Do you want to know what investing is to me? It’s a feeling. To have a feeling for the market, like sailing a boat, is to separate the good investors from the greats.

Why is it important to get a feel for the market? Because the knowledge we seek is not always available in reports, and often it’s distorted by reporting bias.

It’s why I personally favor anecdotal evidence for the truth about the markets.

For example, nothing in the world can replace conversations I have with my clients or emails from you. They give me on-the-ground intelligence I never, ever find in daily stock quotes.

Let me share with you what I mean by this.

Recently, I had a wonderfully informative conversation with a client involved in a family gun business. I told him I was constructing an index to measure the overall investing landscape and tone of the country—my RAGE gauge. The idea being to provide you with a wide array of data in an easy to understand format.

I asked my client about the tone of his customers. What are they sayin’ and what are they buyin’?

There wasn’t even a pause.

He said, “E.J. I can’t keep single-stack handguns on the shelves. As soon as they come in they’re sold. When customers tell me they are concerned for their safety, they buy handguns and preferably ones that can be easily concealed (single-stack).”

That’s it.

That’s all I needed to hear.

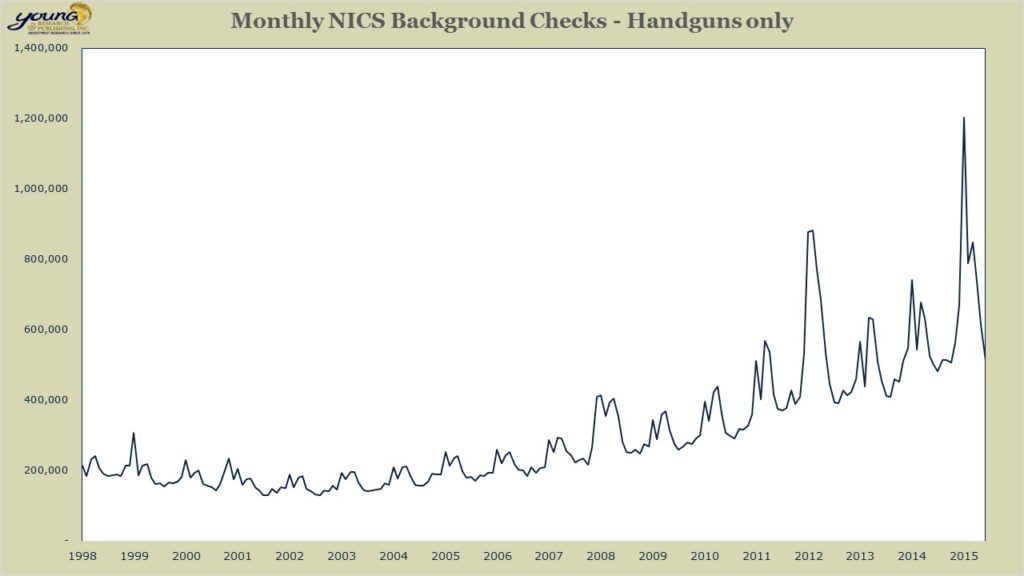

As soon as we hung-up I looked up the FBI background check data for handguns. Background checks give a pretty good indication as to an eventual sale.

And sure enough, they’re way up.

For the month of May 2011 background checks for handguns were 307,929. This May they were 512,406. You and I know tension is high in this country.

We now have some more data points for the index—a tool to help give us a better feeling for the markets.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024