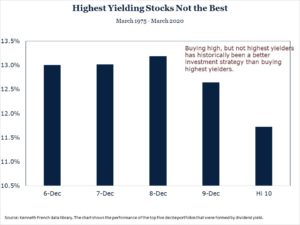

You have plenty of ways to invest in this market if you’re A) dividend-centric (I am) and/or B) looking for a proxy to some of your bonds. Take a look at the charts below and understand what’s happening in the market today. Stocks by Dividend Decile Here you see a breakdown of stocks by dividend yield decile. The 8th Decile, not the tenth, had the better performance from 1975-2020. Caitlin McCabe reports at The Wall Street Journal on today's bull market: A greater number of stocks have been propelling the U.S. market higher lately, a signal that—if history is any … [Read more...]

It’s as Simple as 4%? No, Not Anymore

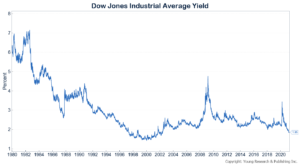

In my conversation with you this week, we talked about the appropriate draw rate from your portfolio. We discussed how the days of a four percent draw are history. With interest rates nailed to the floor, you need to adjust accordingly. Thankfully, most of you have, I hope. Take a look at Dick Young’s investment North Star. That, in a nutshell, is how savers are penalized by Washington. Now, look at the dividend yield on the Dow Jones Industrial Average. Do the math. A simple back of the napkin calculation of a 50/50 portfolio yields a fraction of what it used to. These are not easy … [Read more...]

Richard Young Reports: The Great Money Explosion and Disasters

You and I know disasters happen. Just because they haven’t happened yet doesn’t mean they won’t. But disasters aren’t accidents. People do dangerous stuff—beginning with getting out of bed. It’s the start of your chaotic day. The world is filled with Chaos. As my father-in-law Dick Young reminds me from time to time, “There’s no such thing as accidents.” I try to explain that to my teenaged kids, though they insist “accidents” happen all the time. When it comes to your money, think about it like you’re hiking with a heavy backpack (I hope!) where you have decisions to make about which … [Read more...]

Richard Young Reports: 50+ Years with Fidelity and Wellington

I started in the institutional research and trading investment business at Model Roland & Co. on Federal St. in Boston in August 1971. Just up the street from Model were Fidelity Investments, and Wellington Management, both of whom I called on from my very first hours on the job. Over five decades ago, Ned Johnson, aka “Mister Johnson,” ran the show at Fidelity. At Wellington, Jack Bogle, “Mr. Mutual Fund,” had not yet left Wellington to start Vanguard. My focus in the initial going was international research and trading, and remains so today all these decades later. I still consider … [Read more...]