have heard Joe Biden touting “0% inflation” recently. He was making a big deal out of a month-to-month number no one normally talks about. His claims were confusing, and not given any context, and his press secretary refused to clarify them, even when asked to do so. The casual way the administration conflated these numbers to put themselves in a good light was alarming.

Meanwhile, when the Federal Reserve met last month, they were not as casual about inflation as Biden has been. The Daily Mail reports on the Fed’s real concerns about price increases, writing:

Federal Reserve officials saw ‘little evidence’ late last month that US inflation is easing and predicted it would remain elevated for ‘some time’, newly released minutes from July’s policy meeting show.

The minutes released on Wednesday showed policymakers committed to raising rates as high as necessary to bring inflation under control, and acknowledging that they would have accept lower economic growth for that to happen.

Inflation has been running hot and remained near a 40-year high at 8.5 percent in July, despite a rapid series of jumbo interest hikes that have taken the Fed’s policy rate from near zero to 2.5 percent.

The minutes from the July 26 to 27 policy meeting did not hint at a particular pace of future interest rate increases for future meetings, including the next one scheduled for late September.

Fed policymakers noted in the minutes that lower growth could ‘set the stage’ for inflation to gradually fall to the central bank’s two percent annual goal, though they acknowledged it remained ‘far above’ that target.

But the policymakers made clear that for now, they intend to continue raising rates enough to slow the economy.

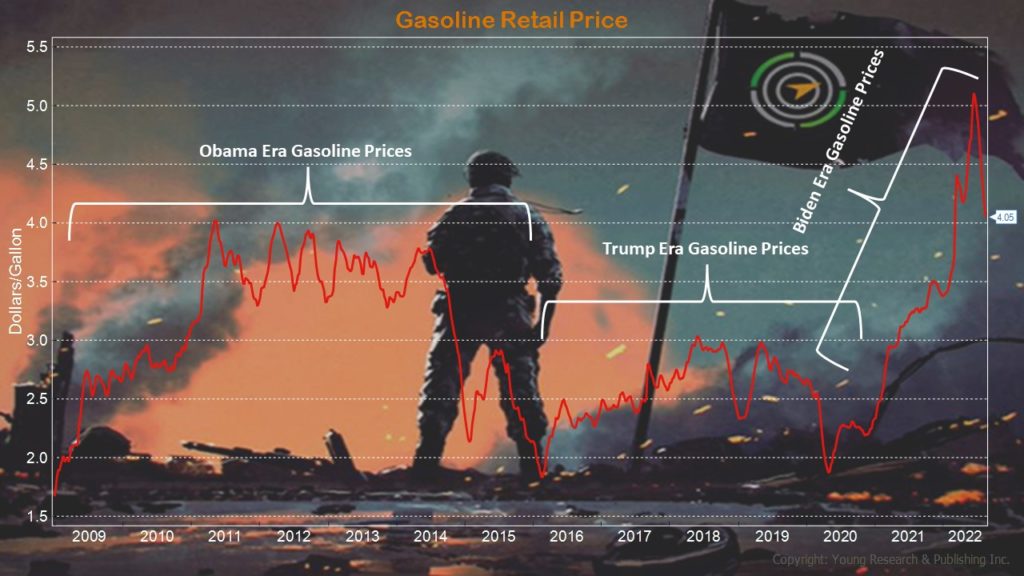

Action Line: You can feel the inflation at your dinner table, and when you fill up your gas tank. Gas prices have come down, they say. Sure, but they’re still much higher than they were before Bidenflation hit. Investors need to pay attention to the effects heightened inflation will have on their portfolio and their cost of living in retirement. If you need help building a plan for investing in a world of higher inflation, let’s talk. If you want to get to know more about me in the meantime, click here to subscribe to my free monthly Survive & Thrive letter, and we’ll weather this storm together.

P.S. Look at the chart below. Just because prices have come down slightly for gasoline is not a win for the Biden administration. Prices are still FAR higher than they were even in most of the Obama-era.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “What Do You Do If the Market Crashes?” - April 19, 2024

- Costco Gold Bars Sell Out Despite Premium Price - April 19, 2024

- A Wise Man’s Take on the Boston Bruins Playoff Chances - April 19, 2024

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024