Dear Survivor,

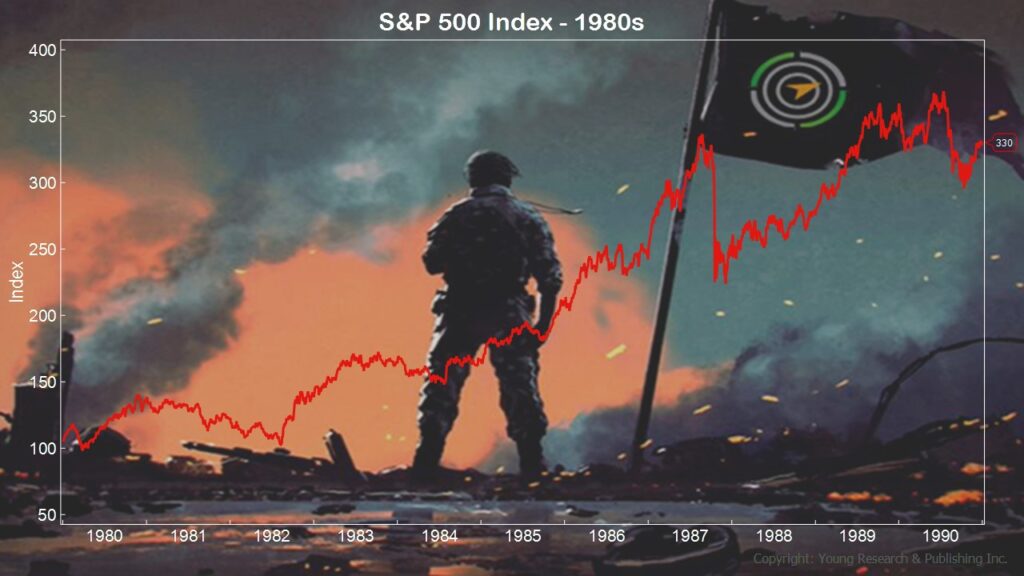

When you look at the long-term advance of stocks over the past four decades, an observation worth noting: It was good to be 24 in 84. Meaning if you were young and hungry and happened to work on Wall Street, the world was your oyster. Until it wasn’t.

Risk was rewarded, and a fair amount of luck was involved, disguised as skill. Not that these weren’t wicked smart people like Mike Milken, for example, the father of junk bonds. Because it was Milken who showed corporate raider Saul Steinberg how to storm Walt Disney’s castle with high-yield debt. Steinberg, like Captain Hook, had a boatload of treasure and eyed Disney’s undervalued stock as an easy target.

But it didn’t go as planned.

Steinberg opened up a saga worthy of Peter Pan where instead of a company sold off in pieces, we still have a theme park in Florida and a company once again with a stock price looking like it’s back to the future.

Your Survival Guy reread the saga this summer, Storming the Magic Kingdom: Wall Street, The Raiders, and the Battle for Disney by John Taylor, and one section that stood out above all others had nothing to do with the takeover drama. It had to do with a former rock and roll band promoter who was now working in high finance on Wall Street. “How did that happen?” I thought. He said he needed to be where the action was, and rock and roll had nothing on Wall Street.

Makes my skin crawl.

And history repeats.

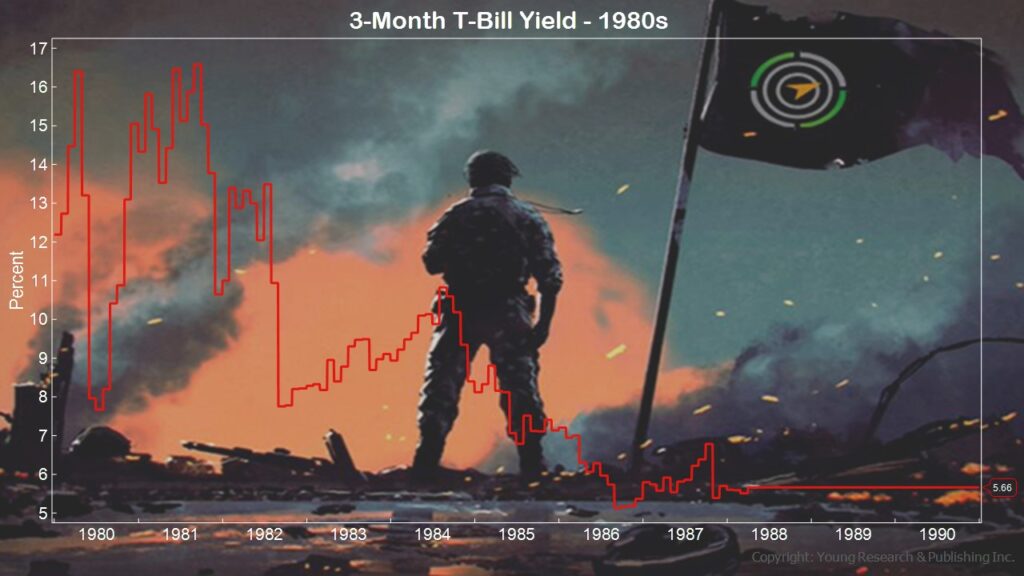

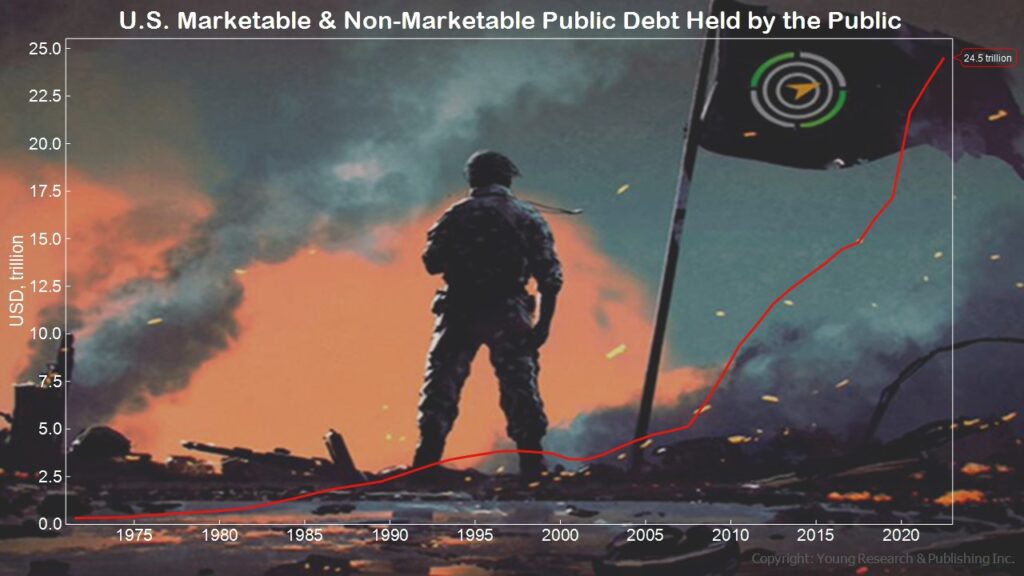

Today, with easy money gone and the rockers and rollers back in the studio, they complain interest rates are too high. Gone are the inflated meme stocks and cryptocurrencies.

Look at interest rates and debt, and tell me what the catalyst for price increases will be. The fun may be over.

Markets are a boom-and-bust fantasyland. Risk is never recognized until after the bust and is invisible during it. Pay attention.

Your Survival Guy is always focused on risk—the return of assets, not the return on assets. Not everyone escaped the 80s unscathed (even if they were in the right).

Build a Margin of Safety Around Yourself and Family

You don’t need to look too hard to realize bad stuff happens. The disaster in Israel is one. How does this happen? In a world where access to money has never been easier, we’re living with risks impossible to see. The U.S. isn’t helping.

When you look inside the dealings of failed crypto exchange FTX and founder Sam Bankman-Fried, you see billions of dollars in the hands of so-called altruists. SBF was surrounded by idealists like himself, trying to make the world a better place. Instead, they helped separate people from their money faster than anything we’ve seen in recent times, never mind the money tucked away by bad actors looking to hide it for their evil doings.

Too much money. Too much power in the hands of those who think they know what’s good for you. Overlords who use their power for what turns out to be nothing good.

It’s like what we’re seeing in big blue blob cities with no accountability for crimes committed.

Pay attention to what’s happening. There’s never been a more pressing time to build a margin of safety around yourself and your family.

Life: When Others Resent You for Your Success

Let’s not beat around the bush. I’m Your Survival Guy, not Your Get Rich Quick Guy. I’m interested in helping the highly successful, fairly wealthy among you get through tough times with the peace of mind you deserve. My focus is mostly on navigating Your Retirement Life, the times when you want to enjoy your life’s work; living off your savings, not draining the bank, and doing what you have always wanted to do.

Ahhh, the savings. I can’t do that part for you. That’s the heavy lifting that’s up to you. The showing up every day and getting the job done. Because the act of saving is just that, an action, and not everyone’s disciplined enough to do it. And to be clear, your success, unfortunately, is not met with the respect it deserves. I know how hard you worked. But it’s not cool when others resent you for your success. Quite frankly, it’s none of their business. Mr. and Mrs. Nosy always seem to know what’s best with other people’s money.

I work with savers like you. I work with savers I like speaking with. I work with you because I enjoy your stories, how you got to where you are, hearing about your family, your trips, what you did last weekend, and what your plan is for this one. That’s what makes life interesting. Living an interesting life is hard to do. It takes effort. It’s not about just sitting around on your phone or cruising social media to see what the Joneses are up to. It’s about creating. Once again, a little bit of work in your life goes a long way.

I don’t like speaking with those who are needy. Those who need the market to do something for them. That person is focused on prices. Prices are qualitative. Prices are opinions. Opinions change. Cold hard cash is tangible. Never mind what the market’s going to do or not. The needy investor doesn’t understand this. He doesn’t understand the virtue of investing for income. The needy investor has a spending problem.

“Stocks Always Come Back,” They Say

“Stocks always come back,” they say. “Just look at the history of the markets.”

OK, thinks Your Survival Guy. Let’s.

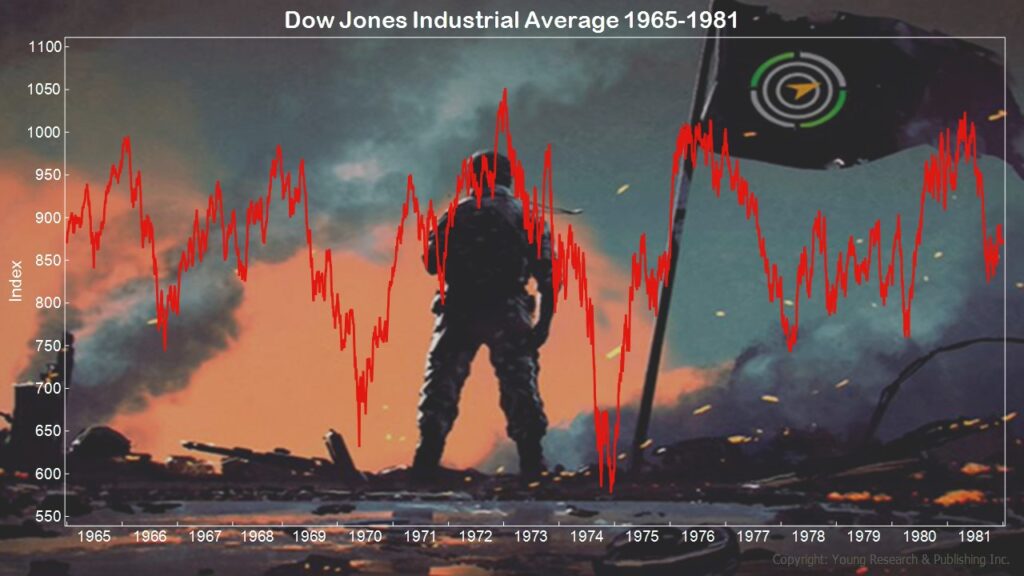

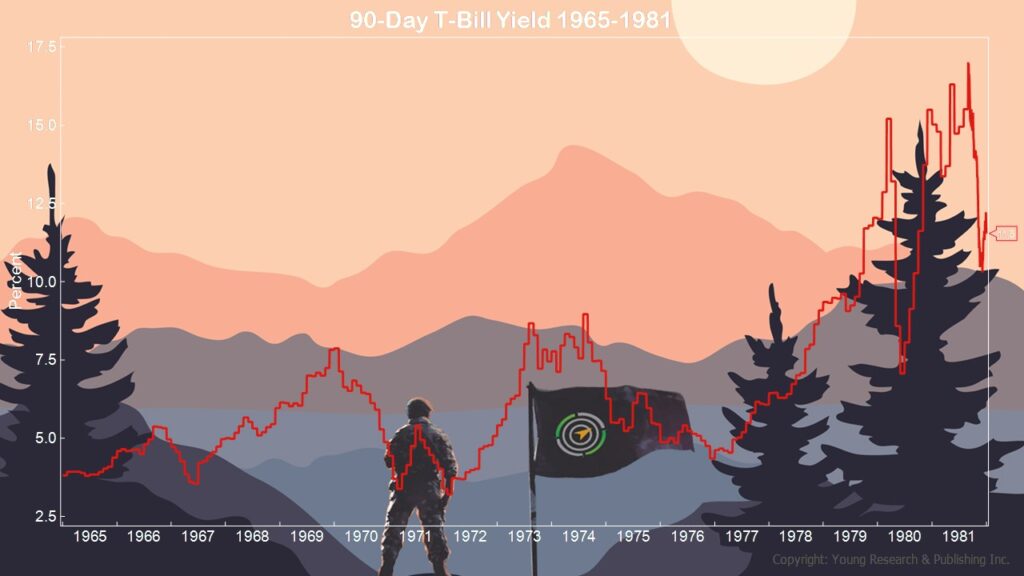

Take a look at how markets did from 1965 through the 70’s, a time not unlike today, where inflation soared, the country was in decline, and stocks did basically nothing good.

That’s a long time for markets to do nothing—a good chunk of retirement for those who were retired. That’s why building a margin of safety is so important for the retired investor. You need to have a line of defense in case stocks don’t save the day. You need to understand risk and know that it’s real, especially in times like these.

When constructing a portfolio for your retirement life, Your Survival Guy first and foremost looks for a stream of fixed income. You’re seeing a generational buying opportunity today, but remember there are two risks with bonds: default and/or maturity. I think we all know what default risk means and maturity risk—how long you need to wait for the bond to mature if it’s underwater and how different the world will be at that point. Everyone thinks they’re a patient, seasoned investor until they see prices go down.

It’s hard to be patient through thick and thin. Be careful with your money and do what is comfortable for you, not anyone else.

Your Survival Guy doesn’t buy stocks, hoping they’ll go up. No, I look at the income from dividends and the historical dividend increases. I want to see the money coming in. I want something tangible, not some pie-in-the-sky valuation based on overvalued prices.

Action Line: Much of retirement investing is about living to fight another day. Focusing on income, for example, is how I feel most comfortable. If you think you might too, then let’s talk.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. Thought you’d like this piece on tinned fish from the Projo.

If you want to know everything about tinned fish, you ask Michael Benevides, whose family has been running Fall River’s Portugalia Marketplace for 35 years.

He’ll tell you about the fish stars of the industry, restaurants featuring it, factories to tour in Portugal, the role of TikTok and social media influencers fueling the popularity, and how this trend caught everyone by surprise.

Benevides said Portugalia has been selling the cans of tinned sardines, mackerel and tuna for decades.

“It’s bizarre now to hear about tin fish date nights,” he said. “It’s quite the thing. Honestly we’ve been experiencing it for a few years. But over the past year, it’s gone crazy.”

Not only does Benevides have a sense of the why for this trend, he’s got Portugalia hopping on board to ride the train. Think curated tinned fish boxes.

What is tinned fish and why should you give it a try?

Some call them curated tins of fish. Maybe your Mom or Grandma called it tuna or sardines.

In Portugal and Spain, they are called conservas, described as freshly-tinned fish and shellfish, preserved in a liquid. Sardines, tuna and mackerel filets are the most common, packed in olive oil. Some are sold intact and others as filets. Other seafood including octopus and squid are also canned and can be flavored with pickles or peppers.

“It’s the perfect pantry staple,” said Benevides. “Each can has a five-year shelf life.”

There’s no cooking required. Open the can and they are ready to eat.

Canned food like tinned fish makes great emergency food for storage. Read more about emergency food you might actually enjoy eating here. And download my free special report FOOD SHORTAGE: Crazed Hoarding Is not Preparing.

P.P.S. Illinois has banned so-called “assault weapons” but grandfathered in those already owned by residents. Now, the window is open to register the guns, and it will be interesting to see how Illinois gun owners respond. The common refrain from many gun owners is that “registration is the first step to confiscation.” They are understandably wary of telling an overtly anti-gun Illinois legislature and governor exactly where to find all the firearms in the state. Craig Wall reports for ABC7:

When the state banned the sale of assault-style weapons earlier this year, it allowed those who already owned them to keep those weapons, with the requirement that starting Oct. 1, the so-called legacy weapons had to be registered with the Illinois State Police.

“I’m counting on people to continue to act the way they do with our FOID law, which is a voluntary compliance, because if they don’t, they run the risk of a crime and imprisonment,” said bill sponsor and State Rep. Bob Morgan, D-Highwood.

The registration requirement is part of the Protect Illinois Communities Act, which was passed in response to the mass shooting in Highland Park. Gov. JB Pritzker signed it into law in January.

Gun rights groups are challenging the law in state and federal court, and say it really has no teeth, so people will refuse to comply.

“To gun owners, registering our firearms, make, model, serial number, caliber, is akin to giving the state government access to our medical records. And we’re not, for lots of them, we’re not going to do it,” former NRA lobbyist Todd Vandermyde.

P.P.P.S. Scientists and governments across the globe recognize the dangers of a solar storm, and they are working on a warning system that could sound the alarm in the face of any impending catastrophe. Christopher Mims explains the dangers of solar storms and the efforts to combat them in The Wall Street Journal, writing:

One day, you wake up, and the power is out. You try to get information on your phone, and you have no internet access. Gradually you discover millions of people across the U.S. are in the same situation–one that will bring months or years of rebuilding.

The odds are low that in any given year a storm big enough to cause effects this widespread will happen. And the severity of those impacts will depend on many factors, including the state of our planet’s magnetic field on that day. But it’s a near certainty that some form of this catastrophe will happen someday, says Ian Cohen, a chief scientist who studies heliophysics at the Johns Hopkins Applied Physics Laboratory.

To get ahead of this threat, a loose federation of U.S. and international government agencies, and hundreds of scientists affiliated with those bodies, have begun working on how to make predictions about what our Sun might do. And a small but growing cadre of scientists argue that artificial intelligence will be an essential component of efforts to give us advance notice of such a storm.

The most dangerous of these solar storms is known as a coronal mass ejection, when a gargantuan blob of charged particles is catapulted from the Sun’s atmosphere by rapidly shifting magnetic fields, at speeds in excess of 8,000 times that of sound. These happen often, but we’re rarely aware of them because they only affect us when they happen to strike earth.

What makes these huge blasts of particles so dangerous to our power grid and electronics is that, when they collide with Earth, the interaction of the sun’s magnetic field with our own can induce large currents in power lines on Earth. If you’ve ever moved a magnet back and forth across a copper wire to illuminate a lightbulb in science class, this is the same effect–but on a global scale. A solar storm can induce currents in power lines that are strong enough to trip safety mechanisms–or even seriously damage parts of our power-distribution infrastructure.

And while the undersea fiber-optic cables for internet data don’t carry electricity, they do have electrical signal-repeaters within them. These repeaters boost the optical signal as it travels the length of the cable. If they’re disabled, the cable ceases to function.

One thing every family needs is water, and with the power shut down from a solar storm or any storm, you’ll have a hard time pumping it from your well. Click here to download my free special report, Emergency Water Storage: How Much, Containers, Purification & More.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024