Your Survival Guy has long observed that the average pension manager can’t live in a two percent world. And guess what—when the going gets tough, the pension manager takes on more risk to save his job rather than being a fiduciary shepherd for his flock. Now the UK is looking for someone to blame for the implosion of its pension industry, and it looks like the Bank of England is the most likely suspect. The Wall Street Journal editorial board writes:

Britain’s newest parlor game is assigning blame for the country’s exploding pension funds. Wobbly balance sheets at some of the United Kingdom’s largest defined-benefit pension managers have triggered a mini financial panic with ripples abroad. The causes of this crisis are worth relating because they may be coming to a financial instrument near you.

Pensions in particular are blowing up because the funds are highly sensitive to changes in interest rates as they seek to balance assets and liabilities over long time horizons. And the explosion is happening in Britain because defined-benefit pension plans—the most interest-sensitive—remain more common in the U.K. than in the U.S. As of 2019 about 35% of Britons enrolled in a private pension were in a defined-benefit scheme, while the U.S. proportion had fallen to 23%.

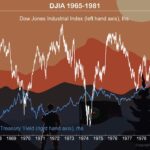

As interest rates hit new lows after 2008, Britain’s pension funds struggled to keep up. A low discount rate increased the present value of their long-term liabilities while low rates across the economy reduced investment returns. The result was a widening pension-deficit chasm as actuarial calculations warned the funds would never be able to meet their future obligations.

One option was to reduce the growth rate in liabilities, and companies sponsoring pensions have tried to do so. As of 2021, 86% of Britain’s defined-benefit plans were either closed to new members or no longer letting members increase future payouts in line with current pay raises—up from 76% of plans in 2012.

Another option was for companies to top-up pension assets with extra cash injections from current operating revenue. Pension contributions of £44.1 billion exceeded normal contributions of £24.3 billion between the third quarter of 2019 and the first quarter of 2022.

But this had substantial economic costs. Some companies couldn’t afford it, and the need to fund gaping pension deficits has pushed several into bankruptcy, including venerable department-store chain BHS in 2016. Cash that poured into pension funds also wasn’t available for business investment.

All of this explains why pension funds and regulators were so reckless to pursue or allow the hedging strategy now blowing up. This strategy—liability-driven investing or LDI—was supposed to offer a way for pension trustees to use derivatives and hedging techniques to better meet liabilities without constant demands for cash from companies.

But LDI strategies are highly sensitive to a rise in interest rates, which reduces the value of some hedges and triggers calls for collateral. Those calls set off the mass selling of gilts that prompted the Bank of England to intervene with bond purchases to stabilize (or rather, manage) long-term interest rates. Fund managers could and should have seen this risk, and many probably did. But they had to cope with ultralow rates, and they heard eminent economists promising that low interest rates and low inflation were here to stay.

What isn’t responsible for this panic, by the way, is tax policy. Conventional wisdom now blames Prime Minister Liz Truss’s tax-cutting plan, announced on Sept. 23, for the pension blowup. That announcement may have lit a match near the pension bomb’s fuse if it momentarily spooked investors, but plenty of other sparks were in the air. A pension crisis was all but inevitable as interest-rate increases created new stresses for hedging strategies.

Blame the Bank of England. The global monetary-policy conceit since 2008 has been that central banks could push interest rates to unprecedented lows and then manage financial fragility via tighter regulation. That’s been no protection at all as Britain’s highly regulated pension funds struggled to cope with the costs created by the sudden reversal of ultralow rates to fight inflation.

This is a warning as central banks elsewhere belatedly tighten policy. After an extraordinary era of loose money, it’s hard to know where the risks will appear. But you can’t have incentives to take extraordinary financial risks for so long without casualties. To put it another way, Modern Monetary Theory has been a great financial confidence trick.

Walter Bagehot, the eminent Victorian, warned that the proverbial John Bull can stand many things but he can’t stand rates as low as 2%. Neither, it turns out, can John Bull’s pension fund.

Action Line: Pensions, much like annuities, are only as strong as the organizations promising them. Your Survival Guy prefers a portfolio of individual securities that YOU own, that generate income to use as fuel for compounding. If you want to talk about how to build a portfolio like that, contact me here. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter, and you’ll learn more about me and how I help American families improve their personal and financial security.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- This Is about Your Survival, Not Anyone Else’s - April 17, 2024

- The Grid Pushed to Its Limits - April 17, 2024

- Your Retirement Life: Newport Is Buzzing - April 17, 2024

- “Happy I Found Richard C. Young’s Intelligence Report” - April 16, 2024

- Residents Lose Faith in Blue Cities - April 16, 2024