Vanguard ‘s head of investment strategy and global chief economist Joseph Davis gives some advice to investors in a low yield world, don’t be a hero. Bloomberg writes:

“The next five years are going to be more challenging than the previous five years in investing,” said Joseph Davis, head of investment strategy and global chief economist at Malvern, Pennsylvania-based Vanguard, which oversees $3.8 trillion. “Be cautious of trying to be heroic in this environment.”

Vanguard’s global head of fixed income, Gregory Davis, echoes his colleague’s sentiments.

Given the uncertainty still facing the global economy, Vanguard’s global head of fixed income, Gregory Davis, cautions investors against ditching the safety of bonds in a search for returns in assets such as real estate investment trusts and high-dividend yielding stocks.

“That’s an extremely dangerous game,” he said in the interview. “They don’t have the defensive characteristics of high-quality bonds. They’re taking on undue risk that they’re not necessarily appreciating.” …

“My main concern is, and what we’re trying to make sure investors recognize, is that just given where we’ve been over the last several years, there’s been this tendency to take more and more risk,” he said.

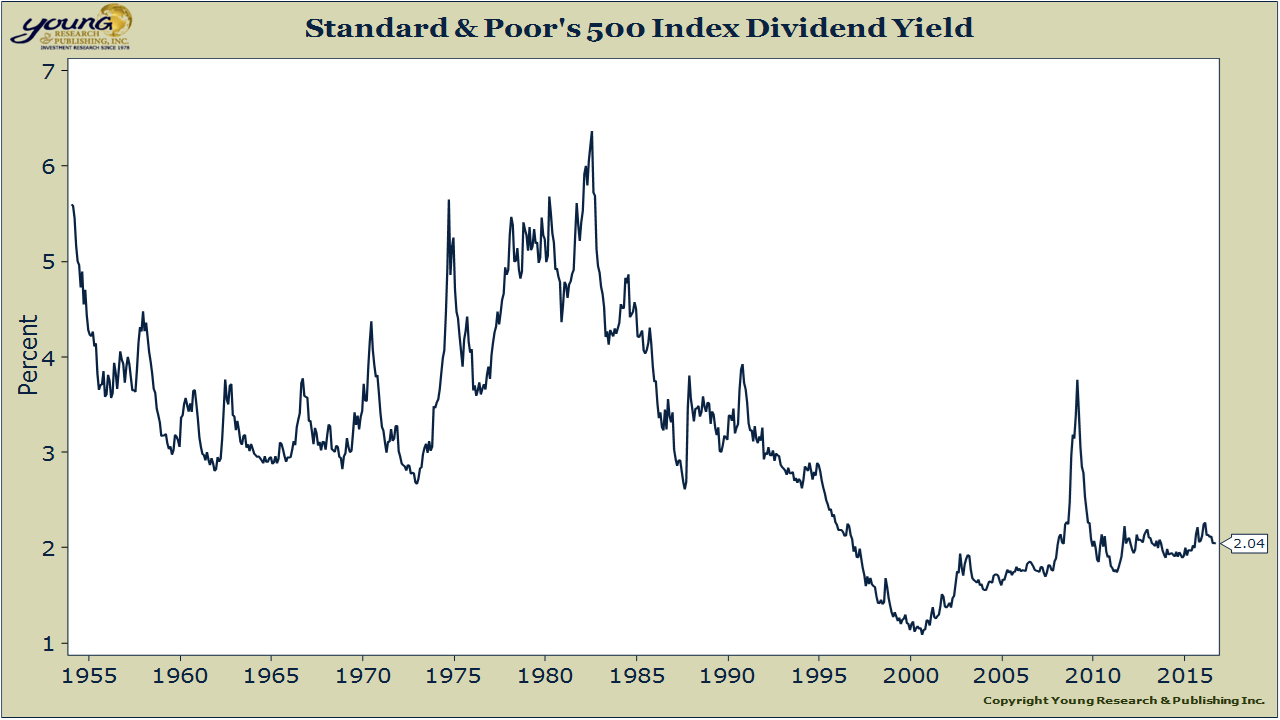

You can see on the chart below that the yield of the S&P 500 remains depressed today.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “What Do You Do If the Market Crashes?” - April 19, 2024

- Costco Gold Bars Sell Out Despite Premium Price - April 19, 2024

- A Wise Man’s Take on the Boston Bruins Playoff Chances - April 19, 2024

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024