Here’s some pro-growth tax reform that businesses can work with. The Tax Foundation has identified America’s best tax reformers of 2015 and honored them with the foundation’s Outstanding Achievement in State Tax Reform. This year’s honorees are:

This year, we honor ten individuals from five states with our award for Outstanding Achievement in State Tax Reform in 2015:

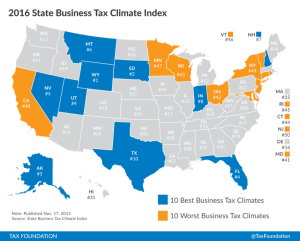

Indiana Senator Brandt Hershman (R) Senator Hershman played the lead role in passing reforms that reduced the state’s small business property tax, a tax on machinery and capital, and in the same session eliminated the state’s “throwback” rule, which wrongly double-taxes certain corporate income. Since 2008, Senator Hershman has been Chair of the Senate Tax & Fiscal Policy Committee, and since 2013, Indiana has improved from 10th to 8th place in the State Business Tax Climate Index. This is Senator Hershman’s second time receiving this award.

Indiana Representative Eric Koch (R) Representative Koch spearheaded legislation requiring the evaluation of all state and local tax incentives and connecting the results to policymaking. The resultant high-quality evaluations have already led to the repeal of two ineffective tax incentives.

Nevada then-Assembly Minority Leader Marilyn Kirkpatrick (D) and Senator Mark Lipparelli (R) fixed Nevada’s Live Entertainment Tax (LET), broadening its base, reducing its rate, eliminating arbitrary and confusing carveouts, and improving its administration. Both conducted considerable outreach to the public and to stakeholders and the simpler, lower LET was approved with overwhelming bipartisan support.

Nevada Taxpayers Association President Carole Vilardo has worked tirelessly to identify and resolve significant implementation and administration issues relating to Nevada’s new Commerce Tax. Ms. Vilardo, who is retiring in spring 2016, is universally recognized in Nevada for her lifetime of service to improve Nevada’s tax system.

North Dakota Senator Dwight Cook (R) took the lead on hundreds of millions of dollars of income and property tax relief, reducing business taxes, and restructuring oil taxes. His leadership has helped make North Dakota competitive for jobs in software, technology, and manufacturing, and reduced costs for employers hiring or locating facilities in the state.

Texas Senator Jane Nelson (R) and Texas Representative Dennis Bonnen (R) led the charge to significantly reduce Texas’ problematic Margin Tax, a modified gross receipts tax that is a dark mark in Texas’ otherwise well-structured tax code. For 2016, Texas businesses face rates reduced by 21 percent, from 0.95 percent to 0.75 percent (and prevented an otherwise scheduled increase to 1 percent), and extended eligibility and reduced the rate for EZ computation. HB 32 also includes language of the legislature’s intent to repeal the Margin Tax in future sessions.

Utah Chairman John L. Valentine and Fraud Unit Manager Dolores Furniss and their team at the Utah State Tax Commission saved taxpayers across the country over $11 million by uncovering and alerting authorities to stolen identity tax refund fraud occurring through commercial software in 2015. After Furniss detected widespread fraud as returns began to be filed, she alerted Valentine and together they investigated the causes. Utah was the first state to notice the fraud and within 24 hours, vendor began working with other states to address it. New data sharing arrangements will protect taxpayer information going forward, thanks to their efforts.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024

- Don’t Be Left High and Dry - April 18, 2024

- April RAGE Gauge: Real Gold Prices - April 18, 2024

- This Is about Your Survival, Not Anyone Else’s - April 17, 2024