Let’s file this one under You Invest They Win shall we?

Unprecedented monetary policy intervention by the Fed has done what all unprecedented interventions by the government do, create winners and losers. In this case, the winner is BlackRock. The Fed picked the firm to handle its corporate bond buying program.

Of course, BlackRock’s share of the corporate bond market grew, and the big got bigger. As one investment professional told the Wall Street Journal “The unprecedented actions taken by the Fed during Covid-19 just accelerated the trend where the biggest products get bigger.”

When government steps in, the big get bigger. And individual investors like you? They get the scraps.

When it comes to bonds, the mutual fund/ETF game is no longer a match for the individual investor interested in securing a steady stream of income and safety.

The big guys like Blackrock have other ideas, mainly, gathering institutional money from bankrupt pensions and sidling up with the connected high priests of the Fed. You do not want to be caught in the vortex of this here-today-gone-tomorrow crew who will sell out of poisonous positions while you sleep only to satisfy their ESG pipe dream.

Today like never before you must rely on yourself to make the correct decisions on the safety of your money and not depend on big institutions to look out for your best interests. To begin with, if they are not talking with you regularly, why would they care about you?

Ask yourself, no ask them, if they’re a fiduciary by law and get it in writing (good luck with that). The race to gather assets will always be their goal, making you just a number.

You deserve more.

Vanguard Proving Why It’s Too Big, Yet Again

Just when you think Vanguard might see the light and get back to its roots, it shows once again why it has become too big and is just like any other money-sucking behemoth–like BlackRock. Vanguard has proven this with the introduction of its own ESG investments program.

In my series “You Invest, They Win,” I prove that you are not necessarily front and center, as you most certainly should be when it comes to how your money is invested. This is especially true with the new, hot, investment flavor-of-the-month, ESG. What is an ESG? It’s a marketing tool hoping to get you to feel good about how your money is allocated.

ESG guided funds follow a “certain” (opaque at best) environmental, social, and governance guideline when investing. In other words, instead of simply focusing on solid investment values, their focus is perhaps on their politics too—with your money—and in the end, it’s always about gathering assets. Yours, that is.

With stocks falling by more than 33% three times so far this century, you have other things to worry about with your money than fighting some boardroom’s social initiative. Already we’ve seen corporate America drop the ball and back the Marxist BLM and side with professional sports that make a mockery of our national anthem.

Do not fall for the ESG narrative. It’s more hubris from the big dogs that know it’s more sizzle than steak (made from peas of course).

Fidelity is #1: Meet FidSafe and Raise Your Family’s Level of Preparation

A valued client was telling me this week about how he’s preparing his family for when he dies. It’s not a pleasant topic, but neither is the prep work. Navigating a subject that guarantees all kinds of emotions takes time and effort.

My client is preparing his family with a dry run. They will receive a call, and then will need to navigate as if he’s no longer around. He’s using Fidelity to keep his family’s important documents and finances secure and accessible.

One way to organize your documents is by using FidSafe. Fidelity’s FidSafe “is the safe, easy, no-cost way to store, organize, and access digital copies of your family’s important documents.”

You can help decide if FidSafe is right for your family and learn much more about it by watching the videos below.

Read more about FidSafe by clicking here.

“They Stick a Q-Tip So Far Up Your Nose, You Can See it Through Your Eye”

“They stick a Q-tip up your nose so far, you can see it through your eye,” I thought, as a friend described what it was like to watch his daughter squirm in pain and holding her in place as the doctor performed a COVID-19 test. No thanks. But Rhode Island requires school children showing two signs of COVID-19, which we all have when we get a cold, must be sent home. They can return with either a doctor’s note saying in writing he doesn’t believe a test for COVID-19 is necessary, or take the traumatizing test and wait at home for the results. Both options stink and are disruptive to say the least. It’s why I want you to think long and hard about how your state because this is a state issue, will treat you and your family as the coronavirus is a political disease.

It’s Time to Find Your Island Life

Not only is state-forced testing disruptive to every family forced to go through the agony and to wait for the results, but clearly this will continue as a big government debacle of epic proportions as it becomes simple “cover-your-ass” liability management. You’re seeing it at schools across the country as more positive tests become a casedemic, while death rates plummet. My friend’s daughter feels fine, and misses her friends, but is stuck at home. America is not meant to be shut down. Kids need to be in school.

A Booming Economy Absorbing Boomer Retirements

At the outset of this year, the economy was booming across all income groups, easily absorbing the megatrend of retiring baby boomers. Now if you didn’t have a desk job you’re out of work. But look at the difference in how this has been managed in Blue states vs. Red. Take a look at what the teachers’ unions are doing to schools in New York City. It’s never about the kids. Just follow the money.

Follow the Money

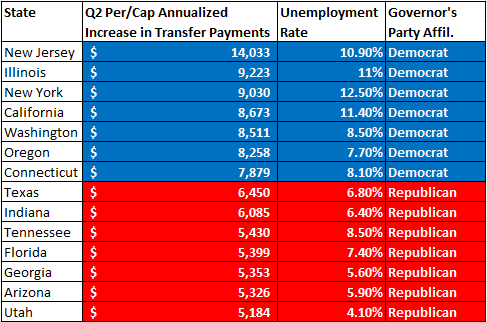

The $1,200 coronavirus relief checks and $600 in supplement unemployment benefits are the perfect disincentives to work. As noted in the WSJ, many Democrat-run states received nearly double what GOP-run states did:

We calculated the per-capita annualized increase in transfer payments, and many Democratic-run states received nearly double what GOP-run states did: New Jersey ($14,033), Illinois ($9,223), New York ($9,030), California ($8,673), Washington ($8,511), Oregon ($8,258) and Connecticut ($7,879) versus Texas ($6,450), Indiana ($6,085), Tennessee ($5,430), Florida ($5,399), Georgia ($5,353) Arizona ($5,326) and Utah ($5,184).

Those seven Democratic states hauled in 24% more in transfer payments relative to their share of the U.S. population while the seven GOP states collected 23% less. Yet these Democratic states continued to boast much higher unemployment rates in August: New York (12.5%), California (11.4%), Illinois (11%), New Jersey (10.9%), Washington (8.5%), Connecticut (8.1%) and Oregon (7.7%) versus Utah (4.1%), Georgia (5.6%), Arizona (5.9%), Indiana (6.4%), Texas (6.8%), Florida (7.4%) and Tennessee (8.5%).

Where’s the motivation to get back to work when it’s all a political game by Pelosi’s Dems et al.? I’ll have more for you tomorrow.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Twitter, Instagram, and Facebook.

P.S. For years, when my kids were younger, we would go to our rifle club with my friend and his two daughters for a Friday night kids shoot sponsored by the club.

We’d grab dinner beforehand and then head over. Every session began with a video on safety and then the kids, from all over the island, would have a club member help them work the club’s .22 rifles.

It was fun bringing the targets home and standing around the kitchen island talking about shots taken, good and bad.

Recently, my kids drove to the club together for their junior membership orientations, but this time without me.

Time flies.

Don’t let it pass you by without taking action for your family’s self-defense.

Take control of your safety for you and your family by staying in touch with the NRA. They have everything necessary to get the training you need.

P.P.S. You have decided to escape the city, and now you’re looking for what Laura Forman at The Wall Street Journal calls “location, location, isolation.”

She writes:

Real-estate searches are looking a lot different lately.

For years, home values have been greatly influenced not only by finished square footage and acreage, but also by walk scores and community. The pandemic is turning those factors on their head—at least for now.

Airbnb, for example, is now touting its ability to enable users to work from anywhere, no matter how remote, after years of inviting its guests to “live like a local.” Last week, it even said it would provide its employees with stipends to allow for their own escape from San Francisco, where the company is based.

Airbnb says some of the fastest-growing locations for long-term stays are now Western Maine and Whitefish, Mont.—a town with less than 8,000 residents, according to 2018 U.S. Census data. Meanwhile, a recent Zillow survey found remote workers could be compelled to move if a home offered them things like dedicated office space or a less dense area with fewer neighbors. Zillow’s data shows home values have held up better in suburban than urban areas in recent months.

Those who paid up before the pandemic to live within walking distance of society are bitter at best. One New York dweller paying a premium to live near theaters, bars and restaurants suggested her rent be adjusted down to reflect the fact that everything has closed. For her neighborhood amenities now, she tweeted, “I will gladly pay…a hundred bucks a month.”

If you’re choosing where to retire, leaving the city can be a good choice. You could live like a billionaire if you choose the right place.

P.P.P.S. When COVID-19 hit America, blue state governors went wild. They locked down everything and anything that might look like economic activity. It hasn’t gone well for their states, where unemployment is extremely high. Look at their unemployment rates:

- Massachusetts (11.3%)

- New Jersey (10.9%)

- New York (12.5%)

- Nevada (13.2%)

- California (11.4%)

- Michigan (8.7%)

- Illinois (11.0%)

- Hawaii (12.5%)

- Pennsylvania (10.3%)

- Delaware (8.9%)

These governors worked hard to protect the rich while stealing the economic future of many middle-class Americans. The crazed response by these governors has put success out of reach for many Americans for years to come.

At LewRockwell.com, Dr. Joseph Mercola analyzes some of the hysteria and wrong turns that were part of America’s response to COVID-19. And, he asks, “Did lockdowns cause more harm than good?” He writes:

Berenson expects similar contradictions to surface soon regarding lockdowns, which were long heralded by the press but may soon go the way of ventilators: “LOCKDOWNS ARE USELESS? Why were we not told? SOMEONE IS TO BLAME AND THAT SOMEONE IS DEFINITELY NOT US,” he Tweeted.

Berenson was being sarcastic, but Dr. Gilbert Berdine, an associate professor of medicine at Texas Tech University Health Sciences Center, used data on daily mortality rates for COVID-19 to track the course of the pandemic in Sweden, New York, Illinois and Texas, which each used different pandemic responses, and has suggested that lockdowns may turn out to be “the greatest policy error of this generation.”

Sweden, which did not implement widespread required lockdowns, hit a peak of 11.38 COVID-19 deaths per day per million population on April 8, 2020, and again on April 15, but deaths have declined since. Now, cases and deaths are very low, and it appears herd immunity has been achieved, leading to the end of the COVID-19 epidemic there “for all practical purposes.”

In Illinois, meanwhile, a strict lockdown was also implemented and daily mortality rates increased more slowly, reaching a peak of more than 15 deaths per day per million on May 17, 2020.

However, mortality rates have also been slower to decline and death rates have remained higher than in other areas. While the lockdowns appear to have succeeded in flattening the curve and slowing transmission among healthy populations, they may also have lengthened the time that young people could transmit the virus to the elderly.

“The lockdown appears to have made more deaths from COVID-19 in Illinois than would have occurred without it,” according to Berdine. “Almost certainly herd immunity has not been achieved and will not be achieved until the schools and economy are reopened.”

The billions wasted on unused ventilators, combined with the emerging evidence that the pandemic lockdowns may have backfired, echo the plague of curiosities and misinformation that have followed the pandemic from the start.

Media Continue to Fan the Flames

Toward that end, even as COVID-19 death rates for some groups have fallen to almost 0%, dire warnings from mainstream media about an ominous “second wave” continue to push doomsday predictions.

The fact is, more than a dozen scientists said the herd immunity threshold (HIT) for COVID-19, at which point its spread slows down or stops, is likely 50% or lower, with some experts saying it could be as low as 10% to 20%. This means COVID-19 could potentially fizzle out or even disappear, without any vaccine.

“If we can actually reach herd immunity after 40 percent or less of the population is infected, far fewer people will die than the early forecasts, even without lockdowns,” Berenson wrote. “And if the best-case estimates of 20 percent or less are correct, we may be closer to the end than the beginning of the coronavirus epidemic.”

The lockdown era has also seen a spike in suicides, violent crime, divorce, drug overdoses, domestic abuse, and rising levels of anxiety and depression. There is a human cost in each of those that should not be discounted.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024