The story for this month’s Rage Gauge is gold. What is it telling us? What is it worried about? Inflation, N. Korea, the economy? In my daily calls with investors the common refrain I’m getting about the stock market is that they don’t trust it.

The story for this month’s Rage Gauge is gold. What is it telling us? What is it worried about? Inflation, N. Korea, the economy? In my daily calls with investors the common refrain I’m getting about the stock market is that they don’t trust it.

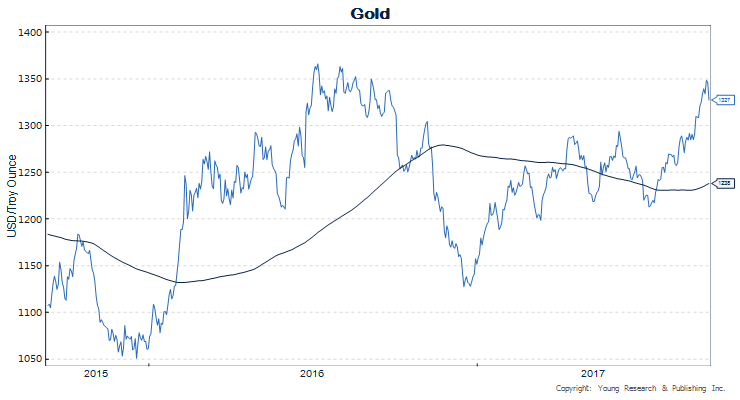

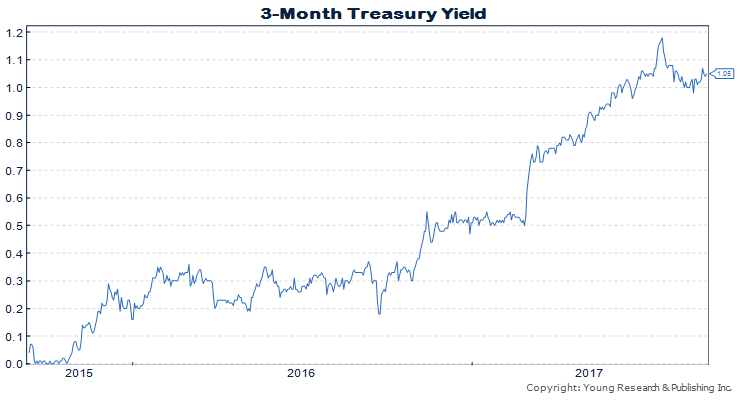

Gold has been jittery of late and I’m not about to guess its short-term track. It sold off big-time yesterday. Which brings me to interest rates which are, if you can believe it, lower. T-bill yields peaked on July 25, closing at 1.18%. Since then the markets have gotten jittery and yields are back down to 1.05%, though they’ve been rising pretty steadily since August 28.

Retirees are being asked to do with less, with a weaker dollar (which they use to buy goods and services) and higher gold. In other words, their daily survival costs are higher.

My advice: Nail down your expenses and think about surviving with less.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “What Do You Do If the Market Crashes?” - April 19, 2024

- Costco Gold Bars Sell Out Despite Premium Price - April 19, 2024

- A Wise Man’s Take on the Boston Bruins Playoff Chances - April 19, 2024

- Is Your Retirement Life a Mess? Let’s Talk - April 18, 2024

- Your Survival Guy Learns from Marie Kondo - April 18, 2024