Are you moving in retirement? If so, look back at this piece I wrote on January 22 of 2016. Don’t move to one of America’s “Tax Hells.”

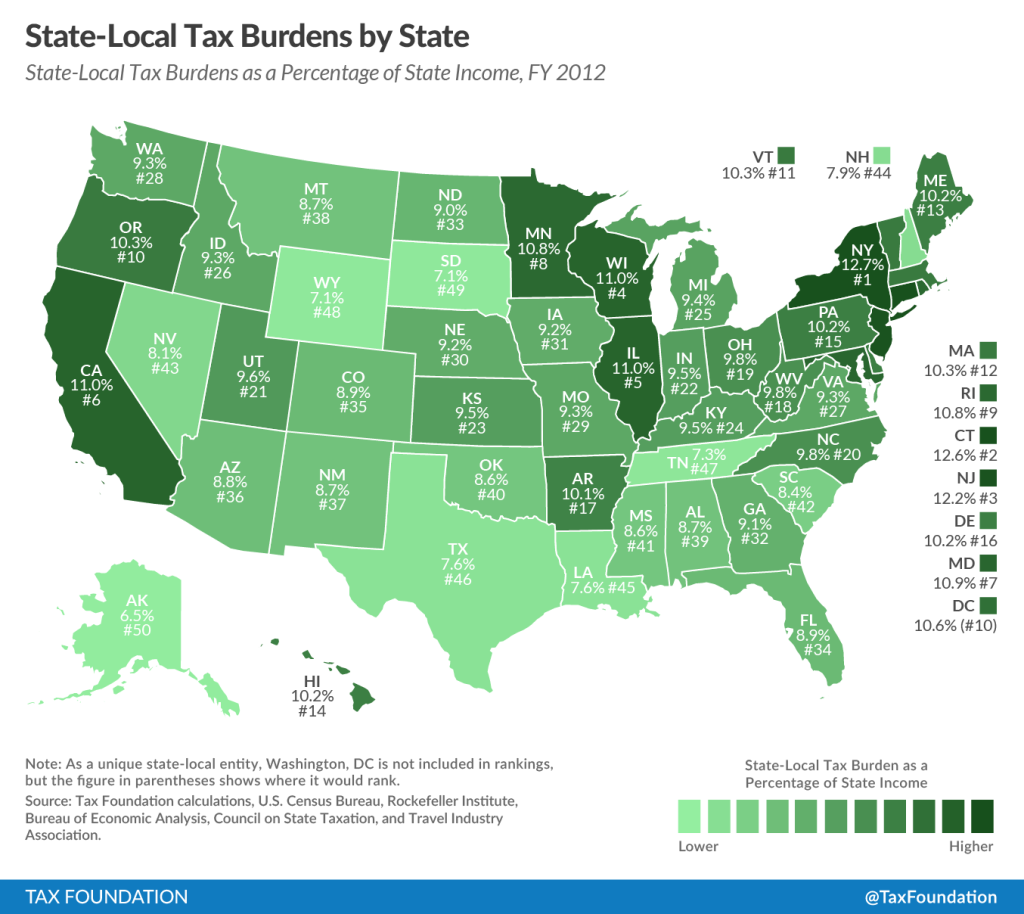

Is your state a tax hell? Some states pile on the tax burden, adding double digit percentage demands on top of their residents’ federal tax loads. New York, unsurprisingly, takes the cake with a 12.7% tax burden. Some of the other leading states may surprise you with their heavy toll.

The Tax Foundation writes:

Tax burdens go beyond tax collections. Taxpayers pay state and local taxes to their own state of residence, but also pay taxes to other state and local governments. For instance, when a family takes a vacation to Disney World, it pays a variety of taxes to Florida. The family might encounter taxes on hotel rooms, rental cars, food, and many other things. They pay taxes in Florida, but the actual burden of the tax resides back in their home state such as Indiana. Understanding how states shift taxes across state lines is a valuable component of state tax discussions.

For fiscal year 2012, 9.9 percent of personal income went to state and local tax payments. This is down from 10.1 percent fiscal year 2011. Average income increased at a faster rate than tax collections, driving down state-local tax burdens on average.

New Yorkers faced the highest burden, with 12.7% of income in the state going to state and local taxes. Connecticut (12.6%) and New Jersey (12.2%) followed closely behind. On the other end of the spectrum, Alaska (6.5%), South Dakota (7.1%) and Wyoming (7.1%) had the lowest burdens.

On average, taxpayers pay the most taxes to their own state and local governments. In 2012, 78 percent of taxes collected were paid within the state of residence, up from 73 percent in 2011.

State-local tax burdens are very close to one another and slight changes in taxes or income can translate to seemingly dramatic shifts in rank. For example, Delaware (16th) and Colorado (35th) only differ in burden by just over one percentage point. However, while burdens are clustered in the center of the distribution, states at the top and bottom can have substantially different burden percentages—e.g. New York (12.6%) and Alaska (6.5%).

FLASHBACK VIDEO: Scott Hodge Compares State Tax Burdens

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024