Dear Reader,

Last year Vanguard GNMA made just under one percent or 0.87% for 2018 as interest payments offset a decline in bond prices from rising interest rates.

As I’ve written to you before, you don’t want to be in the interest rate prediction business. You simply want to collect your interest payments and let the chips fall as they may.

When you near retirement your success as an investor depends on a nine to five mentality—work nine to five to steadily save money for retirement and invest to keep what you’ve saved. It’s that simple.

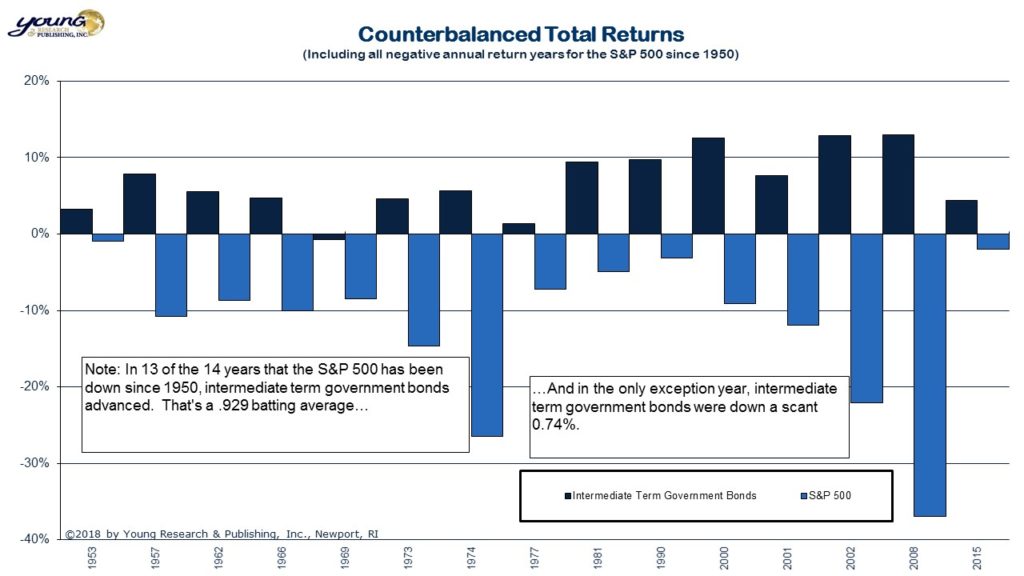

A survival guy investment strategy helps you to win the war when the stock market battle isn’t won every year—and by the way we’ve been long overdue for this stock market.

Vanguard GNMA and a Winter of Political Polarization

Anyone who tells you politics has nothing to do with investing is simply not paying attention. In this winter of political polarization—a deep freeze—politics matter.

Case in point. Look at Vanguard GNMA.

For most of 2018, Vanguard GNMA was sledding from a peak of $10.45 in January.

Guess when the trough, or bottom was hit? November 6th the day of the midterm elections.

Since then, as you’ve witnessed, stocks have been twitching like a desperate squirrel working through that last nut for the winter.

Not Vanguard GNMA. It has been steady.

Yes, it’s difficult to stick to an investment plan when everyone around you is a desperate squirrel. Their chewing can drive you crazy.

But, it’s better to take a deep breath and be happy you understand the principles of counterbalancing. Because the happiness you have from keeping your money far outweighs the desperation of making it and then losing it.

Do You Know this about Vanguard Wellington and Wellesley Funds?

As you know our concerns about Vanguard continue to mount.

Yesterday, a reader wrote: “[Dick] used to be big on Wellington and Wellesley, given their longevity and resistance to tail risk over time. Also, it seemed to me that Wellington Management’s fixed income expertise would be an asset in this part of the cycle. I’m wondering why he has soured on these funds.”

The quick answer is no we have not soured on Wellington and Wellesley with two distinctions.

First, Vanguard has nothing to do with the management of Wellington and Wellesley. Vanguard has outsourced those management responsibilities to Wellington Management in Boston, MA.

Second, the Wellington and Wellesley funds only invest in large U.S. companies (they do have international funds now), and their bonds go out too far—the bonds in Wellington have an effective maturity of 9.4 years and Wellesley 8.3 years.

At Young Research we recommend owning dividend paying stocks outright and bonds with an average maturity about half as many years as Wellesley and Wellington—laddering bonds helps to strip out the interest rate risk since you can hold them until maturity. (More on laddering below).

Yes, there is a lot of history between Wellington Management, Vanguard and Richard Young, but don’t forget that in the case of Wellington Management and Vanguard they are two separate companies all together.

From my father-in-law Dick Young:

My history with Wellington Management and the Vanguard group goes back decades. I started with Wellington over 40 years ago. The Wellington Fund was founded in 1929 by CPA Walter Morgan to provide investment counsel to his clients.

Morgan had the foresight to load the Wellington Fund with fixed-income securities months before the 1929 stock market crash. That decision helped Wellington become the tenth largest in the industry by 1944.

In 1951, Morgan hired John Bogle, who would eventually become the firm’s CEO. In 1974, Bogle left Wellington Management and founded the Vanguard Group, bringing the Wellington Fund and its sister funds along with him. With Bogle gone, the firm was left in the hands of his partners, W. Nicholas Thorndike, Robert Doran, Stephen Paine and George Lewis.

In the 80s Wellington Management expanded to London, and from there grew into a global operation, later opening Singapore, Tokyo and Sydney offices in the 90s. In the early 21st Century, Wellington opened offices in Hong Kong, Frankfurt, Beijing, Luxembourg, and Zurich. Today the firm has 13 offices around the world, and manages $1 trillion in client assets in 62 countries.

Wellington Management Company manages a wide ranging group of funds for the Vanguard Group, including:

- Vanguard Capital Value Fund (VCVLX) (0328)

- Vanguard Dividend Growth Fund (VDIGX) (0057)

- Vanguard Emerging Markets Select Stock Fund (VMMSX) (0752)

- Vanguard Energy Fund Investor Shares (VGENX) (0051)

- Vanguard Equity Income Fund Investor Shares (VEIPX) (0065)

- Vanguard Explorer Fund Investor Shares (VEXPX) (0024)

- Vanguard Global Wellesley Income Fund Investor Shares (VGWIX) (1496)

- Vanguard Global Wellington Fund Investor Shares (VGWLX) (1567)

- Vanguard GNMA Fund Investor Shares (VFIIX) (0036)

- Vanguard Health Care Fund Investor Shares (VGHCX) (0052)

- Vanguard High-Yield Corporate Fund Investor Shares (VWEHX) (0029)

- Vanguard International Explorer Fund (VINEX) (0126)

- Vanguard Long-Term Investment-Grade Fund Investor Shares (VWESX) (0028)

- Vanguard Morgan Growth Fund Investor Shares (VMRGX) (0026)

- Vanguard U.S. Growth Fund Investor Shares (VWUSX) (0023)

- Vanguard Wellesley Income Fund Investor Shares (VWINX) (0027)

- Vanguard Wellington Fund Investor Shares (VWELX) (0021)

- Vanguard Windsor Fund Investor Shares (VWNDX) (0022)

Why We Favor Laddering Bonds

One of the reasons we favor laddering bonds is to help strip-out interest rate risk. When you own a bond outright you have control over your holding period.

Duration measures a bond’s sensitivity to interest rates. For example, a bond with a 15-year duration will decline by 15 percent with every one percent increase in interest rates. Would you pay the same price for a bond you bought last year that yields one percent more today? No, you’d pay less—about 15 percent less in this case.

Compared to a three-year duration—it will decline by about three percent if rates increase by one percent—you’d lose a lot less. And if you happen to own the bond in a ladder you could hold it, collect your interest along the way, and receive your principle at maturity.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

P.S. Vanguard Founder Jack Bogle Sounds the Alarm on Index Funds

You pay attention when the founder of the Vanguard Group, Jack Bogle speaks. As the father of the index fund it would be hard not to include Mr. Bogle’s bust on the Mount Rushmore of financial legends. Therefore, when Bogle speaks, I listen. As do thousands of his groupies known as “Bogleheads.”

“There no longer can be any doubt that the creation of the first index mutual fund was the most successful innovation—especially for investors—in modern financial history,” wrote Bogle recently, “The question we need to ask ourselves now is: What happens if it becomes too successful for its own good?”

Back in 1976, a year after founding Vanguard, Bogle’s First Investment Trust was launched as a way for investors to track the S&P 500. Many in the industry, explains Bogle, scoffed at his idea. Who wants average returns when the game is to beat the market?

As we all know, it wasn’t about beating the market. It was about offering a sound investment at a fair price.

In the forward to Mr. Bogle’s seminal book, Bogle on Mutual Funds, my father-in-law Dick Young wrote “Congratulations! You have made one of the wisest investment decisions of your life…Jack Bogle’s basic premise is the model of simplicity and integrity: Give investors clearly defined investment products at the right price.”

It turns out investors were listening.

42 years after the birth of his index fund, explains Bogle, $4.6 trillion is invested in stock funds while total assets have exceeded $6 trillion.

U.S. index mutual funds are so huge that they comprise 17% of the total U.S. stock-market, and that doesn’t include what mutual fund companies own in their actively managed funds.

Only three companies account for most of the indexing world’s assets: Vanguard (51%), BlackRock (21%), and State Street Global (9%). How long will it take for the big three, notes Bogle, to own a third of corporate America?

And, my point, as Americans age, consider how much money they’ll have tied up in stock funds.

In his must-read piece, Bogle offers ways to resolve the issues connected with the concentration of corporate ownership by these funds. But as tends to happen in politics, it’s difficult to rally around the problem when most Americans have little to no savings, and have bigger fish to fry—like putting dinner on the table.

But make no mistake, this is a big issue and one we’ve been warning you about for some time now.

Also troubling is that retirees, especially those with pensions, do not realize how concentrated their holdings are in just a handful companies.

At this pace a ton of money continues to pile aboard a boat that’s taking on water.

I want you to focus on your bonds. They will be there when the calm waters of an upward moving market begin to churn. And I want you to recognize that the S&P 500 may sound like a well-diversified portfolio, but in essence only a handful of companies, mainly FAANGS, are singing “row, row, row your boat.”

You’ve heard this tune before.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024