Dear Survivor,

It was pitch black on a recent morning outside Your Survival Guy’s home office. It was blowin’ a gale, and felt like a tree could come down at any moment, and it was raining sideways, with rapid-fire drops rat-a-tat-tatting against my bay windows. Louis was tucked into himself on his dog bed beside my desk. It was a balmy 56 degrees outside—in February for cryin’ out loud—and get this, by nightfall, it was 21 with a chance of snow. Crazy times.

Speaking of crazy, Your Survival Guy hears the craziest investing stories on any given day. Here’s one I received recently from a husband and wife. It begins as they have me on speakerphone, which is never a good way to start an investing conversation, and before I say hello…

“You’re the one that lost us $900 thousand dollars!” she said.

“You’re the one that wouldn’t let me do that Amazon thing, and we missed out on a million bucks!” he said.

“Hi, this is E.J.,” I said.

“Hi CJ, this is Bob and Mary.” “She saw you guys in some magazine and…” Bob said.

“He lost us 900 thousand dollars,” Mary said.

“Listen, let me tell you what happened TJ,” Bob said. “I’m not a rich man. My life has been about work, work, work. Up at five out the door by six. Day after day. Every single day. Every day I’d bring $1 dollar to work and come home with $0.50 cents. Do you know why CJ?”

“No, why?” I asked.

“Because I’d buy a little bag of stinkin’ crackers for lunch every single day. That’s why. Why you ask? To save money. I’m a saver. Not a rich man. I save CJ. Mean-time, my co-workers? They go fancy. They go for the steak and fries, the burgers, the milkshakes, every single day. Every single day CJ. Big spenders. Now? They’re all sick or dead. Terrible health. All of ‘em sick. Sick on medications, this thing, that thing, and you know what? One just dropped dead of a heart attack. You gotta eat right. I eat right, CJ. I take care of myself,” Bob said.

“Not always,” Mary said.

“This is my story, Mary!” Bob said.

“Sorry CJ, where was I?”

“Crackers for lunch.” I said.

“Right. So I’m cheap as hell (Mary agrees), and over a lifetime of work, I saved a couple million bucks. We’re comfortable, CJ. Not fancy. Comfortable. Anyways, I get into this stock options trading, and I’m doing real good, real good, trading the VIX and then boom! Out of nowhere, like a bolt of lightning I’m down 900 thousand dollars. Out of nowhere, CJ. Down almost a million bucks. Now, CJ, I’m not a rich man.”

“Especially not now,” Mary said.

“This is my story!” Bob said.

“I understand,” I said.

“Anyway, CJ, where was I?” Bob said.

“Crackers for lunch,” I said.

“Right, so a couple of weeks ago, I see that UPS thing. You know UPS beat its number CJ. Boom! Earnings are up. Then I see this Omicron thing is not too bad. People are getting a little sick, but they’re not dyin’. OK. I’m thinking Amazon is coming out on Thursday with their earnings. Let’s get in front of this. Let’s buy some options and make the $900 thousand back!”

“It was a bad idea, EJ,” Mary said.

“No, it was not!” Bob said. “Some things are a sure thing,” Bob said. “I just knew it in my gut.”

“CJ, sure enough. Next day. Amazon up big. Bam! We missed out on a million bucks. that would have made our life a lot easier,” Bob said. “We’ve been married 40 years TJ. That would have made life a lot easier.”

“Not that much easier,” Mary said.

“You lost us a million bucks, Mary!” Bob said.

“You lost us $900 thousand ACTUAL dollars, Bob!” Mary said.

“Anyway, CJ, Mary said we need to talk with professionals. You people, you do this all day for a living. I like you guys. Listed in a big-time magazine. Professionals. Mary found you on the internet, online you know, the internet? Said we should call you. What do you think?”

“Eat more crackers.”

The best part of my job is getting to know you—getting to hear the real-life stories every day. Hearing the emotions and working with you on the way forward or back (if you will). You don’t have to become a client right away. I’m glad you’ve signed up for my monthly Survive and Thrive letter, and you’ll get to know me a little better. That way, when you do call, I can focus on the important work of getting to know you.

YOUR INVESTMENT STRONGHOLD: A Moat Around Your Money

Two S&P 500 darlings, Facebook (Meta) and Amazon had quite the week recently. What’s interesting is how so many commentators are saying, “I told you so,” as if predicting the future is easy. I can give you plenty of reasons why it could be tough sledding ahead for Amazon’s stock price. But the low hanging fruit is to pick at the road ahead for Facebook.

Here’s my takeaway, why bother with either when such huge price swings are part of the equation? Because when everyone’s talking about the same stocks, isn’t the secret out? Why not focus on the picks and shovels of this technology gold rush? I’ve always been a fan of dividend paying companies that utilize technology to increase value in their own businesses.

A good back of a napkin example is UPS. There’s a lot of technology in place to make this stock tick. Paul Ziobro writes in The Wall Street Journal:

United Parcel Service Inc. is making more money shipping fewer packages and rewarding investors with a meatier dividend payout.

The delivery company on Tuesday boosted its quarterly dividend by 49%, or 50 cents a share, the largest increase since the company’s public-markets debut in 1999. The planned per-share payout of $1.52 reflects the company’s new policy under Chief Executive Carol Tomé to return half of earnings to shareholders through its dividend.

UPS shares closed Tuesday at a record high of $230.69, up 14% for the day. The company posted fourth-quarter revenue and earnings ahead of analysts’ expectations and said it would reach its long-range revenue and operating-profit targets at the end of this year, instead of in 2023.

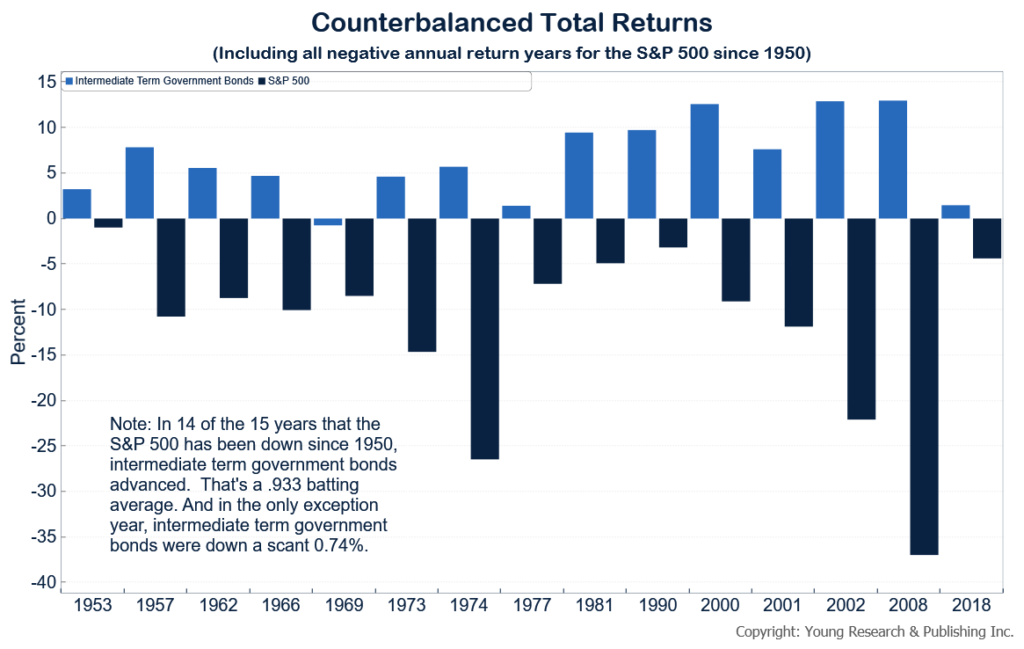

Investing is about building a moat around your money. It’s about creating a margin of safety. You know I always want bonds as a component in your portfolio so you can invest in your stocks with peace of mind.

To me, having too much of your money in a Facebook, for example, where a quarter of your position can be wiped out in a day, is not investing. The same is true about Amazon. Investing is understanding that you need to be just as worried about the downside and get paid in the form of dividends at all times

If you need help building an investment stronghold that includes bonds to build a moat around your money, I would love to talk with you. Until then, get serious about your future and I’ll help you stay motivated to achieve the goals you set for yourself and your family.

INVESTORS: Here’s the Best Way to Beat Inflation

What’s the best way to beat inflation? Own your own business. Get a job. Keep a job. You know basic stuff. Like eating your vegetables. But if you’re retired and have a sizable nest egg, the best approach is to have a basket of Your Survival Guy-type stocks. You know, dividend payers that not only have a history of payments but of increases too. Your proxy for such an approach is Young Research’s Retirement Compounders®. When you’re as rich as Croesus, you don’t need the markets. You can do what Dick Young and Ben Graham advise, which is to run your finger along the allocation mix of between 30-70 and 70-30 of stocks and bonds. This is a stock picker’s market. It’s one that favors Your Survival Guy-type stocks where you get paid to invest.

Don’t Be a FOOL: When Investors Reach for Yield

Quick public service announcement. It’s going to be a busy summer in Newport. Your Survival Guy can sense it. Recently, for example, we went down to the Clarke Cooke House on Bannister’s Wharf for some oysters. It felt like the middle of summer, and it was only mid-February. If you’re planning to visit Newport, make your reservations now.

OK, let’s dig into this. When it comes to investing and personal security, Your Survival Guy looks at risk, first and foremost. As a rule of thumb, I do not base my investment decisions on past performance, and I always look to Dick Young’s North Star for guidance.

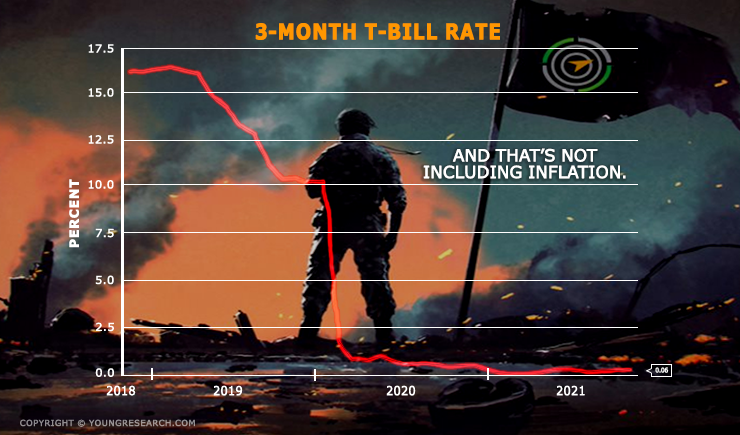

When I see investments yielding many multiples above the risk-free rate of return, I think about risk. Think about real estate, for example. The yield on real estate investment trusts (REITs) is hardly what I’d consider a value, and any private deals offering higher yields scream “no liquidity” to me. The reality, though, is average investors can’t handle one percent on their money. That is until they realize it’s gone, and then it’s a “poor me” sob story and the usual blame game.

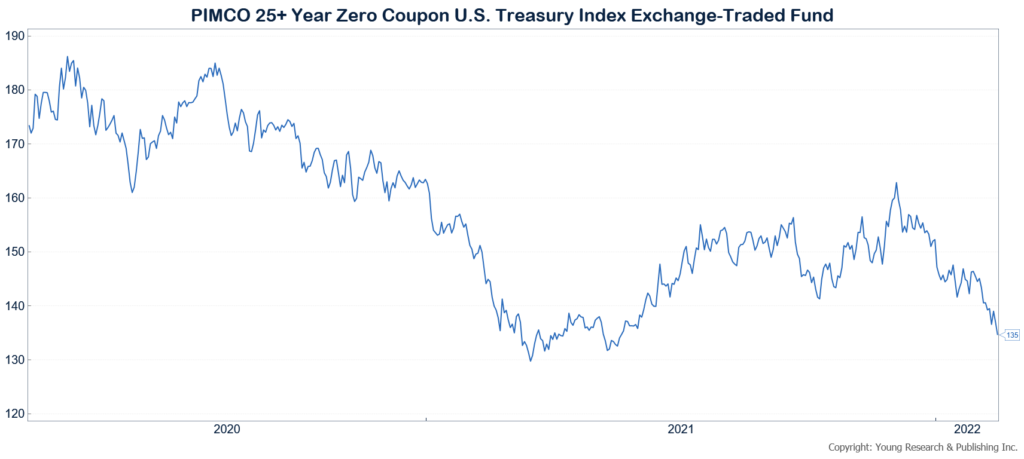

Take a look at the chart below. This is what happens when investors reach for yield. This is an example of the PIMCO 25+ year Zeros ETF. It’s down 27% from its April 2020 high. At current long-term interest rates, it would take about 15 years of compounding to break even. That’s a stock market-like dry spell.

Retiring in Biden’s America Means Accepting Some Hard Truths

OK, it’s not pretty out there. You’re living your life. Everything is expensive. Talk about sticker shock. When filling up your car is enough to make you fall over at the pump—never mind the price of everything else in your life—inflation is real. Forget the 7.5% headline inflation. That doesn’t do justice to what you and I are paying in our own lives. In my conversations with you, for example, you’re telling me that the cost for shipping containers is up 300%, to be kind, and as much as 500% when all costs are included—not 7.5%. And yet the Biden admin talks to you like it’s transitory. It’s not transitory when you keep paying higher prices for months on end.

Retirees are worried, and rightly so. How can they fight inflation when interest rates are nailed to the floor and the prospects of higher rates—you know, ones you can sink your teeth, or savings, into—are waaaay off somewhere in the distance? Growth stocks have been hammered, and money is leaving bond funds to go into value stocks. That is not a Survival Guy strategy. I love dividend-paying stocks but not with my bond money. Investors need to wake up and invest their savings as if each dollar is the last one they ever earn. Period. They need to realize we’re living in a one-percent world.

Take a look at this article below, and you quickly realize the lack of retirement savings for most retirees. You have to take your savings seriously. There’s no other way around it. And you can’t hope the markets will do something for you. It’s about keeping what you’ve made.

NPR’s Chris Arnold reports:

Susan DeFrance retired two years ago when the truck manufacturing company she worked for phased out her division.

“I was pushed into my retirement,” says DeFrance, who’s 66. “So it’s really very scary.”

She’s nervous because she felt just on the edge of having squirreled away enough in her life savings. And now, she’s afraid that money isn’t going to last.

“I am very worried about that,” she says. “Milk has gone up like $2 a gallon … and gasoline.”

To cut expenses, DeFrance sold her house in New Jersey and moved to a mobile home park in Delaware, where the taxes are almost nothing. Her one modest splurge in retirement: a used power boat. The park is on a canal near the ocean and has a dock.

“I bought the boat outright,” she says. “To make sure my boys come and visit me.”

DeFrance is trying to live much more cheaply than she used to, on just $40,000 a year. But even so, she’s anxious about outliving her savings. Her eldest son says if it came to it, she could squeeze in with his family.

“They’re willing to make these sacrifices for me that I’m not willing to accept,” she says. “So hopefully, you know, I won’t last to be 100 years old.” She jokes that maybe “a nice boating accident” will take care of the problem and laughs.

But she says she really does worry. What if inflation keeps going crazy, interest rates go way up, the stock market crashes and wipes out more of her savings?

“I have a hard time getting to sleep sometimes because all of those things run through my head,” DeFrance says.

Many retirees are nervous about the same thing. Inflation is higher than it has been since the 1980s. The higher inflation rate could come back down pretty quickly or be something longer term and more damaging.

There’s a way forward for you. I want you to have the retirement you deserve. But it’s going to take some hard truths. I want you to get to know me here at Your Survival Guy, so if we do speak, you’ll have a feeling for who I am. We’re in this together. But only if you’re serious.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Gab, MeWe, and Gettr.

P.S. OK, Your Survival Guy awoke with a start recently as our bedroom fan stopped turning—the silence deafening—the normal steady cadence, like crashing waves, is usually the background noise dreams are made of. But when it stops, something’s wrong. “What was that droning sound?” I wondered. Military choppers doing a predawn exercise at First Beach? The Coast Guard performing a near-shore rescue? No, just the neighborhood generators. That could mean only one thing—no power. This is no way to start the day.

As Your Survival Guy was getting dressed in the dark, I thought this would be a good morning to do a dry run to see how life is without power. I was greeted by our dog Louis, doing a downward dog stretch that would make any yogi jealous—ready to go downstairs. Ahhhh, about those stairs. They’re wood. There’s no rug or runner, and not too long ago, Louis slipped and slid down them like a one dog luger going for gold. Now, Your Survival Guy carries him down the stairs every morning because he’s psyched himself out, or he simply likes the first-class service. The exception is when he’s upstairs, and UPS/FedEx/USPS arrives, then he’s down the stairs in double time. Who’s being played here?

Down the dark stair hall we go as Your Survival Guy thinks, “Self, why did you not think this was an important part of the house to have lit up in a power outage?” Sure I could use a flashlight, but good luck trying to find one. But, really, I never thought I’d be carrying a 35-pound labradoodle. Which brings me to another recent trend, Louis was wet, the result of a recently acquired habit of doing an entire days’ worth of drinking water after dinner and before bed. Hmmmm, take the water away? Sounds cruel. And the sound of him licking his chops all night from thirst is not tolerable for sleeping.

That morning was a dry run for surviving without power. And, I’ll admit another Survival Guy tick. When the generator’s roaring away, I don’t like using the lights. Call it karma. I feel like it’s time to use candles. I want to shine a spotlight on my deficiencies in case the natural gas kicks off on the coldest day of the year, and there’s no generator. Luckily my kitchen island looks like the candle display at a Christmas Tree Shop. Matches? Note to self: Put back my Scripto lighter near the fireplace that everyone knows not to touch or move. Ever.

Coffee? OK, it’s fun to play pretend, but that outlet’s on the genny, and the coffee’s almost ready. And yes, a couple of taps of my iPhone and the National Grid app shows about 2,000 other homes and businesses are out of power with an estimated restoration time of 7:30 am. And then, poof, power is restored ahead of schedule. Just another morning in the life of Your Survival Guy. And Louis? He’s bathed and ready for the day as if nothing happened.

Join me in the endless task of preparation, whether it’s with your emergency prep Navy SEAL Survival Kit or your retirement investments. Emergencies are a part of life, and unfortunately, too many are manmade.

P.P.S. The CDC has massive amounts of COVID-19 vaccination data that it will not publish. According to the reporting, the CDC isn’t sharing the information because it may be interpreted in ways that counter their narrative. That’s the story from the New York Times’ Apoorva Mandavilli who writes:

For more than a year, the Centers for Disease Control and Prevention has collected data on hospitalizations for Covid-19 in the United States and broken it down by age, race and vaccination status. But it has not made most of the information public.

When the C.D.C. published the first significant data on the effectiveness of boosters in adults younger than 65 two weeks ago, it left out the numbers for a huge portion of that population: 18- to 49-year-olds, the group least likely to benefit from extra shots, because the first two doses already left them well-protected.

The agency recently debuted a dashboard of wastewater data on its website that will be updated daily and might provide early signals of an oncoming surge of Covid cases. Some states and localities had been sharing wastewater information with the agency since the start of the pandemic, but it had never before released those findings.

Two full years into the pandemic, the agency leading the country’s response to the public health emergency has published only a tiny fraction of the data it has collected, several people familiar with the data said.

Much of the withheld information could help state and local health officials better target their efforts to bring the virus under control. Detailed, timely data on hospitalizations by age and race would help health officials identify and help the populations at highest risk. Information on hospitalizations and death by age and vaccination status would have helped inform whether healthy adults needed booster shots. And wastewater surveillance across the nation would spot outbreaks and emerging variants early.

Without the booster data for 18- to 49-year-olds, the outside experts whom federal health agencies look to for advice had to rely on numbers from Israel to make their recommendations on the shots.

Kristen Nordlund, a spokeswoman for the C.D.C., said the agency has been slow to release the different streams of data “because basically, at the end of the day, it’s not yet ready for prime time.” She said the agency’s “priority when gathering any data is to ensure that it’s accurate and actionable.”

Another reason is fear that the information might be misinterpreted, Ms. Nordlund said.

It’s never a good sign for freedom when politicians hide damaging information from the people. Make sure you live where politicians treat you with respect. Find your home for freedom in my Super States.

P.P.P.S. You read in November about Biden’s backdoor gun registry scheme. But now it has been revealed just how extensive the database is. According to The Washington Free Beacon, the Biden ATF registry contains records on nearly one billion firearms transfers. Adam Kredo reports:

The Biden administration is in possession of nearly one billion records detailing American citizens’ firearm purchases, far more than Congress and the public has been aware of, according to new information from the Bureau of Alcohol, Tobacco, Firearms, and Explosives obtained by the Washington Free Beacon.

The ATF disclosed to lawmakers that it manages a database of 920,664,765 firearm purchase records, including both digital and hard copy versions of these transactions. When a licensed gun store goes out of business, its private records detailing gun transactions become ATF property and are stored at a federal site in West Virginia. The practice has contributed to the fears of gun advocacy groups and Second Amendment champions in Congress that the federal government is creating a national database of gun owners, which violates longstanding federal statutes.

Rep. Michael Cloud (R., Texas), who led an investigation into the ATF database following a November Free Beacon report that the Biden administration had stockpiled records of more than 54 million gun transactions in 2021, expressed shock at the number of gun records being kept by the federal government. Cloud maintains that the ATF’s database could be exploited by the Biden administration to surveil American gun owners as it pursues new restrictions on firearms.

“A federal firearm registry is explicitly banned by law. Yet, the Biden administration is again circumventing Congress and enabling the notably corrupt ATF to manage a database of nearly a billion gun transfer records,” Cloud told the Free Beacon. “Under the president’s watch, the ATF has increased surveillance on American gun owners at an abhorrent level. The Biden administration continues to empower criminals and foreign nationals while threatening the rights of law-abiding Americans. It’s shameful and this administration should reconsider its continued attacks on American gun owners.”

While the ATF denies that these records are used to track gun owners, it transfers hard copies of the information into a searchable digital database that it says is used to trace firearms tied to crimes. The ATF reported that 865,787,086 of the records are already in a digital format.

As the ATF stockpiles gun records, the Biden administration is seeking to alter a federal law that allows gun stores to destroy their records after 20 years, preventing the federal government from getting them. The Biden administration wants gun stores to maintain their records in perpetuity, meaning that when a store closes, the ATF receives all of its records. The ATF’s gun records database has long been a flashpoint between Second Amendment advocates and the federal government, with the latter claiming the ATF is exploiting legal loopholes to expand the database. The Biden administration’s push to ensure that all out-of-business records ultimately make their way to the ATF has sparked fierce pushback from 52 Republicans in Congress.

The article concludes: “Make no mistake—this is clear evidence that a partial national gun registry exists,” Johnston said. “If the American people don’t stand up for their rights now, Biden’s anti-gun ATF will be able to track gun owners, infringe on our rights, and potentially even confiscate our firearms.”

You need to prepare yourself to defend your family. That means getting your gun and your training now. Do it in a state where politicians value your right to self defense, like one of my Super States.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024