Dear Survivor,

How well are you securing your cash and valuables? Do you have a safe at home? A safe is an obvious choice for convenience, but unless you have serious security, you wouldn’t want to leave major wealth sitting unattended while you’re at the office or on vacation. You need a better option.

The obvious choice for most is a safe deposit box. That is the route an increasing number of the world’s wealthiest are taking. Disasters like the wildfires and hurricanes that have hit the United States in recent years have made securing wealth an urgent endeavor in the minds of many. Benjamin Stupples writes at Bloomberg Quint:

Safe-deposit boxes can range from a few centimeters in height to the size of a kitchen cabinet. Another option are free ports — warehouses in tax-free zones such as Singapore, Geneva and Delaware favored for storing art, but which typically limit the amount of time that pieces can be held.

There are more than 25 million safe-deposit boxes by some estimates in the U.S. alone. They can be used for the mundane to the exotic. A private collector held the Crown of the Andes, made with 5.3 pounds of gold and more than 400 emeralds, in a Citibank box before its sale four years ago to the Metropolitan Museum of Art. Still, for many banks, they’re no longer a core offering.

The amount of space they require is one deterrent. That’s especially the case in London, home to the world’s largest population of wealthy individuals, according to real estate broker Knight Frank. In the city center, few places have secure storage facilities as large as IBV’s on Park Lane, where customers can also purchase gold coins from across the globe.

In the U.S., safe-deposit boxes also have largely fallen out of favor as banks close branches and opt not to install them in new ones. Demand has waned in recent years, according to JPMorgan Chase & Co. and Bank of America Corp., the nation’s two largest lenders.

“Much of the decline can be attributed to clients opting to store documents online, especially younger clients,” said Bank of America spokesman Don Vecchiarello.

But there’s revived interest as fears of weather disasters and wildfires have prompted more people to secure their valuables, said Jerry Pluard, founder of Safe Deposit Box Insurance Coverage.

You need to take the safety of your wealth seriously. Whether it’s in the form of gold or bitcoin, or cash or art, you should secure it properly.

Here’s Why You Should Treat Your Disaster Cash like Gold

In a true catastrophe, the value of your dollars may plummet to zero, and all you’ll be left with is your gold, canned goods, and ammo for bartering. That would be a terrifying scenario for sure. That said, most disasters you’ll face in life won’t impact the value of your cash, but they could very well impact your access to your bank account.

I’ve been writing to you recently about how the wealthy are moving their money out of bank accounts and into more traditional safety deposit boxes. For large amounts of cash, you wouldn’t want unattended at home, safety deposit boxes are a great idea. This strategy also works for avoiding negative interest rates. But in a disaster that closes banks and ATMs, you need something closer to home.

For your immediate disaster cash needs, you should have a Sentry Safe, or some other fire/water resistant safe at home. You preferably want something portable, in case you need to evacuate quickly.

I like the Sentry Safe Fire/Water Chest (Note: this is not a paid endorsement, this is a real recommendation based on experience). You need something that can protect your cash from wildfires or water damage for a short time until you can collect it.

Save Some for the Family

If you’re a grandparent who has been diligent about keeping money on hand in case of disaster, you may want to consider the needs of your children and grandchildren. Are they preparing themselves to avoid risk in a disaster situation? Do they even have cash to put aside? If the answer to these questions is no, you may want to put a little extra aside for them.

You may consider gently urging them to start preparing by buying them a portable safe for Christmas. Tell them to treat their disaster cash like gold, and keep it close.

Gold/Silver Coins No Longer Allowed in Safe Deposit Boxes

A son of long-time subscribers to Richard C. Young’s Intelligence Report emailed me recently about a letter his parents had received from their bank branch.

Not a phone call to set up a meeting, a letter.

According to him, the bank sent the letter to his parents stating that no gold or silver would be allowed in the bank’s safe deposit boxes.

There was no explanation for the change in the letter.

The note wasn’t from a small local bank on Main Street, USA.

This bank is one of the biggest players in the world.

Its regional branches extend like tentacles to every street corner imaginable.

It’s one of the big guys on Wall Street that received a bailout, of course.

Does this letter sound like they’re looking out for the heart and soul of Americans living on Main Street?

What we are seeing today are desperate moves by banks and investment firms to stay relevant.

The pressure to grow is immense.

Which is why I want you to do some of your banking locally, where everybody knows your name.

Because if they’ve changed their name too many times for you to remember, why in the world would they remember yours?

This is What Troubles Me About Safe Deposit Boxes

Remember, you have zero downside in being prepared for the unexpected.

But, listen up, it’s also imperative to build and cater your security around your situation.

Here’s why.

A client emailed me his concerns about safe deposit boxes that you need to read and then apply to your specific situation:

E.J.,

I read about one case where some bank employees pilfered a number of safe deposit boxes and it was difficult to identify the losses as few or no records were available on what was in them.

That has troubled me and as a result, I keep most of my important records at home in my safe.

I also have monitored security with glass breakage sensors, fire sensors, video cameras etc. I was a dealer for Fort Knox vaults and safes until two years ago, and once delivered a two-ton vault to a customer near the Mexican border.

I did this delivery myself with my main assistant, into a newly constructed house. The customer had a major Winchester collection and the vault was a very large safe like vault with double steel walls, including one layer of ballistic steel.

He wanted it bolted down and, he had a wall built around it. He invested about $12,000 in this setup but he had a lot of volume which was 72 inches high, 61 inches wide and about 29 inches deep.

He had checked with other dealers, including other Fort Knox dealers and I was the only one willing to make this delivery. Just a side note.

He couldn’t use a safe deposit box due to space restrictions. Anyway, just one more way to go.

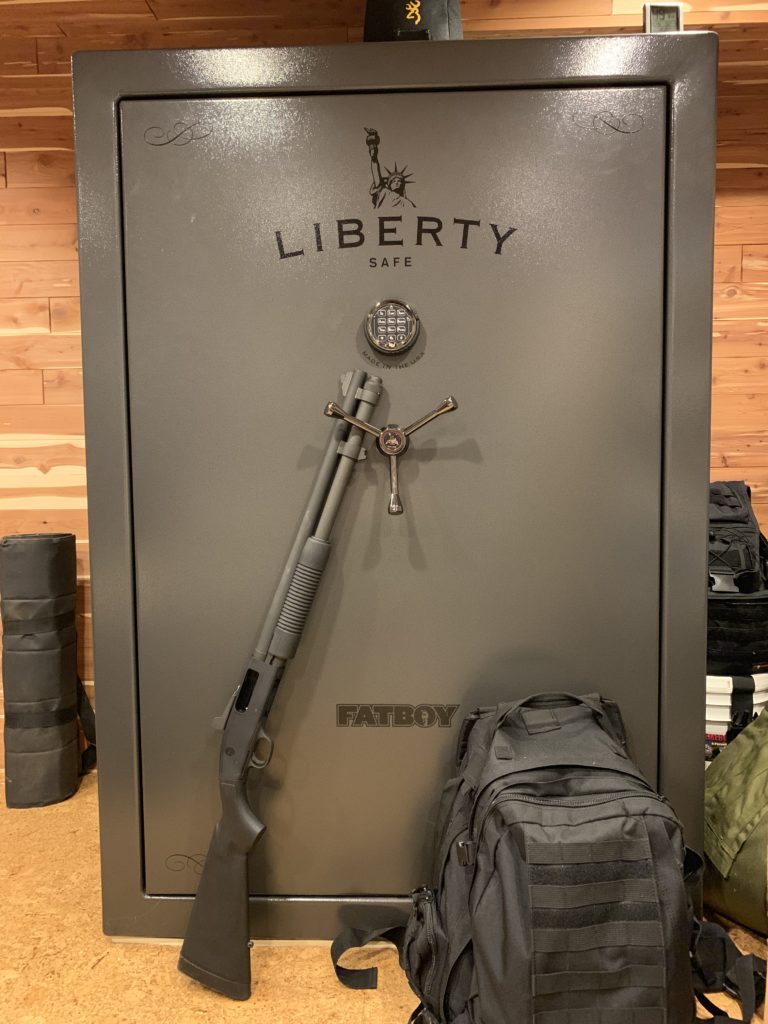

Your situation is unique, and your preparation will be a little different from my client’s and mine. A safe deposit box at your local bank where everybody knows your name (I recommend doing some sort of banking locally), multiple biometric handgun boxes, Sentry Safe Fire/Water Chests, and a gun safe (I like my Liberty Fatboy gun safe) are great ways to start.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Twitter, Instagram, and Facebook.

P.S. If you have a safe deposit box, set-up a schedule and visit regularly. Get to know your bankers, and keep a careful log (pictures) of what is rightfully yours.

P.P.S. America is home to a silent army with 423M guns. Well, maybe not silent as more and more Americans are speaking out to defend their Second Amendment rights. As the recent ATF report reveals, this group is locked and loaded.

Paul Bedard details the report at The Washington Examiner, writing:

New federal data shows that there are 422.9 million firearms in circulation, or about 1.2 guns for every person in the country.

What’s more, despite years of criticism of modern “assault-style” rifles such as the AR-15 and AK-47, there are a record 17.7 million in private hands, proving that it is the most popular gun around.

And last year alone, the arms industry produced 8.1 billion rounds of ammunition.

The figures are from the U.S. Bureau of Alcohol, Tobacco, Firearms, and Explosives and were crunched by the National Shooting Sports Foundation, the gun industry trade group.

“These figures show the industry that America has a strong desire to continue to purchase firearms for lawful purposes,” said Joe Bartozzi, president of the NSSF, in a statement releasing the group’s new report.

“The modern sporting rifle continues to be the most popular centerfire rifle sold in America today and is clearly a commonly owned firearm with more than 17 million in legal private ownership today. The continued popularity of handguns demonstrates a strong interest by Americans to protect themselves and their homes and to participate in the recreational shooting sports,” he said.

In response to nonstop attacks on their Second Amendment rights, Americans have decided to get their guns and their training now. In doing so, they have turned themselves into a silent army.

P.P.P.S. You’re familiar with my piece Rich Grandchild, Poor Grandchild. Now I want you to shift gears and think about which states are the rich states, and which ones are the poor states.

“For each of the past 12 years, Arthur Laffer, Jonathan Williams and I have answered that question in ‘Rich States, Poor States,’ an index of economic competitiveness published by the American Legislative Exchange Council. Every year the top performer has been Utah,” explains Stephen Moore.

Yes, that’s right, the winner once again is Utah.

On a recent ski trip to Utah, my family experienced firsthand why they call it Silicon Slopes. With world-class skiing in and around Big and Little Cotton Canyons such as Deer Valley, Park City, Snowbird and Alta, there’s plenty of winter fun to be had within 45-minutes of booming Salt Lake City.

Sundance Mountain Resort, also within an hour’s drive of SLC was recently voted #1 ski resort in the U.S. and Canada by Conde Nast.

But as the saying goes, you’ll visit for the winter, but you’ll stay for the summers.

“One of the best parts of helping people in retirement is getting to be a part of their retirement life,” I wrote to you last month. “A client recently sent me this picture, and said: ‘Above is a snap of Rainbow Bridge taken from a nearby alcove that held some old signatures.’ It was great to be able to share that moment he had worked for his whole life.”

Here’s a pic:

More Reasons to Live in Utah

More reasons to live in Utah: No death tax, so don’t worry about being adventurous. There’s plenty to do when you have five breathtaking national parks: Arches, Canyonlands, Capitol Reef, Bryce Canyon, and Zion.

“Utah has a low, flat-rate income and corporate tax of below 5%,” writes Moore. “There’s no death tax, so wealthy people don’t have to flee to Florida after they retire. There’s a flat tax income tax, and it’s a right to work state.”

Moore continues (abridged):

Part of the reason for Utah’s consistently strong economic growth is a still-predominant Mormon culture that encourages out-of-fashion virtues such as thrift, delayed gratification and stable families. The state has the nation’s lowest median age. There is no dreary Malthusian concern about “overpopulation” in young and vital Utah. Stand outside a church on a Sunday morning, as I did recently, and you will see families with large numbers of kids spilling out of minivans. In the graying Northeast, that’s a rare sight.

Many analysts have attributed Utah’s prosperity to favorable demographics. But good economic policy leads to favorable demographics. Roughly half of Utah’s population explosion has been due to net migration of almost 80,000 newcomers (mostly young) over the past decade from other states. If Utah had New York’s or California’s tax rates and antibusiness attitudes, the flow of people would likely run the other way.

Progressives dismiss red states like Utah as places that reward the superrich with low taxes at the expense of everyone else. But perhaps the most confounding thing about Utah is that despite (or because of) its antiprogressive policies, it has the least income inequality in the nation, according to the latest U.S. Census Bureau data.

If the progressive soak-the-rich policies of presidential candidates Elizabeth Warren and Bernie Sanders are really the path to prosperity, why does conservative Utah—which spurns all their ideas—keep coming out No. 1?

Read more here.

Download this post as a PDF by clicking here.