Dear Survivor,

“Red sky in morn, sailors take warn,” goes the saying. On this morning, the sun was as red as a lollipop, the kind that turns your tongue so red you want to show it to whoever’s next to you. Your Survival Guy heard it’s the dust, spun up from the wind, reflecting off the sun. Scientific American says it’s from the Bible (Matthew 16:2-3), attributed to a quote from Jesus. “When it is evening, ye say, fair weather: for the heaven is red. And in the morning, foul weather today for the heaven is red and lowering.”

NOAA, not Noah of the Ark, had a “small craft advisory in effect,” and my Weather app was showing a “! High Surf Advisory.” The island of Puerto Rico was without power and water too—again, and another hurricane gathered steam on a northern trajectory.

According to spaghetti models, this storm would spin out to sea. But when it comes to spaghetti, there always seems to be an errant strand when I spin my fork. I’m reminded by a loved one “to be careful about your shirt.” And even if a spot’s avoided, there is always the risk of an errant strand from one more bite cleaning up the pan. Which brings me to you.

Even with the best intentions, spaghetti models can still leave you with a mess. There are still plenty of uncertainties, such as: “should we haul the boat out now since we’ll be away this weekend? Should we pull in the Tucci umbrella and leave the others out? Will you go to the grocery store? Have you called your parents? What are they doing?”

“Hey, Dad, how’s it going?”

“Good, just hauled the dinghy. Storm’s coming.”

Great.

In my recent conversations with you, we talked about whether you want to sell your business or not. You told me about the spaghetti models you’ve seen showing you how long your money will last. “Sounds interesting,” I say. “It takes inflation into account,” you say. “Inflation means different things to different people,” I say.

Growing up in my house, inflation meant fewer dinners out, but I never felt like we were suffering. Inflation predictions are like sitting at your dinner table and being talked to about your future. “There’s this amazing business started by this guy Steve Jobs,” you’re told. When all you can think about is that tonight’s Thursday, and The Cosby Show is on.

Over the last few years, you and I have been told by the so called “experts” to follow the science, invest in bitcoin, and “ESG is the future!” to name a few. And this comes from the left and right sides of the aisle. So called experts aren’t from one political party. When it comes to your money, everyone wants your vote.

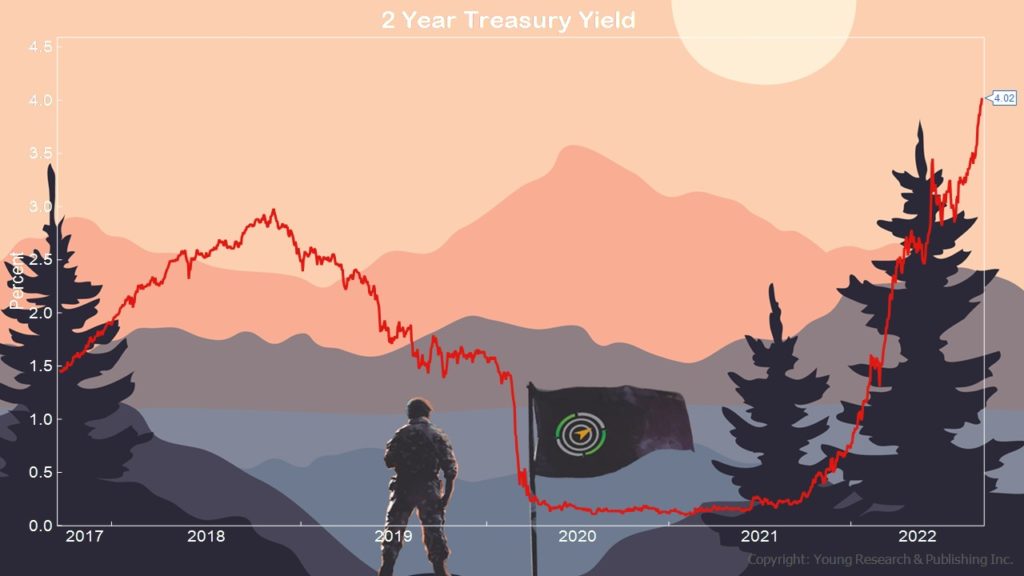

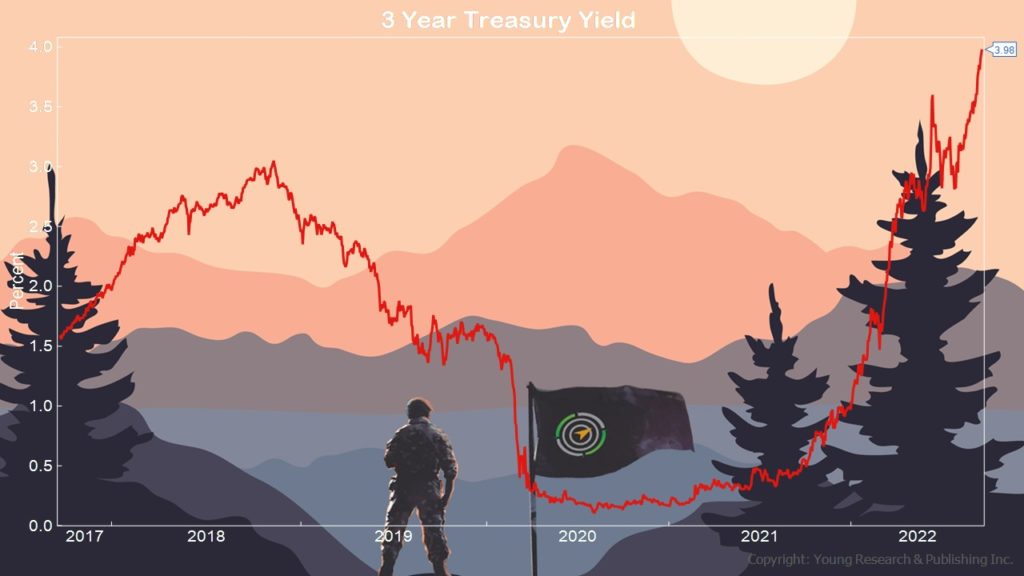

Predictions and models are cheap. Seriously, they are. You can get one online for free right now. See, I told you. What I want you to focus on is today, not tomorrow—the sun’s not coming out anyway. What you can do today with your lazy cash is get its butt off the couch and get it out there doing something with its life. It’s been a while since we’ve seen opportunities like this in fixed income. You can sink your teeth into this. Let’s go.

Is This a New Entry Point for Fixed Income?

Don’t look now, but we’re in a good entry point for fixed income. If you’re looking to get your lazy cash off your couch and up-and-at-‘em, please get in touch with me. Remember, you don’t need to save the world in a day. Slow and steady wins the race.

Read more about investing in bonds here:

- Why We Favor Laddering Bonds

- Why Bonds Always Matter to You

- Bonds vs. Stocks: First Things First

- Why Buying Bonds Matters in Times Like These

- Your Retirement Life: Do You Understand the Value of Bonds?

- Ignore Bonds (at Your Peril) and Be Average, Like the Next Guy

The Woke ESG Investing Money Grab is Falling Apart

ESG investing, pure and simple, is a “woke” man’s arrogance. It’s investing based on a company’s environmental, social, and governance record, something easily manipulated by companies in a process known as “greenwashing.” And now it’s coming apart at the seams. Perfect. Let it.

The lemmings are racing each other to jump off the cliff, not wanting to fail alone. ESG was all the talk in a rising market. Then the market cracked, and ESG was seen for what it truly is: a money grab to charge higher fees.

Along the way, a little thing called Covid happened. Staff at big firms left for greener pastures and customer service cratered. Not a big deal in a rising market. Phones are quiet when stocks are up.

Then suddenly, the market turned, and there was no one to answer the calls of panicked investors. Understaffed customer service departments couldn’t handle the volume. Questions about “what the heck is going on with my money?” had to wait. The phone tree looked like the forest in Avatar.

Yes, rising markets make for quiet investors. But once the going gets tough, investors want to know what’s going on with their money. Can you blame them? Getting a live voice shouldn’t be that hard. Look at the thought that went into our “on hold” music, and you see that listening to you is what matters most.

ESG is all about EGO. Stick with the Prudent Man Rule, and YOU will be the focus.

My father-in-law, Dick Young, recently explained what you’ll hear when you call our offices. He wrote:

When you call the office of Richard C. Young & Co., Ltd. during business hours, what you’ll hear first is the voice of a real human being working at an American small business that values its clients. You won’t hear a recorded phone tree directing you to a no man’s land of extensions and recordings. You won’t be answered by someone in a far-off place. Whoever answers the phone will pick up in either of our Naples, Florida, or Newport, Rhode Island offices. The personal touch you get from the folks you’ll talk to is part of what has earned Richard C. Young & Co., Ltd. a ranking in the top 5 of CNBC’s 100 Financial Advisors (2021), and what has earned my son, Matt Young, President and CEO of Richard C. Young & Co., Ltd., an induction into the Barron’s Hall of Fame Advisors (2021). Disclosure

While you are being transferred to your advisor by the helpful reception staff, you may be put on hold for a brief moment. That’s when you’ll be treated to something I have picked out for you personally. The hold music you’ll hear is a recording of Booker T. and the MGs playing “Green Onions.” Booker T. Jones, recorded his first version of “Green Onions” with the MGs in 1962 after he began composing it two years earlier while still attending high school. “Green Onions” peaked at number 3 on the Billboard Hot 100 in August of 1962 and spent four nonconsecutive weeks at the top of the R&B singles chart.

The first MGs consisted of Lewie Steinberg on bass, Steve Cropper on guitar (a Telecaster), and Al Jackson Jr. on drums. Jones played a Hammond M3 organ on the track. Many will tell you he played a B3, but I have seen the organ with my own eyes at the Stax Museum of American Soul Music in Memphis and can assure you it’s an M3 in the building. This point confuses many because Jones is so well known as a B3 player.

I have followed Booker T. Jones’s career for decades, and I have met him multiple times at venues around the country. When he was inducted into the Musicians Hall of Fame in Nashville in 2008, I was there in the center of the eighth row. I own all of Jones’s original 45s, including multiple versions of “Green Onions,” and play them regularly on my Wurlitzer jukebox at home. The various versions include;

- The original on Stax’s sister label, Volt, released in May 1962, on which Green Onions was the B-side to Behave Yourself.

- A September 1962 release on Stax, with Behave Yourself as the B-side

- And a March 1967 UK-only release on Atlantic Records that included Boot-Leg on the B-Side

The song you hear while you briefly hold during a call to Richard C. Young & Co., Ltd. is not some random muzak assigned to such moments by the telephone company. I picked it out specifically for clients in order to connect them to my lifelong interest in jazz, instrumental R&B, and Southern soul music. There are many versions of “Green Onions,” both by Booker T. himself and others, including an outstanding version by Mike Bloomfield and Al Kooper live at the Fillmore West in 1968. Harry James also recorded a respectable version in 1965.

If you’re looking for investment advice, please call in at 888-456-5444. Enjoy the service you’ll receive, and if you do find yourself on hold, please know that I personally selected the music for you.

Dick Young

P.S. When markets get hit by a hurricane, Young’s World Money Forecast is your port in a storm. Click here to sign up for my free email alert. I’ll never share your information with anyone.

You’re a Compounding Machine: Shop Stocks Like You’re at Walmart

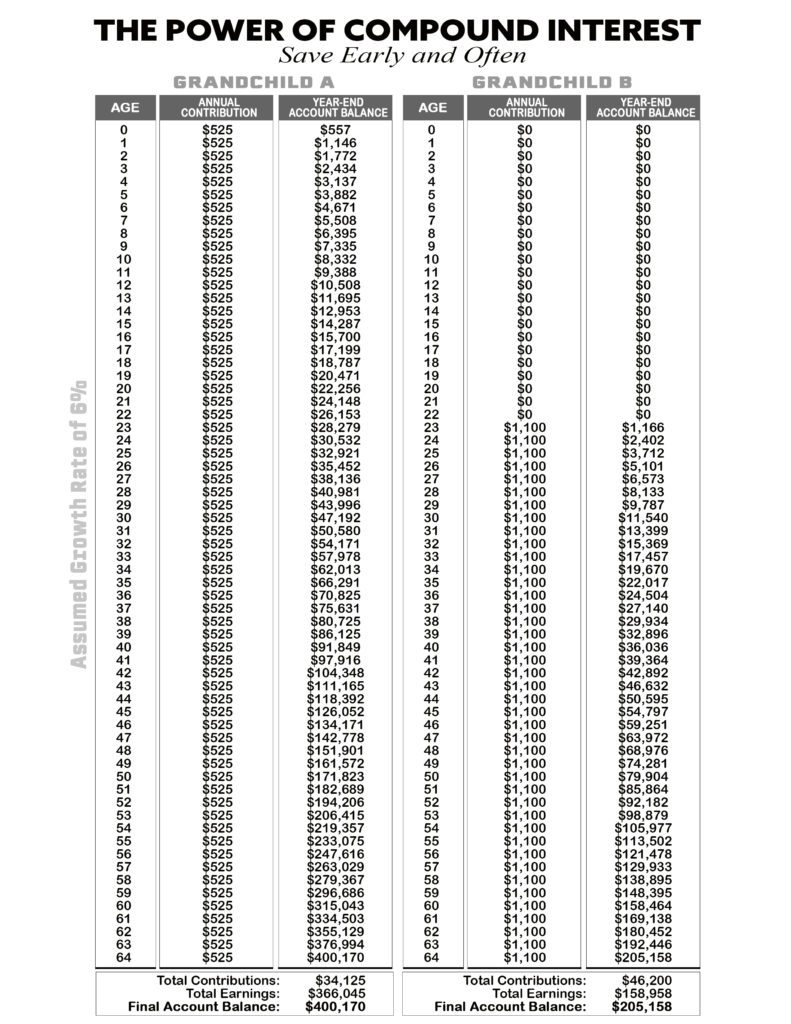

Are you investing like you’re shopping at Walmart? Everyone loves a sale, right? But when it comes to stocks, what’s never surprising to me is how investors run for the hills when prices fall. A few months ago they may have been snapping up shares at full price, but as soon as the rollbacks come, they’re scared to buy even good companies. My hope for you, my valued reader, is to not focus on prices but to focus on income. Prices come and go. Income is forever. I want you to be a compounding machine.

Look at the technology sector. Nasdaq is worth ¾ of what it was at the beginning of the year and basically pays a pittance of a dividend. You can have it.

My focus is on compounding. My concern is, does a particular stock pay a healthy dividend? How healthy is the company? How long has it been paying a dividend? Does it have a solid track record or not? And for how many consecutive years has the dividend been increased? There can be some gold at the end of this rainbow.

Prices are a hope and a prayer. Focus on being paid to be invested in this market. Focus on dividends and reinvest them at lower prices like you’re a Walmart shopper. If you need help focusing your portfolio on dividends, let’s talk.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Gab, MeWe, and Gettr.

P.S. Your Survival Guy loves the fact that the new Ford Mustang is a loud, sock it to ‘em V8 engine. Let it rip!

At Car and Driver, Eric Stafford writes of the new Mustang:

The Dark Horse is an entirely new breed of Mustang, one that shares no bloodlines with historic models. While it’s based on the new seventh-generation V-8–powered Ford Mustang GT, the Dark Horse is more badass out of the box, and it’s bred for racing, with numerous standard performance features and exclusive track-focused options.

Think of the 2024 Ford Mustang Dark Horse as the love child of the outgoing Mach 1 and Shelby variants, neither of which is offered for the redesigned Stang’s inaugural model year. Like the Mach 1 before it, the Dark Horse is the most track-capable Mustang that doesn’t have Shelby badging. It also inherits parts from the Shelby GT350 and GT500, most notably their lightweight carbon-fiber wheels. It’s the first time Ford will offer the exotic rims on a non-Shelby Mustang, and they’ll likely still cost a pretty penny when they become available later in the model year.

Like the regular Mustang GT, the Dark Horse variant is only offered with Ford’s Coyote 5.0-liter V-8. Not only is this the latest generation of the engine, now featuring dual throttle bodies fed by dual air intakes, but the version in the Dark Horse is enhanced even further. It features forged internal components along with connecting rods from the GT500’s 760-hp supercharged 5.2-liter Predator V-8. It produces a projected 500 horsepower, and Ford says the Dark Horse engine is the most powerful naturally aspirated V-8 it has ever built. It pairs with a standard Tremec six-speed manual (GT models use a different Getrag gearbox), and the shifter has a special 3D-printed titanium knob. Ford’s 10-speed automatic is the other option, and both transmissions power the rear wheels through a Torsen limited-slip diff.

Ed Krenz, Mustang chief nameplate engineer, told Car and Driver that Dark Horse as a brand name had been rattling around at Ford for quite some time before it was picked to christen the seventh-generation Mustang. “With the S650, we knew we were going to come out of the gate with a feature car,” said Krenz.

While heritage model names such as Bosses, Bullitts, and Mach 1s were considered, one of the reasons Dark Horse was selected is because it describes the unexpected, which Krenz said played into the company’s assertion that some competitors are leaving the segment while Ford—perhaps surprisingly—has introduced a brand-new Mustang.

If your retirement life includes a Mustang or the love of any car, you might want to come visit Your Survival Guy in Newport, RI. Located here on Aquidneck Island are not one, but two of the coolest car museums in America, not to mention Mr. Motorhead himself, Jay Leno, is often found in town. Catty-corner to my office in Newport sits the Audrain Auto Museum, with access to collections of over 350 cars. Right up the road is the Newport Car Museum, a massive warehouse filled with over 90 amazing cars on permanent display. If you’re planning a trip to Newport, get in touch, and let’s talk.

P.P.S. Are we having fun yet? If you’re with me, and I hope you are, I know you don’t love big swings in the stock market. But, at the end of the day, prices are opinions, and based on the state of the world, opinions are in no shortage in the supply chain.

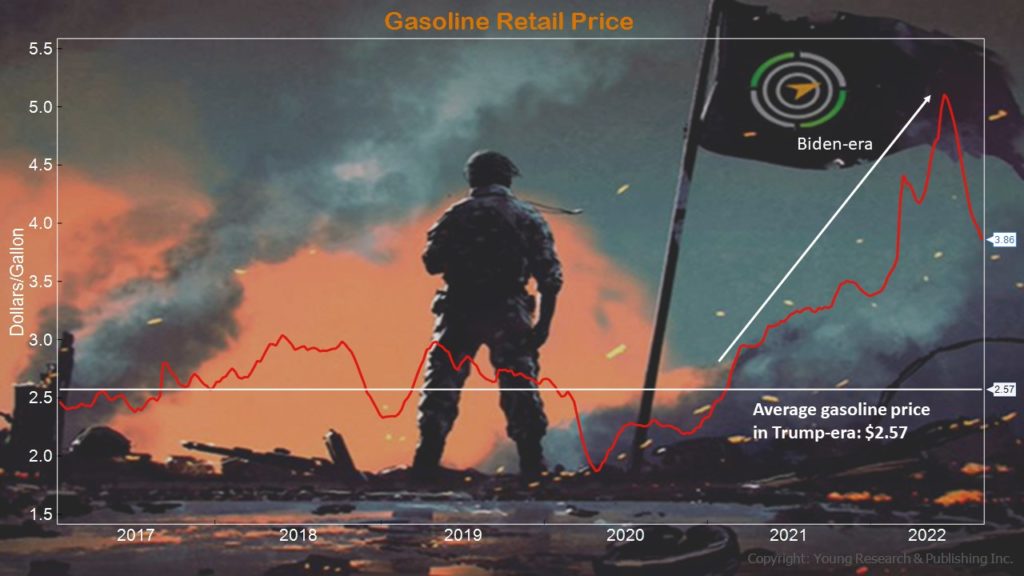

Your Survival Guy’s got quarters in his loafers tryin’ to fight inflation. Inflation at 8.3%? You and I know it’s much higher in many areas of our life. You know that no matter who wins in November, spending in Washington is not going to stop. The executive branch is clearly unhinged from the reality on Main Street, and even a massive electoral defeat will not check their radicalism.

Remember, and this is key; inflation means different things to each and every one of us. When half the country is pushing for more spending, you and I still have control over our own. We can spend less and save more. We can work until we can’t work another hour. We can be methodical in how we invest like it’s the last dollar we have. Your Survival Guy is by your side.

Because when the leader of the free world talks like he lives in a bubble, then some bubbles pop. Prices in real estate and stocks, for example, can come crashing down when mortgages are due, and earnings disappoint.

“When are we going to be getting back to normal?” you ask. In normal times, investing in stocks and bonds is boring. Today, gambling in stocks has become America’s favorite pastime. But fads come and go. Your Survival Guy knows the Prudent Man doctrine is forever.

In the September 2015 issue of Richard C. Young’s Intelligence Report, Dick Young wrote:

The Prudent Man Rule is based on common law stemming from the 1830 Massachusetts court formulation Harvard College v. Amory. The Prudent Man Rule directs trustees “to observe how men of prudence, discretion and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital invested.”

Since I started our family investment management firm in 1989, I have operated under the assumption that the Prudent Man Rule to this day carries as much weight as it did in 1830. Common sense and prudence just don’t go out of style—ever.

Rather than being a gambler, Your Survival Guy wants you to look for good values like you’re a Walmart shopper. Where you’re paid dividends to be invested. I can’t promise it will be easy, but chances are you’ll be rewarded for your patience. I know my life of compounding didn’t happen overnight. If you need help, let’s talk. In the meantime, click here to subscribe to my free Survive & Thrive letter, and get to know me before we talk.

P.P.P.S. Do you remember the 70s? “Like it was yesterday,” you said in my conversation with you.

We were talking about your portfolio and markets and transitioned to Roxbury, Massachusetts of all places, and the Mission Hill neighborhood. I was explaining how, on Tuesday following Labor Day Weekend, Becky and I helped our daughter move to her new apartment where it seems everyone at Northeastern University lives.

I said it’s outrageous what they’re getting for rent in these triple-deckers.

“Funny, you should mention that,” you said. “I lived around the corner when I was at Northeastern a long time ago,” you laughed.

I told him what the rental rates are (triple what he paid based on average wages then and now). Do you remember what you paid for your first apartment?

When thinking about money today it’s no surprise how wrong the so-called experts have been about inflation. “It’s transitory,” they said. “It’s because of Ukraine,” they rail. “It’s Putin’s fault.” And yet all they need to do is look at this chart, and the truth speaks for itself.

The truth of the matter is this: When a dollar ain’t worth a dime, you can’t afford to listen to the ruling class.

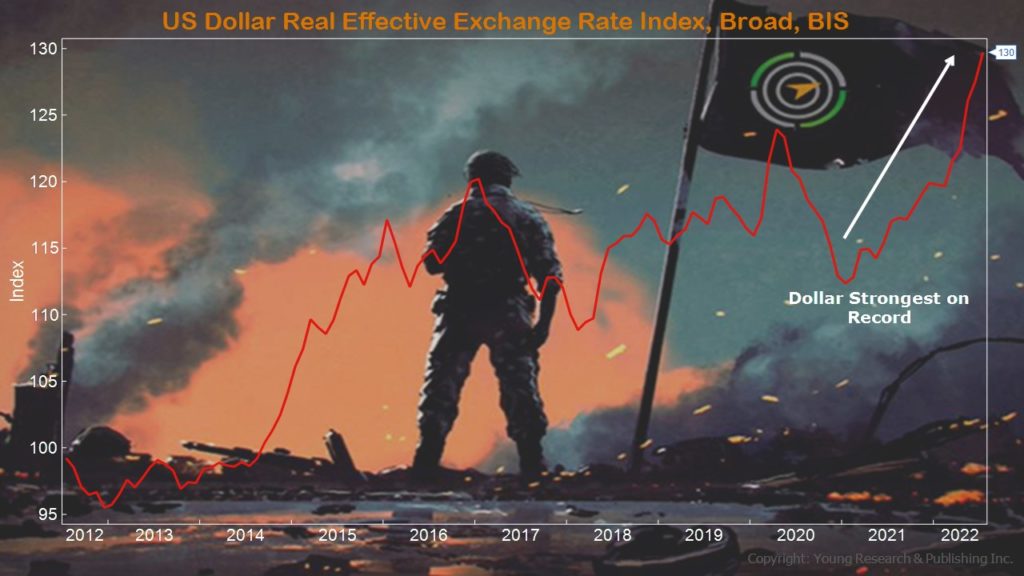

But on a global scale, the US dollar is the best house in a bad neighborhood. Go figure. That’s how bad it is out there in the big bad world.

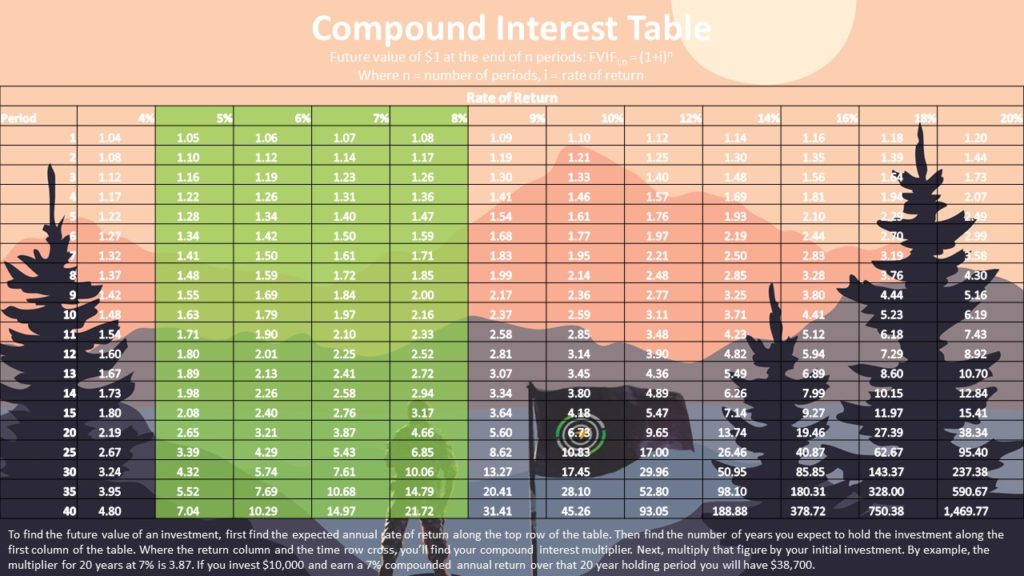

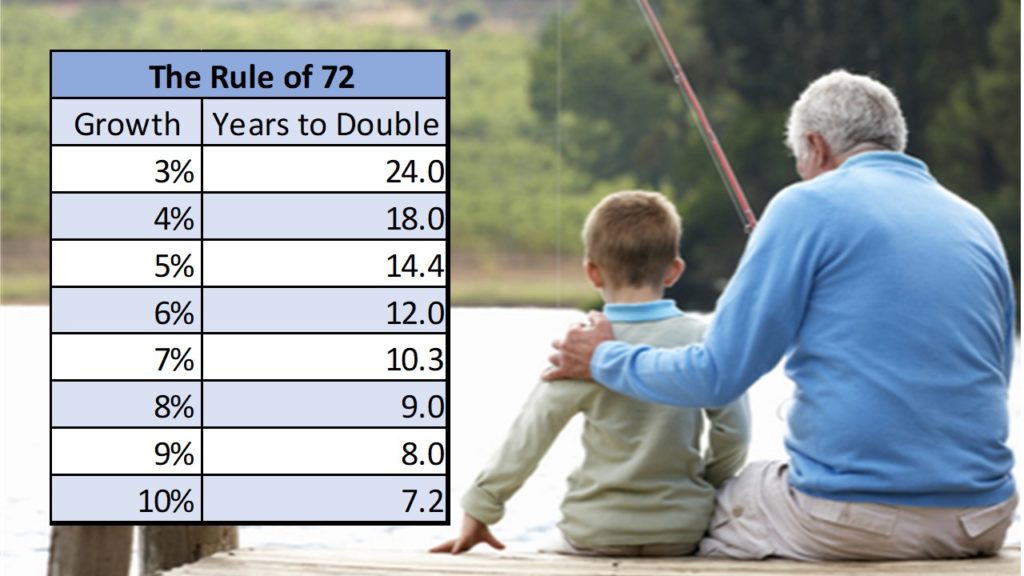

Remember this: Your number one investment, what got you out of bed in the morning working all hours of the day, was a linear event. But your steady growth turned you into a compound machine in your line of expertise.

But your portfolio isn’t linear. Your portfolio is perhaps your best chance yet for geometric growth. It’s called compounding, where you put growth and time to work for you.

Working day to day feels like a linear A to B progression. Investing, however, if you harness time and money, can be geometric—if you allow steady growth to be your friend. Yes, you can go from C to B in rough markets, but you can also go, with time, from C to Z. It’s just a matter of how patient you can be. And if you think 50 years is a long time, remember it literally feels like yesterday. Stick with me. Let’s go.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024