By CashGuy @ Shutterstock.com

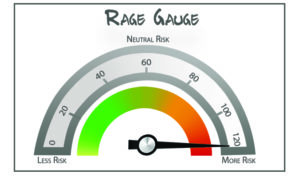

OK, my September Rage Gauge is in, and it’s not pretty. Risk perception continues to be at an all-time high. I get it. And as an investor, you can’t afford to keep your head in the sand. This may be a perfect time to make some adjustments to an often overlooked area of your portfolio. I’m talking about your CASH. As I wrote to you yesterday, I think about cash in three ways:

- You have your emergency stash on hand that you hope to never use.

- You have cash in your investment portfolio as part of your strategy. To buy stocks when others are selling, for example.

- You have a pile that’s getting bigger and bigger at your bank. You know, the cash you used to use to buy CDs. Remember them? Well, that’s your sleep well at night cash, and quite frankly—it’s gotten lazy. Chances are you have too much of that cash sitting around doing nothing.

Right now, I want to talk about your LAZY cash that typically goes into CDs or T-Bills, which, by the way, yield 0.06%. How much cash is lying around in your bank account doing nothing? Probably too much. I’m guessing some of that money could be working for you.

Right now, I want to talk about your LAZY cash that typically goes into CDs or T-Bills, which, by the way, yield 0.06%. How much cash is lying around in your bank account doing nothing? Probably too much. I’m guessing some of that money could be working for you.

Let’s say you have $100k more than usual in cash, and your back of a napkin portfolio allocation targets 50/50 between stocks and bonds. Don’t you think some of that $100k in cash could be generating above-average yields in dividend-paying stocks? It’s worth thinking about.

Action Line: Take a look at the chart below. My interest isn’t so much about the price, which has been outstanding, it’s about the earnings. As in earning dividends. Get that LAZY cash off the couch and give it something to do. I’d love to talk with you.

Want someone you care about to receive my Rage Gauge? Pass it along. They can sign up here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “Happy I Found Richard C. Young’s Intelligence Report” - April 16, 2024

- Your Retirement Life: Watching The Masters and More - April 15, 2024

- Fight Food Inflation with Gold - April 15, 2024

- How’s Your State’s Financial Health? - April 15, 2024

- Your Retirement Life: A Living Income from Savings - April 12, 2024