Dear Survivor,

You, my fairly wealthy, highly successful reader, learned a long time ago how to harness a most powerful force: t-i-m-e. You saved ‘til it hurt and put money away with the faith that you might be in a better spot down the road.

And now, when you look back on it all, you think, “No way I want to do that again. Not sure how I even did it. Can we change the subject?” Don’t worry, I won’t tell anyone.

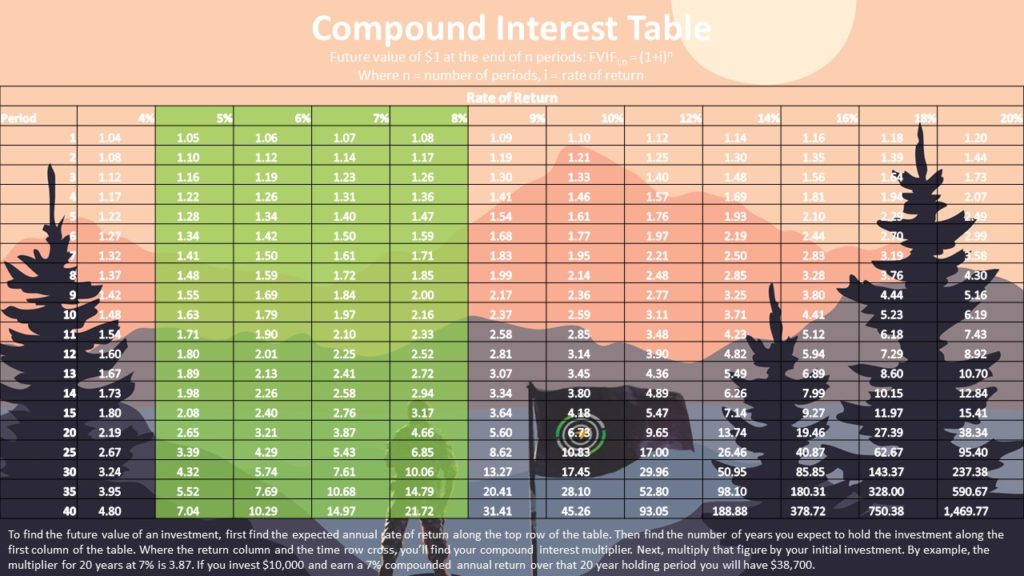

But saving ‘til it hurts does something magical. It puts the most powerful force into action. You put time on your side. You become a compounding machine, and without even knowing the miracle of the math involved, you’re pretty well off. You paid yourself first, and if there was some left over fine, but you got so used to saving, you didn’t even spend that. Nice.

But here’s the hard part: Once you retire and start living off your cornucopia of savings, it’s human nature to feel uneasy. There’s no more lifeline. No more paychecks to refill the bucket from losses in areas like AI. The tide rolls in, it rolls out, and father time keeps ticking.

The other night, Your Survival Guy was with friends and family sitting around a fire pit when someone asked another guest how old she was (never a good idea).

“38?” he asked.

“Ha! You’re funny,” she said. “I rounded that mark a long time ago.”

Which got us talking about how, in our minds, we never really feel older than our thirties or forties, but our bodies never let us forget. The younger generation in attendance never looked up from their phones. If they were listening, I’m sure they were thinking, “38’s old.”

When the commodity of time is no longer in abundance, it’s not always easy to recognize. That’s the mystery of it all. One way to solve it is to look at your largest financial position and do the mental math of the hours you would have had to work in your prime to replace it. That’s probably a long time.

Your Survival Guy rounded 50-years old not too long ago. I learned a long time ago investing isn’t about making you a Rich Man. It’s about keeping you as one.

It Can Be Done, But to Be Done Right Takes Time

I want to share a couple conversations I had this week. One was with a client who’s been with us for 25 years. “We just decided we couldn’t do two big jobs at once,” she said. “It can be done, I guess, but to be done right, it takes time.” All these years later, I remember sitting with her and her husband, along with their son, here in Newport, RI. They wanted their son to understand the process of finding a wealth manager. Ironically, he retired last week. Time flies.

In another conversation, a client told me some guy called him last week with a promise to double his income. Thankfully, my client said no. But it’s a reminder of how easy it is for others to tell you the grass is greener. There’s no skin in the game. What do they have to lose? You’re the one who’s taking all the risks. The current gravity for interest rates is a lot higher than it has been, but let’s not get crazy.

There Is No Miracle More Powerful than This

If you want to get a bird’s eye view of how hard your money works, spend a few minutes reviewing my piece Rich Grandchild, Poor Grandchild. When you start saving early, good things can happen. It’s probably why you’re able to invest today for the retirement you deserve.

Accumulating money is work. Literally. You get up every day and do it. You go to work and save ‘til it hurts. Investing money in retirement is a different kind of work. You get up every day and wonder what it’s done for you lately. The reason Your Survival Guy recommends living below your means is because it gives your money a longer life span.

Giving money a longer life—the gift of time—is an act of love. There is no other miracle more powerful than harnessing the power of time to compound your money. A simple concept, but hard to do.

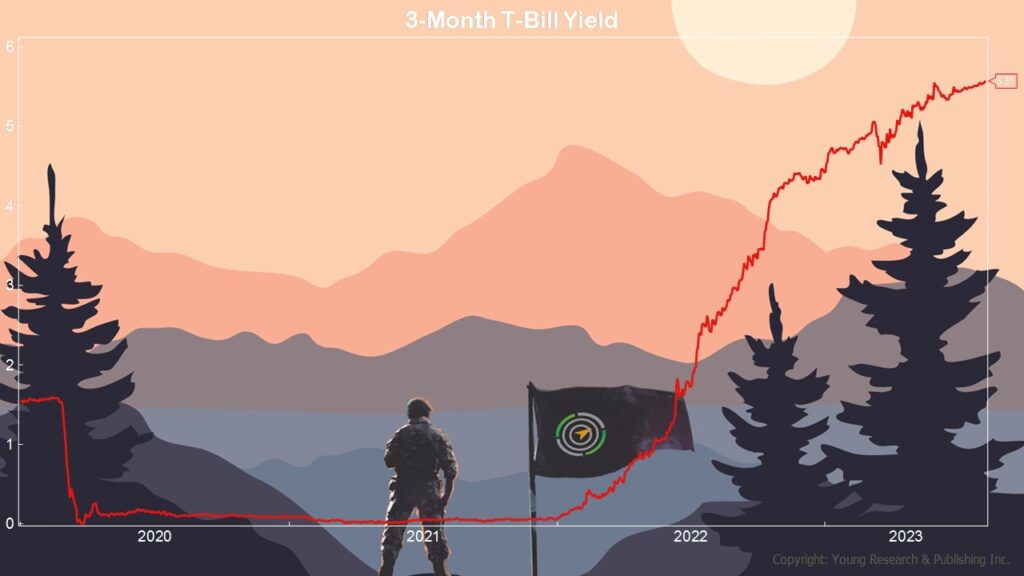

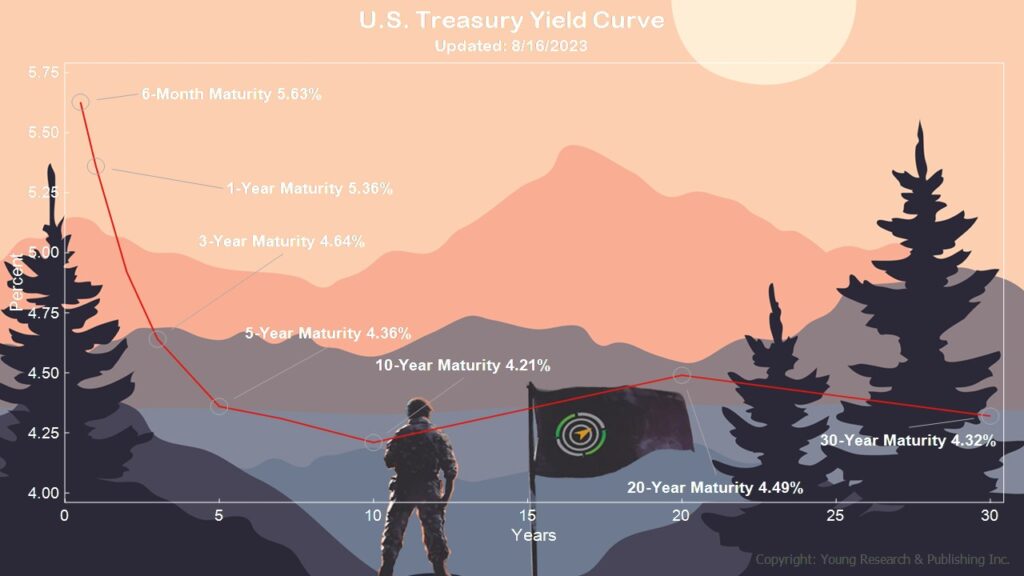

With yields like these you can see how the power of compounding is right in front of you.

Don’t Get Caught Up on Prices, Do This

When market prices float through space, it’s worthwhile remembering this: prices are a qualitative measure, not quantitative. Prices are opinions. Everyone’s got one. They can change with the wind.

But, stock dividends, for example, they’re quantitative. They’re tangible. You can see them enter your account if you pay attention. Trading stocks—a zero-sum game—is not investing. That’s speculation. With most of the world focusing on prices, why wouldn’t you focus on dividends?

We learn at a young age how to make money. How to save. But at some point, after they’ve accumulated a pile of money, some investors begin to treat it like it’s a game. Investing isn’t a game. It’s hard work. It’s a daunting task, even when done well. Anyone can buy stocks. Creating and maintaining wealth when you’re no longer working? That’s not an easy task.

It never ceases to amaze me how investors will load up on one stock—not realizing that their life depends on it. I advise doing the mental math of how many hours of work it would take to replace your largest stock position.

Show me the money. That’s what I like for you, my valued reader. Because cold hard cash gives you laser-like focus on the quantitative, such as: Income. What amount of income, for example, can your pile of money create for you? How can your pile of cash work for you and not be a lazy bum? Let’s not lose sight of how attractive bonds are. Don’t get caught up on the prices. Focus on income. If you need help building a portfolio that focuses on income, let’s talk.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. You are my hero. Not Mr. Market. You invested or saved your first dollar for no other reason than survival—self-protection. I know this because I’m Your Survival Guy. You tell me your stories, and I listen. Rare is the occasion where you went from rags to riches by trading stocks. No, you worked for it.

Your story is one where your back was against the wall, and you needed to survive. You wanted a better life. You needed to raise your family. The part where you thrived came later, often much later. You appreciate what you have now because you know how hard it was to get. “I don’t want to do that again,” you think.

You realize the pain and suffering it took to get to where you are might not be repeatable. You don’t want to start over. And thinking about “investing”—doubling or even tripling your money—fills the mind. On whose dime? Mr. Market doesn’t care about dreams.

When an individual makes enough money—where survival is no longer an issue, the pressure is off. The birds are singing, and the flowers smell nice. And the thinking about money shifts. It’s no longer about survival, it’s about how much easier “my” life could be if… and hope fills the air. But Mr. Market isn’t concerned about your hopes or with making your dreams come true. He’s just Mr. Market.

P.P.S. The U.S. 30-year bond yield is the highest it’s been since 2011, and globally, government bond yields are at 15-year highs. Garfield Reynolds and Michael Mackenzie report in Bloomberg:

Global government bond yields extended their climb — with the US 30-year reaching the highest point since 2011 and other benchmarks returning to 2008 levels — as resilient economic data challenges the view that central banks rates are peaking.

In early US trading Thursday the 30-year Treasury yield rose as much as seven basis points to 4.42%, slightly exceeding last year’s high. It was below 4% as recently as July 31. The US 10-year yield approached 4.31%, within a few basis points of its 2022 peak. The equivalent UK yield jumped to a 15-year high, while its German counterpart approached the highest since 2011.

Treasuries have led the global debt selloff as the US economy defies expectations that more than five percentage points of Federal Reserve interest-rate hikes would cause a recession. Officials at the last policy meeting remained concerned that inflation would fail to recede, requiring further rate increases, minutes of the meeting released Wednesday showed.

Finally, some yields you can sink your teeth into.

P.P.P.S. Recently, I was asked about robo-advisors: You set up an account with a low minimum, answer a questionnaire, and an algorithm invests you in a basket of mutual funds, ETFs, and/or stocks.

The robos save money on phone reps, have a big marketing spend, and a neat-looking website.

But what if there’s a problem? A couple of years ago, when stocks were down 1,600 points, Bloomberg reported that the websites of robo-advisers Wealthfront Inc. and Betterment crashed. This is one of the MANY reasons robo-advisors will NEVER work for investors–NEVER. What a SHAM.

Also, it’s been my experience that investors want regular conversations about their life savings, especially when they’ve made money over a lifetime, and it would take another one to replace the losses.

Losing $500 on a company like Shopify might be a cheap education to help a young saver seek out a diversified portfolio with the help of a robot.

Investing your life savings for and during retirement might require a more personal touch, especially when you have a lot more to lose than money.

New problems with robo-advisers are being uncovered. The SEC is working to limit the conflicts of interest it sees arising in the robo-adviser industry. Lawyers Sandra Dawn Grannum, Jamie L. Helman, and Justin Ginter of Faegre Drinker write of the SEC’s concerns about robo-advisers:

One area of concern is the recent proliferation of robo-advisors and mobile apps that use them. For example, SEC Chair Gary Gensler specifically expressed concern about the conflict of interest that arises between investors and robo-advisor brokerage apps, stating “Artificial intelligence has complexity. But you have a basic, high-level strategic question: Are you optimizing just for investors, or are you optimizing also for the robo-advisor brokerage app? That’s a straight-up conflict.”

In other words, are the robo-advisers working for you? Or for themselves?

When you want to talk to a real human with decades of experience in the investment business, I’m here.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024