Social Security is underfunded, and in one way or another, your retirement is going to be affected. There are two solutions, 1) more money goes into the system, meaning a tax hike or 2) less money comes out of the system, meaning a reduction in benefits. In the first instance, you’ll have less of your own money to invest as you see fit, and in the second you’ll need to invest more of your disposable income to make up for the loss. Either way there’s bound to be pain.

Stephen Entin of The Tax Foundation writes:

Social Security retirement programs (Old Age and Survivors Insurance, and Disability Insurance, OASDI) are projected to run large, growing deficits over the next 75 years as a reduction in the number of workers per retiree and longer lifespans in retirement increase promised benefits beyond projected revenues currently dedicated to the system.[1] This means that there will have to be a rise in payroll or other taxes to pay promised benefits, or the growth of future benefits will have to be scaled back. The “returns” on Social Security taxes will be low. Revenues and benefit growth will be limited to population growth and real wage gains due to technological advances. Any effort to raise payroll tax rates to support larger real transfers under the program will retard growth by making labor less rewarding to offer and more expensive to employ. Shifting the burden to capital income would depress technological advances, capital formation, and wages, and lose much of the presumed revenue gains.

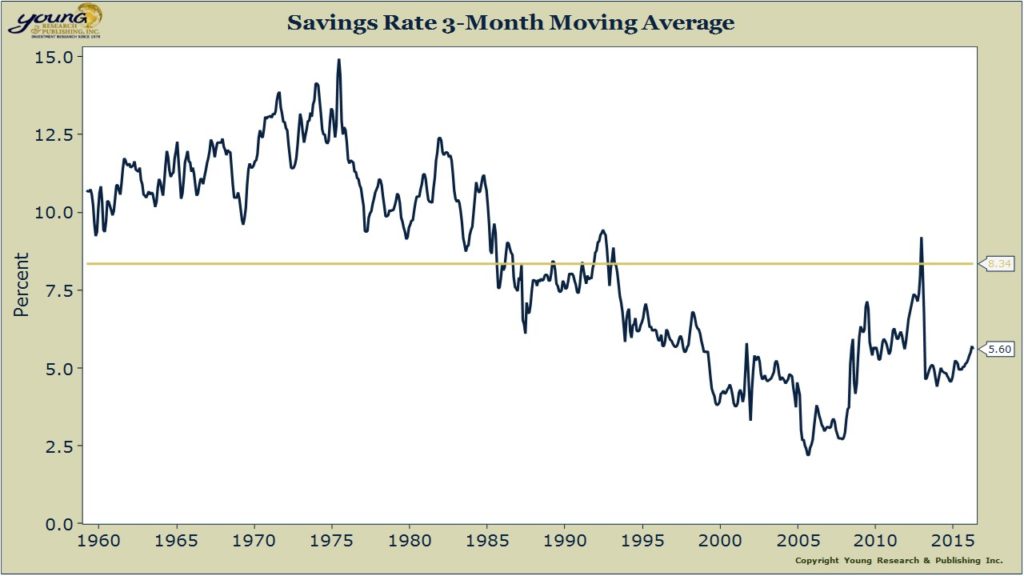

The trick I mentioned in the headline for beating the collapse of Social Security, is simple in theory, though in practice it may prove more difficult: save more. Despite some recent growth in the savings rate, Americans are still saving much less than they have on average since the 1960s. These numbers have to move up.

Entin continues, reminding readers that Social Security was never setup to be the only source of spending power in retirement.

Social Security benefits alone are not adequate to replace retirement income. They were never intended to be the only support in old age, merely part of a “three legged stool” in association with personal saving and employer-provided pensions. Unfortunately, millions of Americans save too little to support their preretirement living standard after they stop working. Many workers do not have a tax-favored retirement plan, such as an employer-provided pension, a 401(k), or an IRA, to fully fund them when they are available.

As I have warned time (and time, and time, and time, and time) and time again, pension funds are currently playing a game with employees’ retirement funds they cannot win by overestimating future returns. Two legs of Entin’s three-legged-stool–Social Security and employer funded pensions–are not to be trusted in today’s retirement reality. The only leg left is personal savings, and that means the security of your retirement is up to you. It’s that simple.