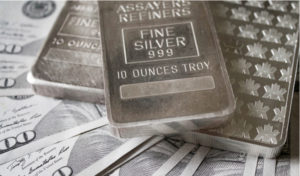

I like having a little silver in my pocket especially when times are desperate. And I also like some in my portfolio.

We may not see a rally in silver this year, but it’s coming off it’s best December in almost two years, up 9.1 percent, making me happy I own some. For me, silver is a counterbalance to my cash.

And if the Fed’s going to sit tight on rates and silver is at its smallest output since 2013, it might be time to pay attention.

Marvin Perez reports at Bloomberg:

Think of it as a potential silver lining for investors. A deepening shortage is promising to help boost prices as haven demand for the precious white metal rebounds in 2019.

Silver surged 9.1 percent in December, its biggest monthly gain in almost two years. The commodity has benefited as a persistent trade war, weakening dollar and prospects of slower pace of U.S. rate increases drove haven demand for precious metals. The price outlook is improving at a time when demand for gold’s cheaper cousin is poised to top production for a seventh straight year.

With miners avoiding new projects amid global economic uncertainty, the price could spike as high as $17.50 an ounce from about $15.87 now, according to a Bloomberg survey of 11 traders and analysts. About 26,000 tons of silver is expected to be produced this year, according to estimates by Robin Bhar, a London-based analyst at Societe Generale SA. That would be the least since 2013, and means global physical demand will again top output.

“Supply growth has started to slow, more than for any other precious metal,” said John LaForge, the head of real assets strategy at Wells Fargo Investment Institute.

Read more here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Yes, Money Can Buy You Happiness - April 23, 2024

- State Income Taxes and the 2024 NFL Draft Class - April 23, 2024

- This ARK is Sinking - April 23, 2024

- “That’s Why I Hired You,” They Tell Me - April 22, 2024

- The Silver Lining of Higher Interest Rates - April 22, 2024