I have grave concerns with the S&P 500 (See parts one, two, three, four and five of my series dedicated to those concerns).

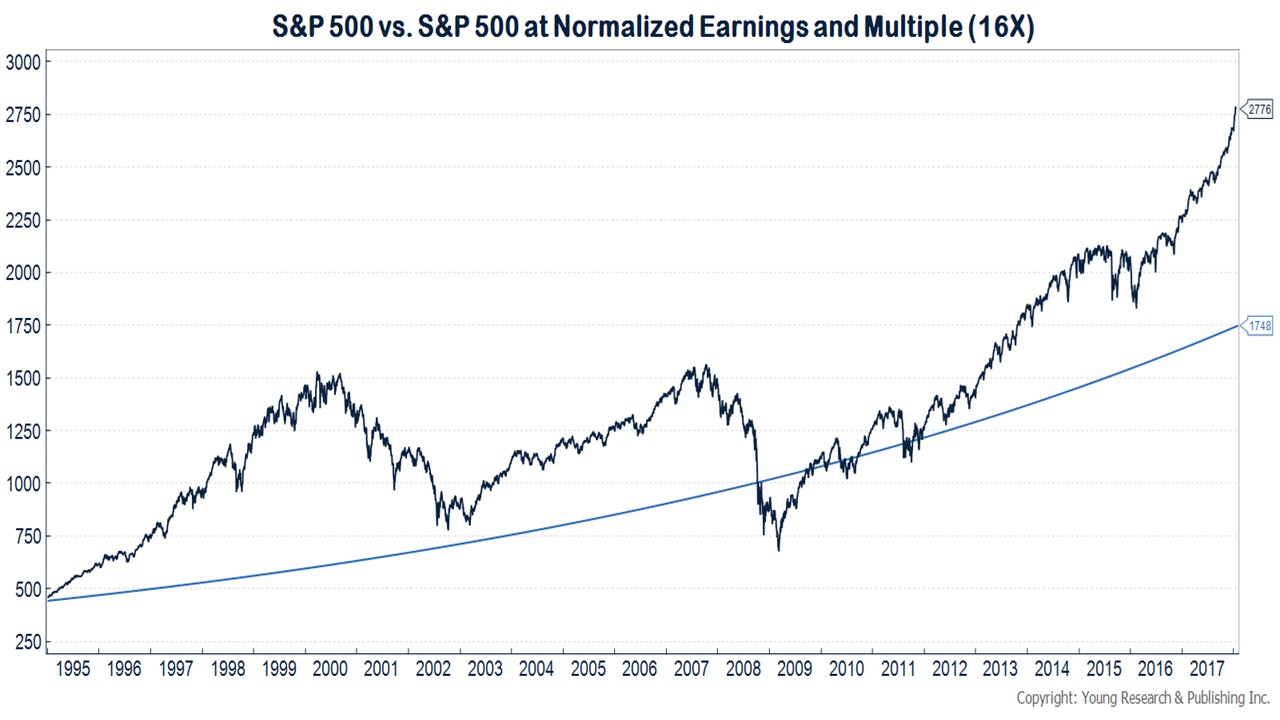

You can see in my chart below the index would need to fall by 38% based on yesterday’s closing value to trade at a normalized valuation.

Doing as well as the S&P 500, or the market, is a double-edged sword. Receiving market performance guarantees you’ll never beat it.

Believe me you’ll want to beat it when it crashes, because the grief from losses far outweighs the jubilation from gains.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Yes, Money Can Buy You Happiness - April 23, 2024

- State Income Taxes and the 2024 NFL Draft Class - April 23, 2024

- This ARK is Sinking - April 23, 2024

- “That’s Why I Hired You,” They Tell Me - April 22, 2024

- The Silver Lining of Higher Interest Rates - April 22, 2024