President Joe Biden and Ukrainian President Volodymyr Zelenskyy talk at the Walk of the Brave, Monday, February 20, 2023, during an unannounced visit to Kyiv, Ukraine. (Official White House Photo by Adam Schultz)

Joe Biden is facing troubles both abroad and at home. In Europe, the war in Ukraine is extremely expensive, and its outcome remains to be seen. Here in the United States, the banking industry is increasingly volatile. But one similarity in both cases is that the Biden administration is relying on BlackRock to put out the fires like the company is his own personal bucket brigade.

In Ukraine, BlackRock is being asked to smooth the way for large-scale business projects that will rebuild the country if the war ever ends. Ukrainian President Volodymyr Zelensky told the world about his meeting with BlackRock management on his Telegram channel, writing:

The details of the creation of an investment fund to restore Ukraine’s economy were discussed at a meeting with the management of the largest asset management company in the world, BlackRock. The main goal of the fund’s creation is to attract private and public capital for implementing large-scale business projects in Ukraine.

At home, the Biden administration’s FDIC is relying on BlackRock to smooth over the smoldering banking problems. Silla Brush calls BlackRock Washington’s “favorite Wall Street cleaning crew,” writing in Bloomberg:

After almost two months of smoldering turmoil in the banking sector — and investors worrying there could be more trouble ahead — BlackRock Inc. has only just begun its work.

The firm’s Financial Markets Advisory unit, a sort-of financial-crisis SWAT team, has been retained to size up and sell investments related to two failed lenders, Silicon Valley Bank and Signature Bank. A third, First Republic Bank, has been sold to JPMorgan Chase & Co., but markets remain on edge.

For FMA, the client is the Federal Deposit Insurance Corp., and the challenge is to find buyers for $114 billion of securities left to the US government by SVB and Signature, all while not further ruffling financial markets.

It’s a big job – the biggest of its kind ever, in fact — and one that will entrench BlackRock, the world’s largest asset manager, even more deeply in the regulatory apparatus of Washington. Insiders acknowledge the potential payoff isn’t money: Fees haven’t been disclosed, but BlackRock’s take on previous projects has been modest.

The real reward, as is often the case at such moments, comes in the form of access, prestige and influence — a seat at the table when the next crisis, or perhaps the next opportunity, arises. That clout burnishes BlackRock Chief Executive Officer Larry Fink’s reputation as a power broker — and draws attention to the firm’s growing reach into global markets.

Fink has spent years positioning FMA as the crisis-manager favored by governments and central banks. Largely behind the scenes, it spends most of its time — when not contracting with the government — advising financial firms around the world about risks to their books.

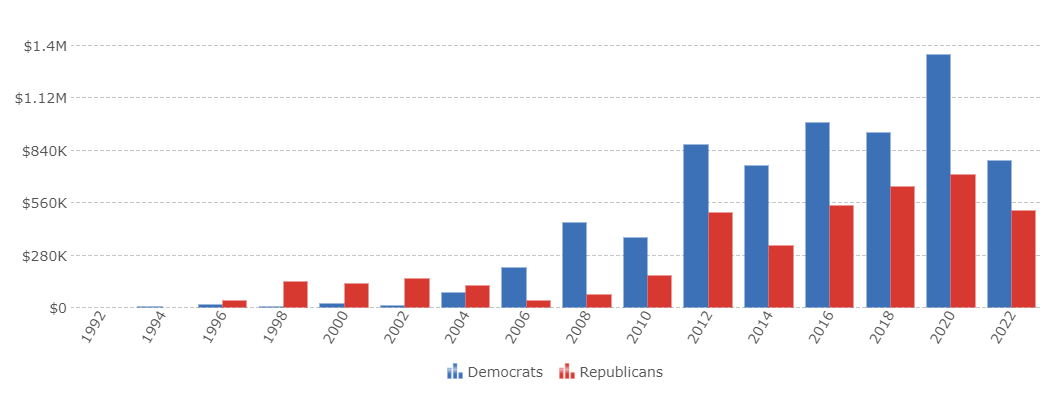

According to Open Secrets, BlackRock has increased its donations during presidential election years, with about two-thirds of its donations going to Democrats and the remaining third toward Republicans.

BlackRock Inc. Total contributions by party of recipient. Source: Opensecrets.org

Action Line: Beware when politicians and money managers combine forces to use taxpayer and investor monies to achieve politically acceptable goals. You invest, and they win. Click here to subscribe to my free monthly Survive & Thrive letter.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “What Do You Do If the Market Crashes?” - April 19, 2024

- Costco Gold Bars Sell Out Despite Premium Price - April 19, 2024

- A Wise Man’s Take on the Boston Bruins Playoff Chances - April 19, 2024

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024