Dear Survivor,

With Your Survival Guy’s kids home for the weekend, it was the perfect opportunity to stack another cord of wood. Living in New England, you never know when the next natural gas outage will come. I don’t like the chances it will be smooth sailing, and the thought of being without a source of heat while it’s snowing outside (got a dusting of snow last night) isn’t my idea of fun.

“Mornin’,” I said to my son. “I got a cord of wood delivered. Do you want to help stack it after breakfast?”

If you recall, after a summer of work a couple years ago, I helped him set up a Roth IRA, and I’ve been paying for it ever since.

For example, here’s what I’ve heard over the first semester of college: “Dad, you put all my summer savings in the Roth. Now I have no cash for pizza.”

Lesson learned.

While we were sitting around having coffee (like some lazy cash with nothing to do), he asked, “How big can that Roth grow?”

Clearing my throat, just happy to be useful in a conversation, I said, “Depends on the Rule of 72. Divide it by your annual rate of return to find the number of years it will take your money to double.”

“It’s the magic of time that can turn $1,000 into a big number over a lifetime.” The response I got wasn’t, “Wow, that’s magical.” It was “Imagine if you started with $100,000.”

If you want to make money fast, then save early. Because it’s time that does the heavy lifting. Use the rule of 72 and run it out for 60 years, and you’ll see why a grandchild might never forget you.

Your Survival Guy at Fidelity and Your RMD Compliance

When I worked at Fidelity Investments in the mid-90s, I was at FIRSCO. What the heck is FIRSCO? Glad you asked. Because to enter the realm of Fidelity as an employee is to enter a world of acronyms you never knew existed.

FIRSCO stands for Fidelity Investments Retirement Services Company. Imagine Fidelity as the military, and FIRSCO as a branch within it, and you get the idea. I was on a special team within FIRSCO, the Withdrawal Team.

If you’ve ever had a 401(k) statement from Fidelity and worked for a major corporation in the 90s, there’s a chance we spoke. On high-volume call days, my team was called to the phones as Reserves. But it’s more likely we, or someone from the Withdrawal Team, came in contact if you were planning to withdraw money.

If you turned 70.5, for example, we made sure you got your required minimum distribution (now starting at age 72) on time, keeping you on good terms with the IRS.

It can be a challenge threading the RMD needle if you’re 72 and have a Rollover IRA or a 401(k). You need to comply and manage your tax bracket to keep more of what’s yours. I have a long history of working in spec. ops when it comes to withdrawing your tax-deferred money. Need help? Let’s talk.

How Your Survival Guy Feels about CDs

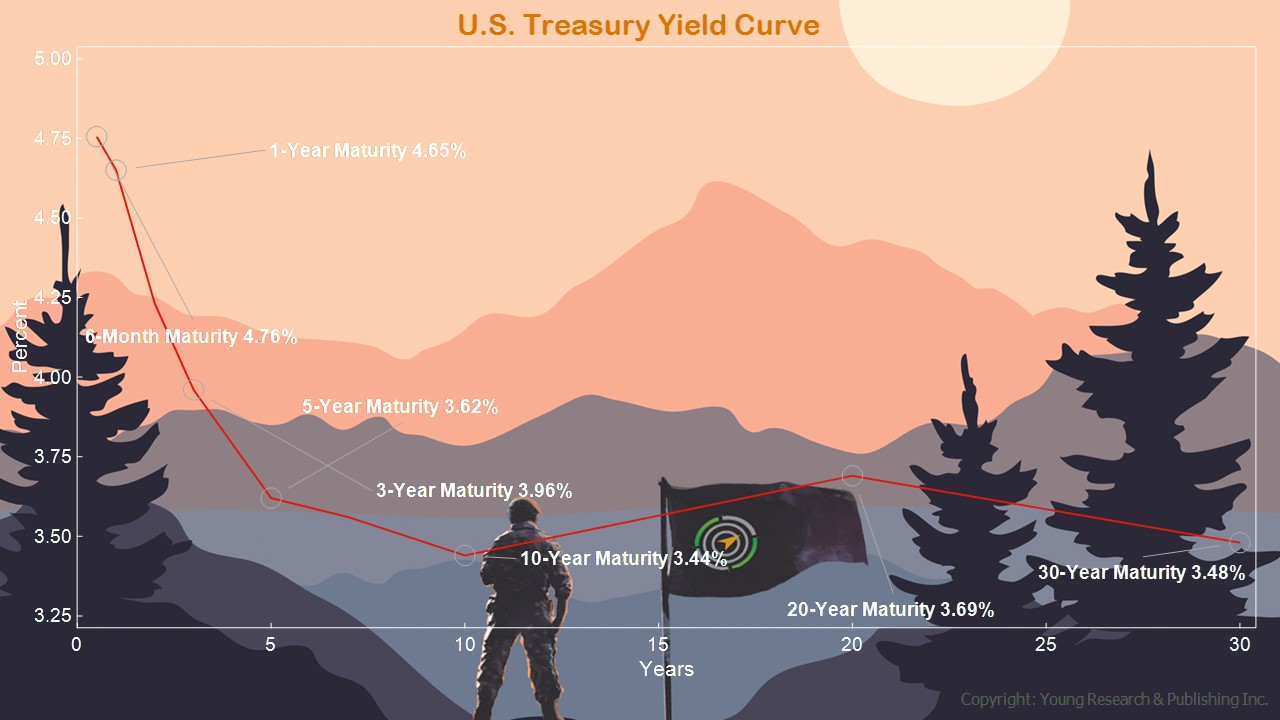

Investors in deep blue states can take pleasure in knowing interest income from Treasuries is tax free on a state and local level—but that’s not the case for CDs. Also, Treasuries are backed by the full faith credit pledge of the federal government. Again, not so for CDs.

This is a wonderful time of year to get working on your Treasury bond ladder. Let’s go.

ESG, Richard Young, Jack Bogle, and You

Vanguard, one of America’s largest mutual fund companies, is, according to Will Hild in The Wall Street Journal, violating an agreement with the Federal Energy Regulatory Commission (FERC) by meddling in the affairs of regulated utilities with its ESG policies. Hild writes:

Americans are paying sky-high electricity rates and companies like Vanguard are making the problem worse. This week my organization, Consumers’ Research, joined 13 state attorneys general in a complaint against Vanguard at the Federal Energy Regulatory Commission. With more than $7 trillion in assets under management, the Pennsylvania-based investment firm has publicly committed to pressuring utilities to lower their emissions. Vanguard appears to be not only putting America’s critical infrastructure at risk but violating its agreement only to control utility company shares passively. To protect U.S. consumers and safeguard national security, FERC should investigate the company’s conduct.

The three biggest asset managers—Vanguard, State Street and BlackRock—wield enormous clout over the companies in their investment portfolios. That influence is primarily exercised in board meetings and elections. The big three can cast nearly 25% of the votes in any director election at S&P 500 companies. That leverage means CEOs listen when asset managers make demands.

Vanguard isn’t shy about doing so, and it has made climate its top priority. In March 2021 the company joined a group of other asset managers in the Net Zero Asset Managers Initiative—a U.N.-linked organization dedicated to transforming the global economy to reach net-zero carbon emissions. Before joining the initiative, each member must commit to implementing a “stewardship and engagement policy” consistent with “achieving global net zero emissions by 2050.” Asset managers like Vanguard then use their clients’ assets—not their own—to “accelerate the transition.”

Committing to net zero isn’t an abstract goal. The Net Zero Asset Managers Initiative requires its members to prescribe specific emissions targets for industry sectors, especially utilities. The International Energy Agency’s net-zero road map envisions eliminating fossil fuels from electricity generation by 2050. That would require every American utility to remake its operations radically.

Under FERC rules, asset managers aren’t permitted to meddle in a utility’s operations. Vanguard is aware of this; that’s why the company promised FERC at its August 2019 authorization hearing it would be a passive investor in the utilities in which it holds shares. The commission granted authorization, and Vanguard’s investment has been anything but passive, actively pushing corporate managements to pursue net-zero targets and shutter coal and natural-gas electricity generation.

Why would Vanguard join an outfit like the Net Zero Asset Managers Initiative and risk violating the law? It could leave net-zero decisions up to individual companies, none of which are required by law to reach such targets.

The answer may be that such asset managers have a major conflict of interest. These companies want to manage blue-state pension funds—say, for New York or California—which are some of the largest in the country. With control, however, come demands to push net-zero policy across their assets. Doing so effectively allows them to extend their environmental activism into other states.

On Sept. 21, New York City Comptroller Brad Lander sent a letter to BlackRock CEO Larry Fink—one of the city’s pension asset managers. In his letter, Mr. Lander details Blackrock’s net-zero commitments and cites IEA’s pathway toward zero fossil-fuel production. He then asks Mr. Fink to “provide a detailed approach to keeping fossil fuels reserves in the ground.” If Vanguard isn’t already under similar pressure from its own blue-state clients, it will be soon.

The consequences of such politicking could hardly be more severe. Consumers saw electricity prices rise 14% over the past 12 months. The rest of the country can’t afford to adopt the environmental policies of New York and California.

Vanguard’s founder, Jack Bogle, never in his wildest dreams created the index mutual fund to meddle in the affairs of the companies owned by it for investors. It was meant to be a way to passively invest in the market. Simple. In the forward to Mr. Bogle’s book, Bogle on Mutual Funds, my father-in-law Richard Young writes, “Congratulations! You have made one of the wisest investment decisions of your life…Jack Bogle’s basic premise is the model of simplicity and integrity: Give investors clearly defined investment products at the right price.”

Notice the words “clearly defined.” The goals of ESG investing are so hazy that Elon Musk’s Tesla has been removed from ESG indexes, while ExxonMobil is one of their top holdings.

If you need help building a portfolio of individual securities that avoids the pitfalls of ESG investing, let’s talk.

Learn more about Bogle here:

Your Survival Guy’s Great Year Picking Some Lessons Learned

Let’s get this out of the way. If you’ve been with me, it’s been a great year. As I’ve said before, slow and steady wins the race and, just as important, finishes it too. For those tangled up in crypto, FTX, et al. the game is over—there’s no more time on the clock.

And the finish line comes up quick. For a number of my valued customers and readers like you, this year was the end of the road for your careers. It wasn’t a surprise because it’s what we have spent years talking about regarding your savings and investments. And creating a comfortable exit plan is what we’ve focused on.

Take a doctor client of mine, for example, who wanted to make sure his staff was well cared for when he departed. We talked about creating rollover IRAs for their profit-sharing/401(k) plans and keeping them under our management. It’s just part of what made this transition better for him so he could continue to sleep well at night.

In another example, we talked about some of your early experiences in your illustrious career. But it wasn’t always that way. You remember when you ran the produce section of a grocery store, and what you liked most was the instant feedback. You didn’t need consultants to tell you what customers loved. If the top apples were bruised, then the customer believed the best ones were on the bottom, creating a mess in aisle one. If the green beans weren’t perfect, they’d be picked through—with the ones left behind wondering what they did wrong. That’s no way to live. Don’t make the customers do your work for you. Do the picking behind closed doors. Beans have feelings too.

As an aside, when I was working at Fidelity in my early 20s, my dad and I met up at Babson to hear a few speakers and grab dinner afterward. One speaker was Staples founder Tom Stemberg. His message to students and young professionals like me was not to be in a rush to start a business. Learn as much as you can from every job you have and build a quiver of experiences. You can be an entrepreneur inside a major company. Lesson learned.

My favorite investment is in YOU. And it turns out that’s been yours too. I know this because I see it every month on your Fidelity statements. Let’s go.

Survive and Thrive this Month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. My client told me yesterday that years ago, he and his wife traveled from Alaska back to his childhood home to accept an award for excellence in dentistry. Home for him was LA—not that LA—Shreveport. The ceremony was in New Orleans.

The plan was to borrow one of his sister’s cars in Shreveport and drive to New Orleans. Before they drove off, he asked his buddy if he needed anything.

“Would you mind picking up some alligator meat?” he asked.

“No problem.”

Driving home from New Orleans, they took a left into the swamp, walked into the store, and said he was there to pick up alligator meat for his friend. The old Cajun came back, slid it across the counter, and said how much it would be.

My client turned to his wife, who said to the man, “We’re going to pay with a traveler’s check.”

“What’s a travelin’ check?”

“It’s like money,” she said.

“Ma’am, I don’t accept anythin’ that’s like money. Just money.”

And that’s about how Your Survival Guy feels about digital dollars: If it’s only like money, you can have it.

In a November working paper on the benefits and risks of central bank digital currencies (CBDCs), Nicholas Anthony and Norbert Michel of the Cato Institute come to the conclusion that the purported benefits of CBDCs don’t live up to scrutiny. They write:

CBDCs have the potential to radically transform the American financial system and all signs point to that transformation being to the detriment of the American people. A U.S. CBDC poses substantial risks to financial privacy, financial freedom, free markets, and cybersecurity. Yet the purported benefits fail to stand up to scrutiny. CBDCs have certainly made central banks the talk of the town and thrown a splash of life into an otherwise dense policy field. But there is no reason for the U.S. government to issue a CBDC when the costs are so high and the benefits are so low.

P.P.S. After receiving pressure from investors and others, Vanguard has announced that it will withdraw from the Net Zero Asset Managers (NZAM) initiative. Brittany Bernstein reports in National Review:

Vanguard announced Wednesday it is pulling out of the Net Zero Asset Managers initiative, an investment-industry effort to encourage fund firms to reach net zero emission targets by 2050.

“We have decided to withdraw from NZAM so that we can provide the clarity our investors desire about the role of index funds and about how we think about material risks, including climate-related risks—and to make clear that Vanguard speaks independently on matters of importance to our investors,” Vanguard said in a statement.

Vanguard, the world’s top mutual fund manager, said the change “will not affect our commitment to helping our investors navigate the risks that climate change can pose to their long-term returns.”

The change of heart comes roughly a week after Consumers’ Research and 13 state attorneys general asked the Federal Energy Regulatory Commission to review Vanguard’s request to own energy company stocks.

“Americans are paying sky-high electricity rates and companies like Vanguard are making the problem worse,” Will Hild, executive director of Consumers’ Research, wrote in an op-ed for the Wall Street Journal.

“With more than $7 trillion in assets under management, the Pennsylvania-based investment firm has publicly committed to pressuring utilities to lower their emissions,” Hild added. “Vanguard appears to be not only putting America’s critical infrastructure at risk but violating its agreement only to control utility company shares passively. To protect U.S. consumers and safeguard national security, FERC should investigate the company’s conduct.”

Hild responded to Vanguard’s announcement in a statement on Wednesday, saying the decision “proves what we’ve been saying from the beginning, this is a conspiracy against the consumer.”

Your investments should not be used to push the agenda of your asset manager. Your investments should benefit you. That’s the fiduciary rule. Does the fiduciary rule apply to your financial advisor? If you don’t know, you should ask. If you need help from a fiduciary, let’s talk.

P.P.P.S. You have read the disturbing reports about terrorists who targeted power stations in North Carolina, Washington, and Oregon recently. The alarming part of this story, according to Mayor Carol Haney of South Pines, NC, is that it could happen to anyone. Frank Morris reports for NPR:

“This beautiful part of the world gets sabotaged,” said Haney. “So, it could happen to anyone. And that’s probably the most frightening for everyone– that this could happen to anyone.”

It could. Across the United States some 55,000 electrical substations are humming right now, mostly transforming high voltage from big power lines, into lower voltages for homes and businesses. Many of them are sitting ducks for saboteurs.

“The electric grid is the Achilles heel of the United States,” says Mike Mabee, a self-described “grid-security gadfly” who pours over electric company data to highlight vulnerabilities.

Like many he’s worried about Russian or Chinese cyberattacks, but Mabee says the easiest way to hurt Americans is something a lot less exotic, shooting up substations with widely available assault rifles.

“If a terrorist organization, whether homegrown or a foreign terrorist organization wants to visit damage on the United States electric grid, the easiest way to do it is by a physical attack,” says Mabee.

Protect yourself from the damage these attacks can do to your life by preparing yourself now. Own a generator, have a plan for food (download my free special report, FOOD SHORTAGE: Crazed Hoarding Is not Preparing) and water storage (download my free special report, Emergency Water Storage: How Much, Containers, Purification & More), and develop an evacuation plan if it comes to that.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024