I found this gem from Richard C. Young’s Intelligence Report, December 1988 issue. Some things never change.

I found this gem from Richard C. Young’s Intelligence Report, December 1988 issue. Some things never change.

When it comes to serious money invested in common stocks, for my money, the sun rises and sets on dividends. With dividends as your friend, you have the miracle of compounding on your side through thick and thin.

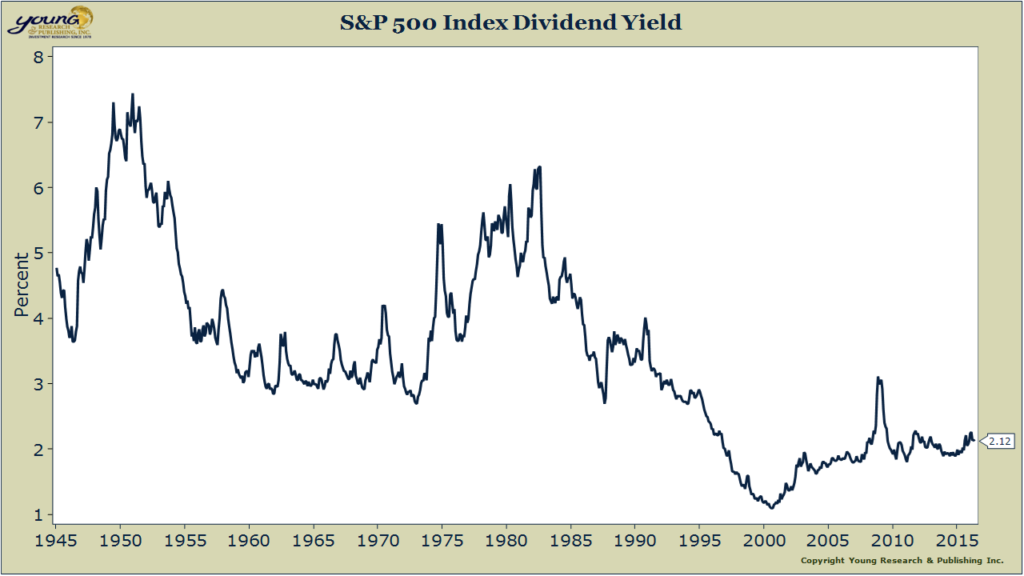

What question should you ask first before you invest in common stocks? You ask, what is today’s yield on stocks compared to the historical yield on stocks? If the current yield is higher than the average yield over many cycles, you can take advantage of a period of value. If the current yield is below the historical norm, that’s a warning of relative lack of value. During low-yield periods such as we have now, you should have higher-than-average cash reserves and you should adopt an increasingly defensive strategy as yields decline.