Despite the role they played in spreading risk during the financial crisis, CDOs (collateralized debt obligations) are making a comeback. Christopher Whittall and Mike Bird report in the Wall Street Journal that investors are coming back to CDOs.

In the U.S., the CDO market sunk steadily in the years after the financial crisis but has been fairly flat since 2014. In Europe, the total size of market is now rising again—up 5.6% annually in the first quarter of the year and 14.4% in the last quarter of 2016, according to the Securities Industry and Financial Markets Association.

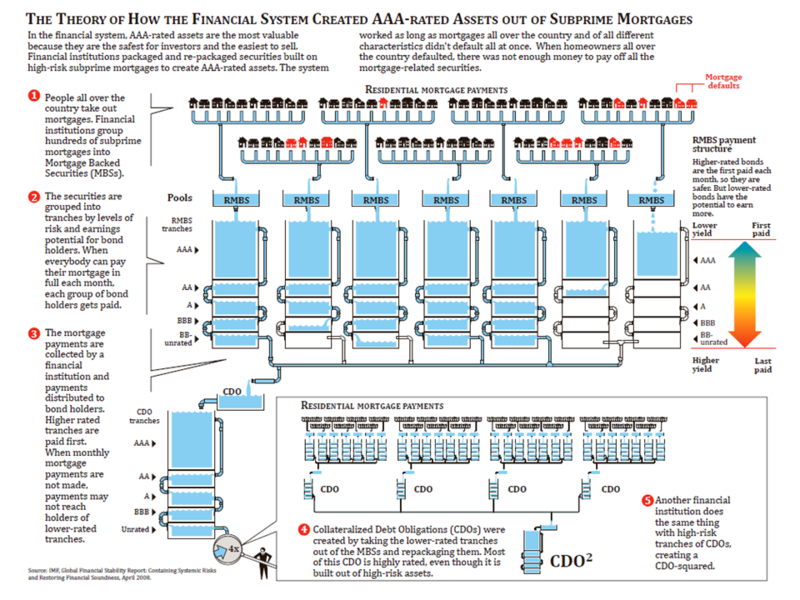

Collateralized debt obligations package a bunch of assets, such as mortgage or corporate loans, into a security that is chopped up into pieces and sold to investors.

The assets inside a synthetic CDO aren’t physical debt securities but rather derivatives, which in turn reference other investments such as loans or corporate debt.

During the financial crisis, synthetic CDOs became a symbol of the financial excesses of the era. Labelled an “atomic bomb” in the movie “The Big Short,” they ultimately were the vehicle that spread the risks from the mortgage market throughout the financial system.

Synthetic CDOs crammed with exposure to subprime mortgages—or even other CDOs—are long gone. The ones that remain contain credit-default swaps referencing a range of European and U.S. companies, effectively allowing investors to bet whether corporate defaults will pick up.

Read more here.